Question

Table Plc is currently preparing financial statements for the year ended 31 March 2019. The accounting team discover that the sales figure for 31 March

Table Plc is currently preparing financial statements for the year ended 31 March 2019.

The accounting team discover that the sales figure for 31 March 2018 was understated by £200,000. The Trade Receivables at 31 March 2018 was also understated by the same amount.

This error is regarded as material.

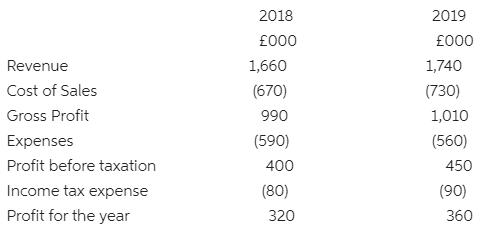

Table Plc’s draft Profit or Loss Comprehensive Income Statement for the year to 31 March 2019, before correction of the error, is as follows:

Retained earnings at 1 April 2017 were £950,000. No dividends were paid during the two years to 31 March 2019. It should be assumed that Table Plc’s tax liability is always 20% of its profit before tax.

Requirement:

- Prepare a Profit or Loss Statement of Comprehensive Income for the year ended 31 March 2019, including the restated comparative figures for the year ended 31 March 2018.

- Calculate Table Plc’s restated retained earnings at 31 March 2019, after correcting the above error.

2018 2019 000 000 Revenue 1,660 1,740 Cost of Sales (670) (730) Gross Profit 990 1,010 Expenses (590) (560) Profit before taxation 400 450 Income tax expense (80) (90) Profit for the year 320 360

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Statement of Comprehensive Income For the year ended M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started