Answered step by step

Verified Expert Solution

Question

1 Approved Answer

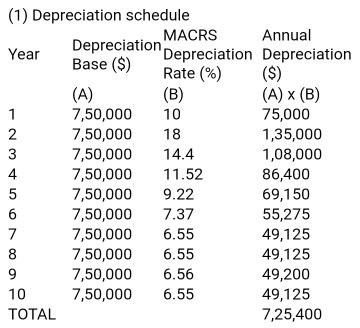

Table for first 10 years of operation of: Land purchase for hotel: $750,000 Building Cost 18.5 million Hotel in Service July 4th 2017 The property

Table for first 10 years of operation of: Land purchase for hotel: $750,000 Building Cost 18.5 million Hotel in Service July 4th 2017

The property above will be sold in October 30th 2027 with a projected sale price of 21.5 million. What will be the tax liability of the is company, assuming that they are in a 28% tax bracket and that the land did not appreciate?

(1) Depreciation schedule MACRS Annual Depreciation Base Depreciation Depreciation Rate (S) Year (A) x (B) (B) (A) 75,000 7,50,000 10 7,50,000 18 1,35,000 7,50,000 14.4. 1,08,000 86,400 7,50,000 11.52 69,150 7,50,000 9.22 55,275 7,50,000 7.37 49,125 7,50,000 6.55 49,125 7,50,000 6.55 49,200 7,50,000 6.56 49,125 10 7,50,000 6.55 TOTAL 7,25,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started