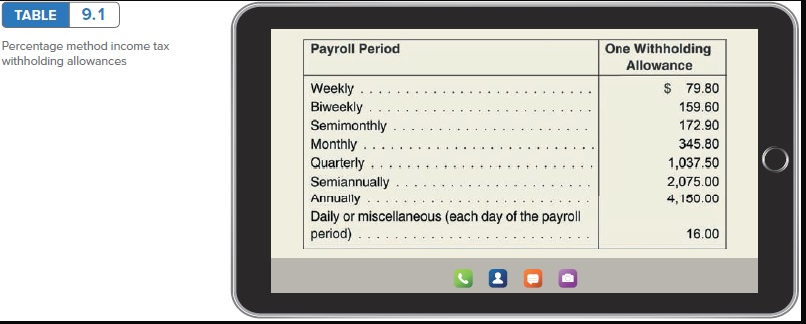

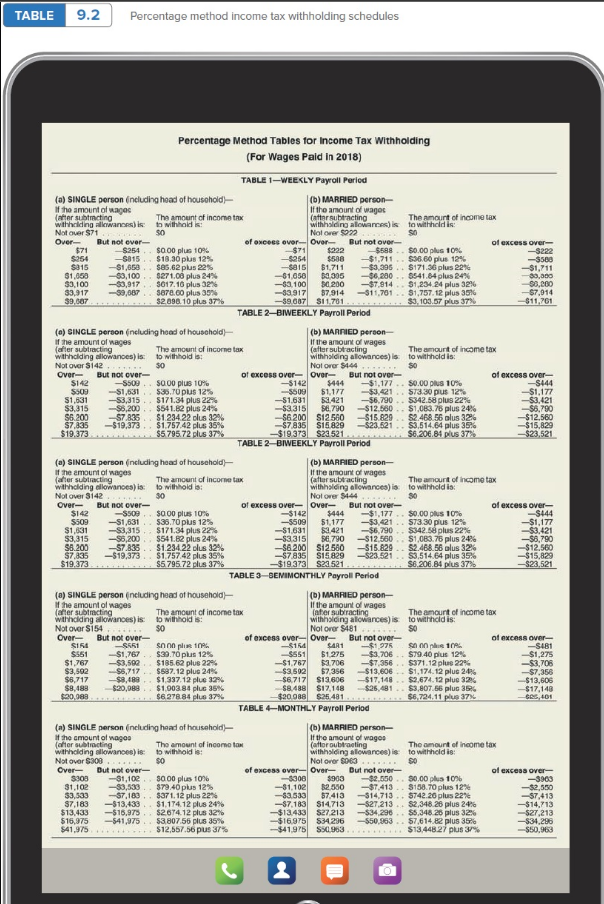

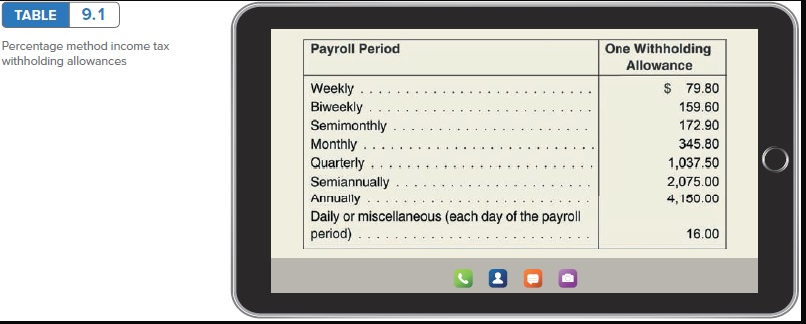

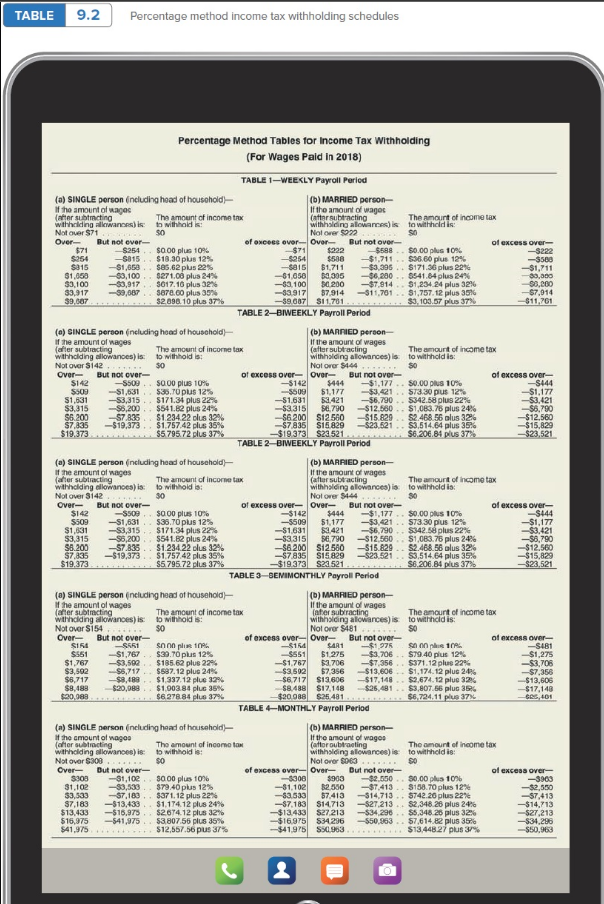

TABLE 9.1 Percentage method income tax withholding allowances Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 TABLE 9.2 Percentage method income tax withholding schedules 254 -3500 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1WEEKLY Payroll Period (a) SINGLE person including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax Caftar subtracting The amount of income tax withholding Fillowances) is to withhold : withholding allowances) is to withheld is: Not over $71 SO Nol over $22 SO Over- But not ever- of Oncees over Over- But not over of excess over- $71 $254 $0.00 plus 10% $71 $222 -$588 $0.00 plus 10% -$222 $254 -5015 $18.30 plus 12% $500 -$1.711 $36.60 plus 12% $815 -$1,650 $85.62 plus 22% $815 $1,711 - $3,396 $171.56 plus 2216 -$1,711 31.053 -$3,100 5271.08 plus 24% -81,650 30.305 -$6.200 5541.64 plus 24% 0,000 $3,100 -$3,917 $617.16 plus 32% -53.100 30 200 -$7.914 $1.234.24 plus 32% -98.000 33,917 -39,687 3870.60 plus 35% -33.917 87.914 -S11,761 .. $1.757.12 plus 3676 -$7.914 39.687 $2.090.10 plus 37% -59.687 811701 $3.109.57 plus 37) -$11,761 TABLE 2-BIWEEKLY Payroll Period () SINGLE person (ncluding head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is to withheld is: Not over $142 SO Not over $144 SO Over- But not over of excess over-Over- But not over- of excess over- -S500 $0.00 plus 10% -5142 $444 -$1,177 .. 80,00 plus 10% -S444 $509 -$1,631 $36.To plus 12% 51,177 -$3,421.573.30 plus 12% --$1,177 $1,831 -$3,315 $171.31 plus 22% --$1.631 53.421 - $6.790 .. $342.58 plus 22% -$3.421 $3,315 -$5,200 $641.82 plus 24% -$3.315 56.790 -$12.560 - $1,083.76 plus 24% -$6.790 S6.200 57.835 $1.234 22 olus 32% 56200 S12560 -$15.829. 