Answered step by step

Verified Expert Solution

Question

1 Approved Answer

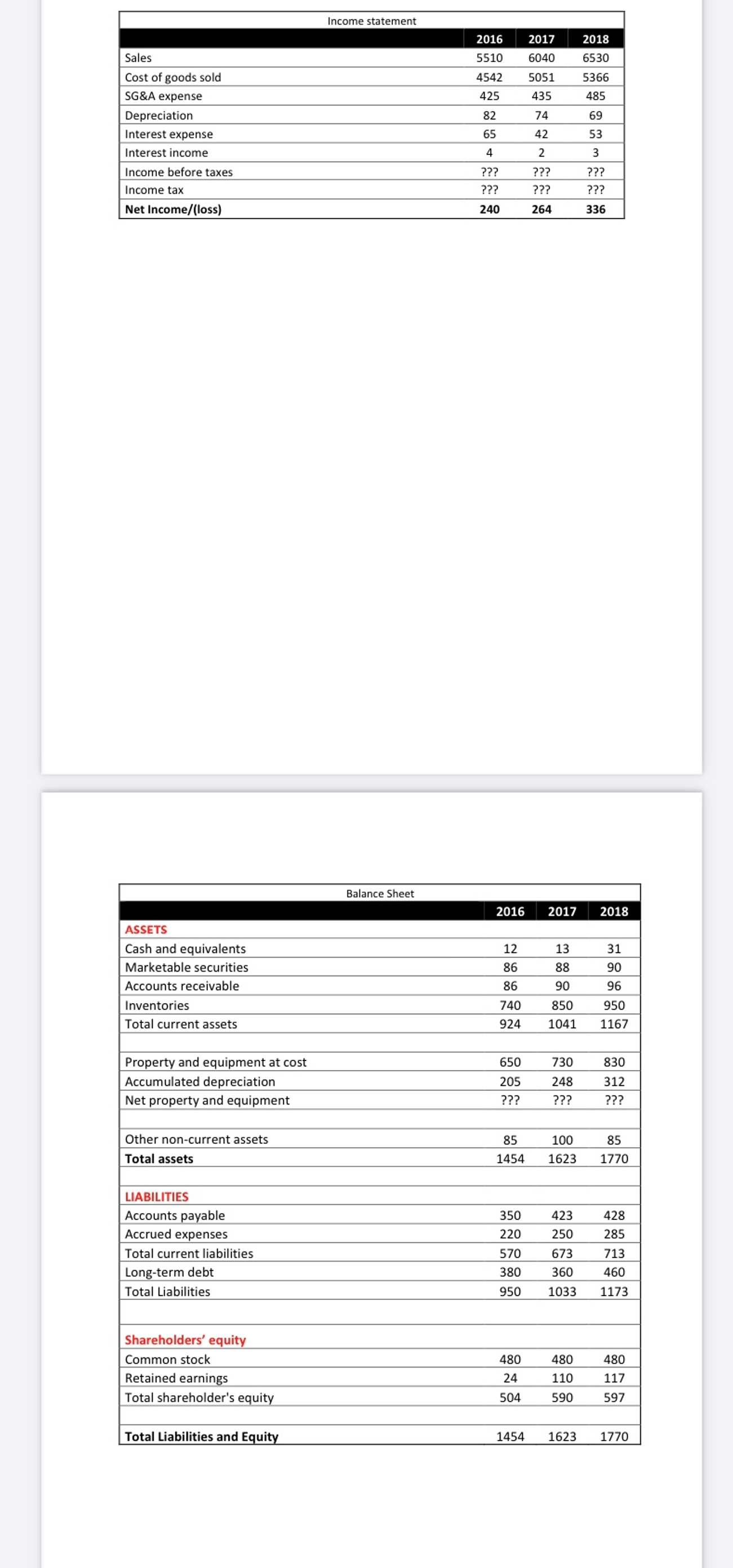

table [ [ Income statement,, ] , [ Sales , 2 0 1 6 , 2 0 1 7 , 2 0 1 8

tableIncome statement,,SalesCost of goods sold,SG&A expense,DepreciationInterest expense,Interest income,Income before taxes,Income tax,???,???,???Net Incomeloss

tableBalance SheetASSETSCash and equivalents,Marketable securitiesAccounts receivable,InventoriesTotal current assets,Property and equipment at costAccumulated depreciation,Net property and equipment,???,???,???Other noncurrent assets,Total assets,LIABILITIESAccounts payable,Accrued expenses,Total current liabilities,Longterm debt,Total Liabilities,Shareholders equityCommon stock,Retained earnings,Total shareholder's equity,Total Liabilities and Equity,

what are the answers to the following questions given the financial statement?:

Question pts

EBIT in

Flag question: Question

Question pts

EBIT in

Flag question: Question

Question pts

EBT in

Flag question: Question

Question pts

EBT in

Flag question: Question

Question pts

Income tax in

Flag question: Question

Question pts

Income tax in

Flag question: Question

Question pts

Tax rate in answer in percentage

Flag question: Question

Question pts

Tax rate in answer in percentage

Flag question: Question

Question pts

NOPLAT in

Flag question: Question

Question pts

NOPLAT in

Flag question: Question

Question pts

Depreciation in

Flag question: Question

Question pts

Depreciation in

Flag question: Question

Question pts

Net PPE in

Flag question: Question

Question pts

Net PPE in

Flag question: Question

Question pts

Net PPE in

Flag question: Question

Question pts

CAPEX in

Flag question: Question

Question pts

CAPEX in

Flag question: Question

Question pts

Operating CA Current Assets in

Flag question: Question

Question pts

Operating CA Current Assets in

Flag question: Question

Question pts

Operating CA Current Assets in

Flag question: Question

Question pts

Operating CL Current Liabilities in

Flag question: Question

Question pts

Operating CL Current Liabilities in

Flag question: Question

Question pts

Operating CL Current Liabilities in

Flag question: Question

Question pts

NWC in

Flag question: Question

Question pts

NWC in

Flag question: Question

Question pts

NWC in

Flag question: Question

Question pts

Increase in NWC in

Flag question: Question

Question pts

Increase in NWC in

Flag question: Question

Question pts

FCF in

Flag question: Question

Question pts

FCF in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started