Answered step by step

Verified Expert Solution

Question

1 Approved Answer

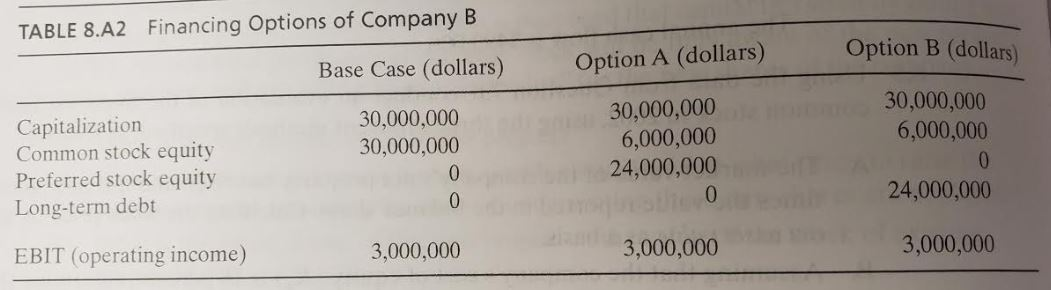

TABLE 8.A2 Financing Options of Company B Base Case (dollars) Option A (dollars) Option B (dollars) Capitalization Common stock equity Preferred stock equity Long-term debt

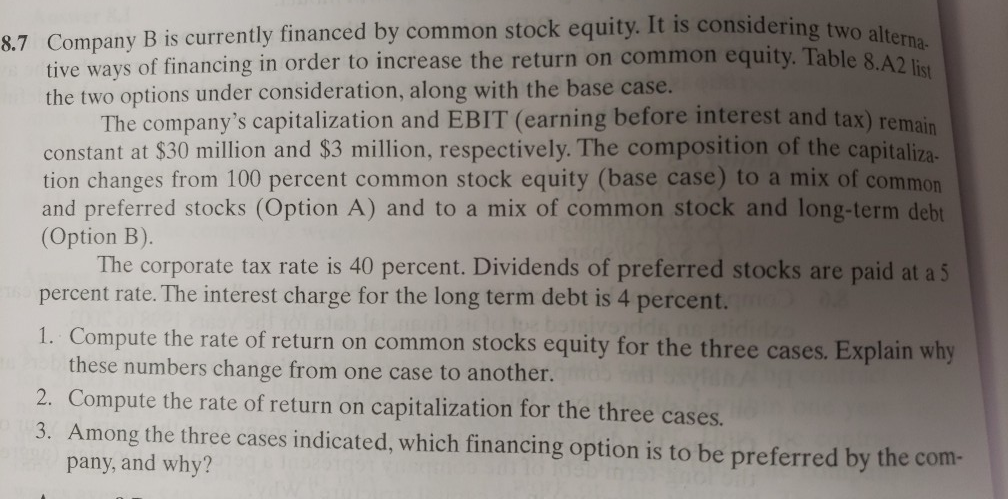

TABLE 8.A2 Financing Options of Company B Base Case (dollars) Option A (dollars) Option B (dollars) Capitalization Common stock equity Preferred stock equity Long-term debt 30,000,000 30,000,000 30,000,000 6,000,000 24,000,000 30,000,000 6,000,000 0 24,000,000 EBIT (operating income) 3,000,000 3,000,000 3,000,000 is considering two alterna- lity. Table 8.A2 list 8.7 Company B is currently financed by common stock equity. It is considering tive ways of financing in order to increase the return on common equity Table the two options under consideration, along with the base case. The company's capitalization and EBIT (earning before interest and tay constant at $30 million and $3 million, respectively. The composition of the capitali tion changes from 100 percent common stock equity (base case) to a mix of common and preferred stocks (Option A) and to a mix of common stock and long-term debt (Option B). The corporate tax rate is 40 percent. Dividends of preferred stocks are paid at a 5 percent rate. The interest charge for the long term debt is 4 percent. 1. Compute the rate of return on common stocks equity for the three cases. Explain why these numbers change from one case to another. 2. Compute the rate of return on capitalization for the three cases. 3. Among the three cases indicated, which financing option is to be preferred by the com- pany, and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started