52.468 56 plus 32% -$12.560 $7,835 -$19,373 $1.757.42 plus 35% -57.835 S15829 -$23.521. 53.514.64 plus 35% -$15,829 $19.373 $579572 plus 37% --$19.373 $23521 $6.206.84 plus 37% -$23,521 TABLE 2-BIWEEKLY Payroll Period $142 $500 (a) SINGLE person (ncluding head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (aftur subtracting The amount of income tax withholding allowances) is to withhold is: withholding alowance is to withhold is Not Over 3142 30 Not over $444 30 Over- But not over- of excess over-Over- But not over- of excess over- $142 5509 $0.00 plus 10% -$142 $444 -$1.177 $0.00 plus 10% -$444 $509 -$1,631 $35.70 plus 12% -5509 $1,177 -$3,421 S73.30 plus 12% -$1.177 $1,831 -$3,315 $171.34 plus 22% -$1.631 62.421 - $6.790 S342.58 plus 22% -$3,421 3,315 -$5,200 5541.62 plus 24% -$3.315 56.790 -$12,560 $1,083.76 plus 24% -$8,790 S6.200 -57.835 $1.234.22 olus 32% -S6.200 S12560 -515.829. 52.468.56 alus 32% -$12.560 $7,835 -$19,373 $1.757 42 plus 35% -57.835 S15 829 -$23.521 $3.514.64 plus 35% -$15.829 $19,373 $5.795.72 plus 37% ---$19.373 S22521 $6.206.84 plus 37% -$23,521 TABLE 3-BENIMONTHLY Payroll Period () SINGLE person including head of household - (6) MARRIED person the amount of wages if the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is to withholdis: withholding alowances) is to withhold is: Not over S154 50 Not over 5481 SO Over But not over of excess over-Over- But not over of excess over S16 -$551 son plin $164 SAA1 -$1.975 Son 10 -S481 $551 -$1,767 $39. Toplus 125 5551 $1,275 -$3.706 $79.40 plus 12% $1,275 $1,767 -$3,592 $185.62 plus 22 -S1.767 $2.706 - $7,356 $371.12 plus 22% -$3,706 $3,502 $5,717 $687.12 plus 24% -$3.502 57,356 -$13.606 $1,174.12 plue 24% - $7,358 $6,717 -$8.489 $1,337.12 plus 32% - $6.717 $13.606 -$17.148 $2.674.12 plus 32% -$13,606 $8,488 $20,988 $1,903.84 plus 35% $8.488 $17,148 $26.491 .. $3,807.56 plus 36 ---$17,148 $20,089 $6278.84 plus 37% $20 088 $26.481 $6.724. 