Answered step by step

Verified Expert Solution

Question

1 Approved Answer

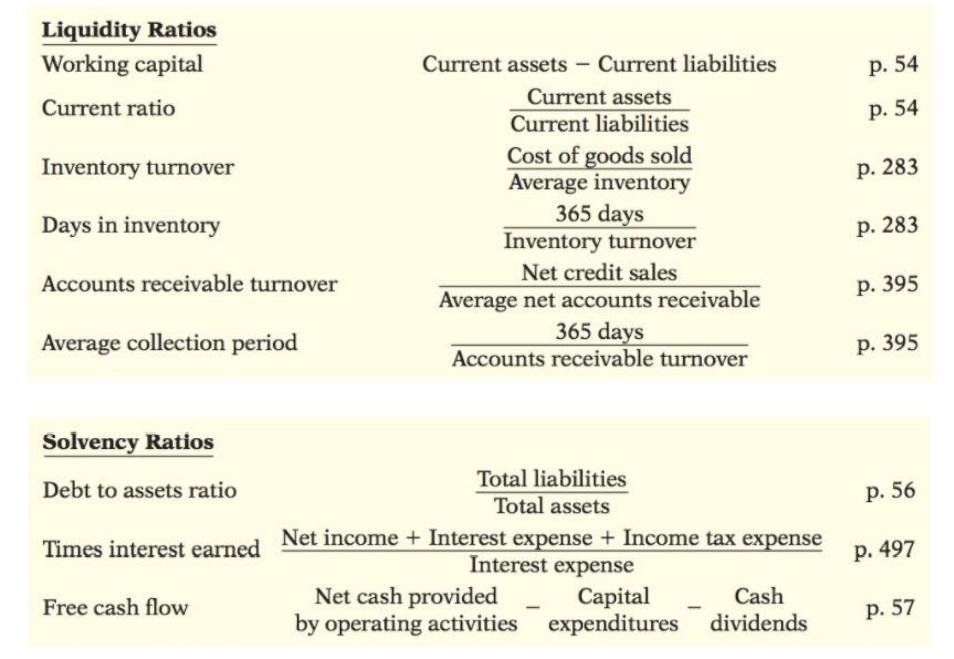

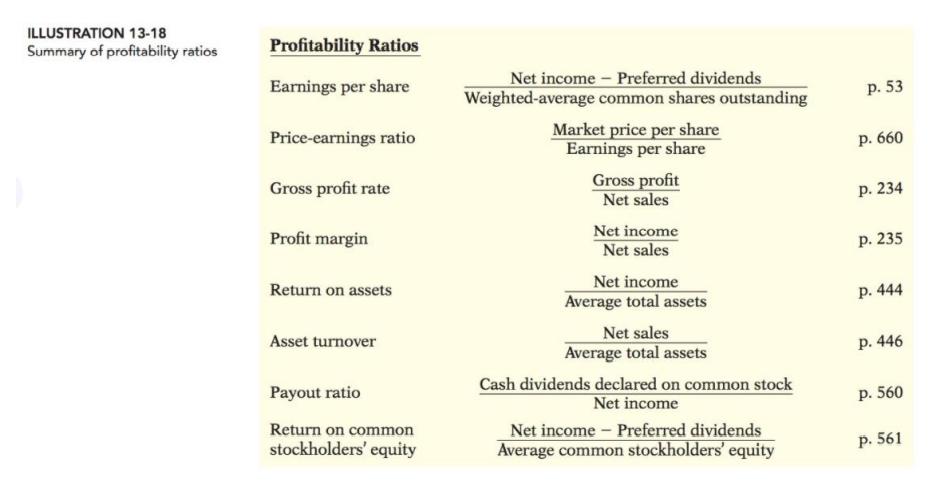

Using an Excel spreadsheet* and your company's financial statements, compute the following for the most recent two years (chapters with information on each ratio are

Using an Excel spreadsheet* and your company's financial statements, compute the following for the most recent two years (chapters with information on each ratio are in parenthesis next to the ratio, refer to the tables in Section 13.3 Ratio Analysis on WileyPlus or pages 661-662, Appendix 13A provides a great example of ratio analysis):

- Current ratio (2,13)

- Working capital (not really a ratio) (2, 13)

- Inventory turnover ratio (6, 13)

- Accounts Receivable turnover ratio (8, 13)

- Debt to total assets ratio (2, 13)

- Return on assets (9,13)

- Asset turnover ratio (9, 13)

- Return on equity (11, 13)

- Gross profit ratio (5, 13)

- Profit margin ratio (5, 13)

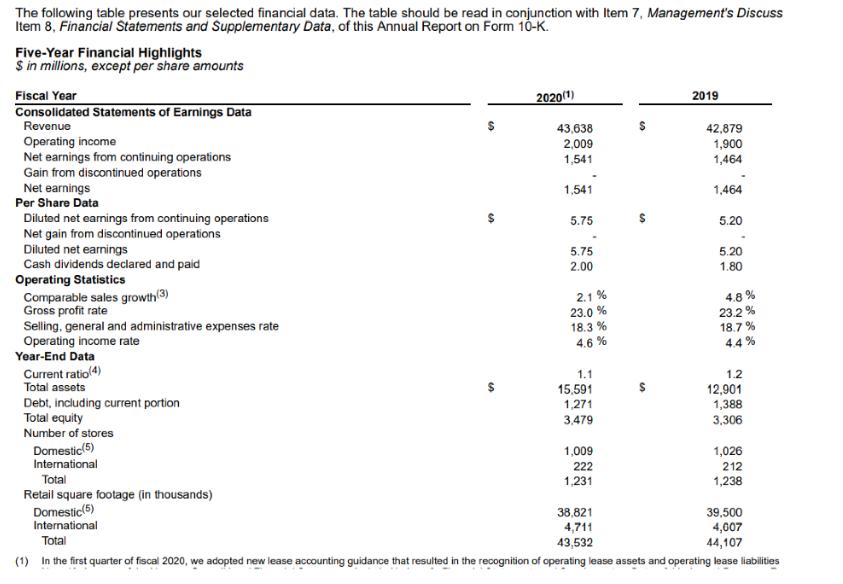

The following table presents our selected financial data. The table should be read in conjunction with Item 7, Management's Discuss Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K. Five-Year Financial Highlights $ in millions, except per share amounts Fiscal Year Consolidated Statements of Earnings Data 2020(1) 2019 Revenue 43,638 42,879 Operating income Net earnings from continuing operations 2,009 1,900 1,541 1,464 Gain from discontinued operations Net earnings Per Share Data 1,541 1,464 Dilutod net earmings from continuing operations Net gain from discontinued operations Diluted net earnings Cash dividends declared and paid Operating Statistics Comparable sales growth 3) Gross profit rate Selling, general and administrative expenses rate Operating income rate Year-End Data Current ratio(4) Total assets 5.75 5.20 5.75 2.00 5.20 1.80 2.1 % 23.0 % 18.3 % 4.6 % 4.8 % 23.2 % 18.7 % 4.4 % 1.1 1.2 15,591 12,901 Debt, including current portion Total equity 1,271 1,388 3,306 3,479 Number of stores Domestic(5) 1,009 1,026 International 222 212 Total 1,231 1,238 Retail square footage (in thousands) Domestic(5) 38,821 39,500 4,007 44,107 International 4,711 Total 43,532 (1) In the first quarter of fiscal 2020, we adopted new lease accounting guidance that resulted in the recognition of operating lease assets and operating lease liabilities %24

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started