Answered step by step

Verified Expert Solution

Question

1 Approved Answer

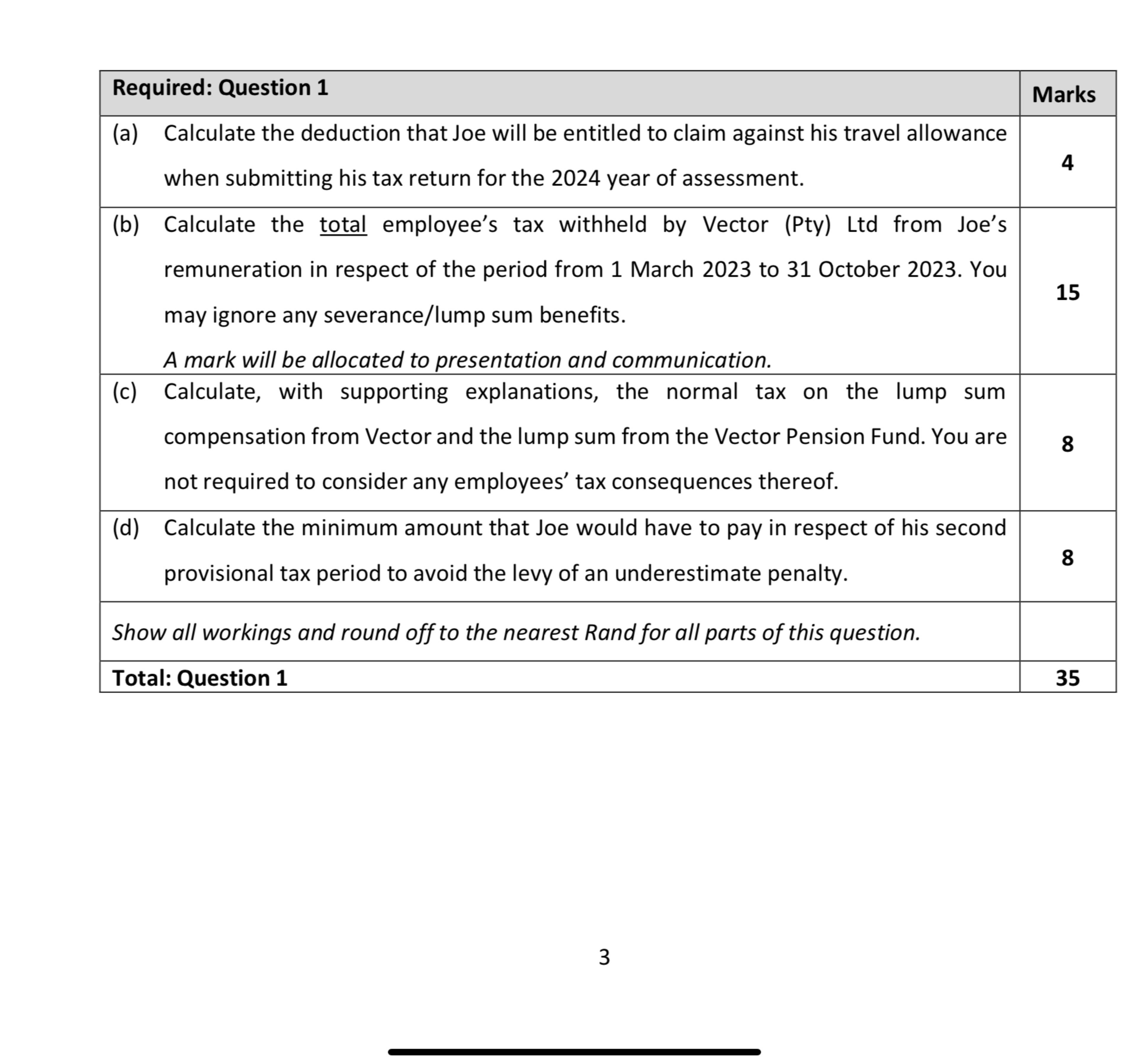

table [ [ Required: Question 1 , Marks ] , [ table [ [ ( a ) Calculate the deduction that Joe will

tableRequired: Question Markstablea Calculate the deduction that Joe will be entitled to claim against his travel allowancewhen submitting his tax return for the year of assessment.tableb Calculate the total employee's tax withheld by Vector Pty Ltd from Joe'sremuneration in respect of the period from March to October Youmay ignore any severancelump sum benefits.A mark will be allocated to presentation and communication.tablec Calculate, with supporting explanations, the normal tax on the lump sumcompensation from Vector and the lump sum from the Vector Pension Fund. You arenot required to consider any employees' tax consequences thereof.tabled Calculate the minimum amount that Joe would have to pay in respect of his secondprovisional tax period to avoid the levy of an underestimate penalty.Show all workings and round off to the nearest Rand for all parts of this question.,Total: Question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started