11 plus 37% GAS, 401 TABLE MONTHLY Payroll Period (a) SINGLE person (ncluding head of household (b) MARRIED person of the amount of wagon If the amount of wages after subtracting The amount of income to (aftoroubtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is to withheld is Not over $300 0 Not over 5063 SO Over- But not over- of excess over-Over- But not over of excess over $303 -$1,100 3000 plus 10% -6000 8908 -80,650 30.00 plus 10% -3903 -$3,533 $79.40 plus 12% -31.102 32.300 -$7,413 $158.70 plus 12% 33,533 -S7,183 $37 1.12 plus 22% -$3.533 57.413 -$14,713 .. $742.26 plus 22% -57,413 $7,183 -$13,433 $1.174.12 plus 24% -57.183 S14713 -$27.213. 82,348 26 plus 24% -$14.713 $13.433 -$16.975 $2674.12 plus 32% -$13.433 $27213 -$34.296 S5.348 26 plus 32% -$27.213 $16,975 -541,975 53,807,56 plus 38% -$16.975 534296 -$50.963 $7,614.82 plus 356 -$34,286 $41,975 $12.557.56 pus 37% --$41,975 50.963 $13,448.27 plus 3/% -550,963 31.102 -$2.550 The San Bernardino County Fair hires about 170 people during fair time. Their hourly wages range from $5.70 to $7.20. California has a state income tax of 9%. Sandy Denny earns $7.20 per hour; George Barney earns $5.70 per hour (assume this is the current minimum wage). They both worked 35 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT (use the Table 9.1 and Table 9.2), Social Securty tax, state income tax, and Medicare have been taken out? (Round your answer to the nearest cent.) Sandy's net pay after FIT b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay after FIT c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.) Difference in net pay