Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. B. C. Describe one (1) type of risk associated with an interest rate swap (IRS). (3 marks) Xavi is a speculator who is

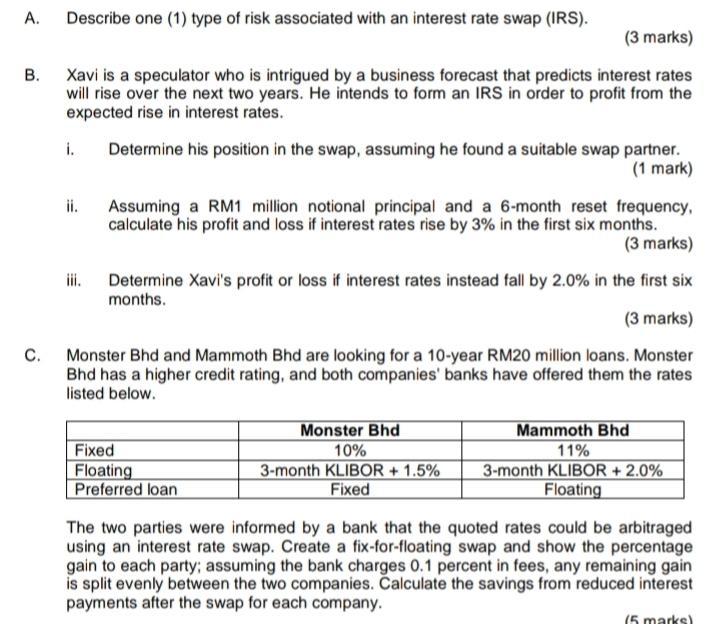

A. B. C. Describe one (1) type of risk associated with an interest rate swap (IRS). (3 marks) Xavi is a speculator who is intrigued by a business forecast that predicts interest rates will rise over the next two years. He intends to form an IRS in order to profit from the expected rise in interest rates. i. ii. Determine his position in the swap, assuming he found a suitable swap partner. (1 mark) Assuming a RM1 million notional principal and a 6-month reset frequency, calculate his profit and loss if interest rates rise by 3% in the first six months. (3 marks) iii. Determine Xavi's profit or loss if interest rates instead fall by 2.0% in the first six months. (3 marks) Monster Bhd and Mammoth Bhd are looking for a 10-year RM20 million loans. Monster Bhd has a higher credit rating, and both companies' banks have offered them the rates listed below. Fixed Floating Preferred loan Monster Bhd 10% 3-month KLIBOR + 1.5% Fixed Mammoth Bhd 11% 3-month KLIBOR + 2.0% Floating The two parties were informed by a bank that the quoted rates could be arbitraged using an interest rate swap. Create a fix-for-floating swap and show the percentage gain to each party; assuming the bank charges 0.1 percent in fees, any remaining gain is split evenly between the two companies. Calculate the savings from reduced interest payments after the swap for each company. (5 marks)

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Market Risk This type of risk is associated with the movement of the underlying market interest rate Since the IRS is an agreement between two parties to swap cash flows any change in the market rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started