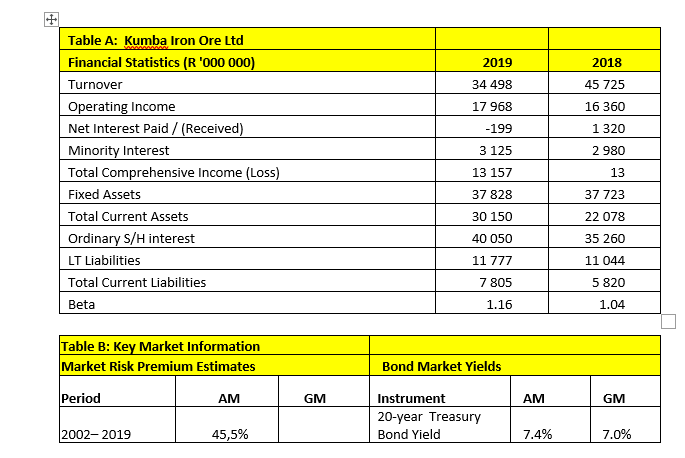

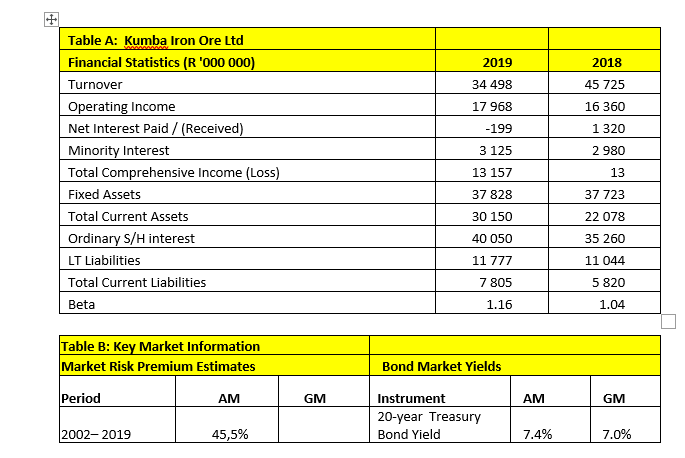

Table A below provides key financial information for Kumba Iron Ore Ltd for the years ended 2018 and 2019. Table B provides key market information and Industry Beta and Tax Information Use this information to calculate a WACC for Kumba Iron Ore Ltd for 2019. For every input value assumed, give reasons for your choice. If you are forced to use an input that is not your first choice, mention that and state why you are using the alternative. Note: every input into the calculation of your WACC should be explained. (20 marks) Other information you may want to consider: The company's Long Term Liabilities are all interest bearing. The company's marginal cost of debt, i.e. cost of the next rand of debt is 9,5% The company had 322 085 974 shares outstanding at the end of 2019. The share price at the end of 2019 was R49,94 2019 2018 45 725 34 498 17 968 -199 16 360 1 320 3 125 2980 Table A: Kumba Iron Ore Ltd Financial Statistics (R '000 000) Turnover Operating Income Net Interest Paid / (Received) Minority Interest Total Comprehensive Income (Loss) Fixed Assets Total Current Assets Ordinary S/H interest LT Liabilities Total Current Liabilities Beta 13 157 13 37 828 37 723 22 078 30 150 40 050 35 260 11 777 11 044 7 805 5 820 1.16 1.04 Table B: Key Market Information Market Risk Premium Estimates Bond Market Yields Period AM GM AM GM Instrument 20-year Treasury Bond Yield 2002-2019 45,5% 7.4% 7.0% Table A below provides key financial information for Kumba Iron Ore Ltd for the years ended 2018 and 2019. Table B provides key market information and Industry Beta and Tax Information Use this information to calculate a WACC for Kumba Iron Ore Ltd for 2019. For every input value assumed, give reasons for your choice. If you are forced to use an input that is not your first choice, mention that and state why you are using the alternative. Note: every input into the calculation of your WACC should be explained. (20 marks) Other information you may want to consider: The company's Long Term Liabilities are all interest bearing. The company's marginal cost of debt, i.e. cost of the next rand of debt is 9,5% The company had 322 085 974 shares outstanding at the end of 2019. The share price at the end of 2019 was R49,94 2019 2018 45 725 34 498 17 968 -199 16 360 1 320 3 125 2980 Table A: Kumba Iron Ore Ltd Financial Statistics (R '000 000) Turnover Operating Income Net Interest Paid / (Received) Minority Interest Total Comprehensive Income (Loss) Fixed Assets Total Current Assets Ordinary S/H interest LT Liabilities Total Current Liabilities Beta 13 157 13 37 828 37 723 22 078 30 150 40 050 35 260 11 777 11 044 7 805 5 820 1.16 1.04 Table B: Key Market Information Market Risk Premium Estimates Bond Market Yields Period AM GM AM GM Instrument 20-year Treasury Bond Yield 2002-2019 45,5% 7.4% 7.0%