Answered step by step

Verified Expert Solution

Question

1 Approved Answer

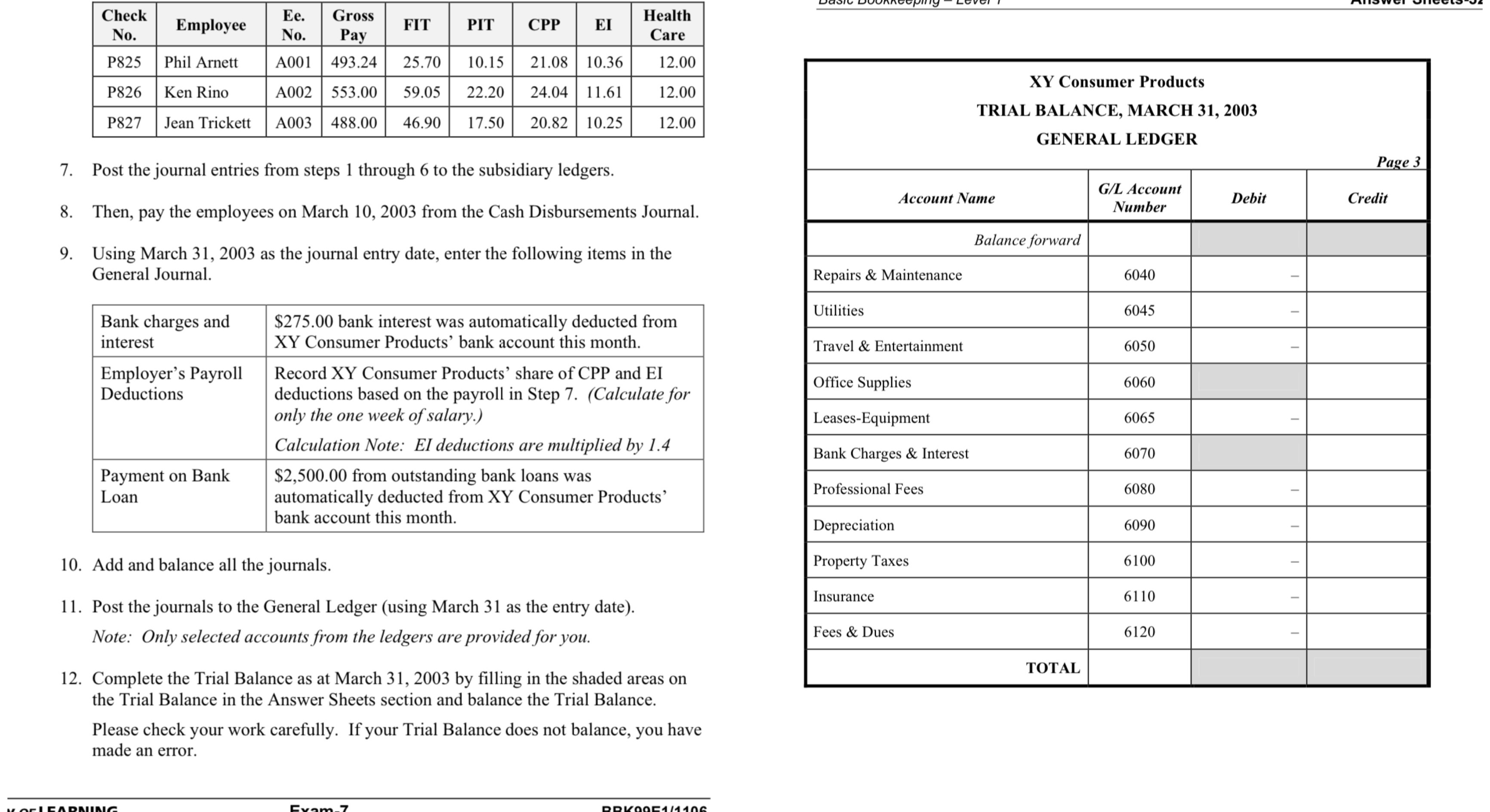

table [ [ table [ [ Check ] , [ No . ] ] , Employee, table [ [ Ee . ]

tabletableCheckNoEmployee,tableEeNotableGrossPayFIT,PIT,CPPEItableHealthCarePPhil Arnett,APKen Rino,APJean Trickett,A

Post the journal entries from steps through to the subsidiary ledgers.

Then, pay the employees on March from the Cash Disbursements Journal.

Using March as the journal entry date, enter the following items in the General Journal.

tabletableBank charges andinteresttable$ bank interest was automatically deducted fromXY Consumer Products' bank account this month.tableEmployers PayrollDeductionstableRecord XY Consumer Products' share of CPP and EIdeductions based on the payroll in Step Calculate foronly the one week of salary.Calculation Note: EI deductions are multiplied by tablePayment on BankLoantable$ from outstanding bank loans wasautomatically deducted from XY Consumer Products'bank account this month.

Add and balance all the journals.

Post the journals to the General Ledger using March as the entry date

Note: Only selected accounts from the ledgers are provided for you.

Complete the Trial Balance as at March by filling in the shaded areas on

the Trial Balance in the Answer Sheets section and balance the Trial Balance.

Please check your work carefully. If your Trial Balance does not balance, you have made an error.

tabletableXY Consumer ProductsTRIAL BALANCE, MARCH GENERAL LEDGERAccount Name,tableGL AccountNumberDebit,CreditBalance forwardRepairs & Maintenance,UtilitiesTravel & Entertainment,Office Supplies,LeasesEquipment,Bank Charges & Interest,Professional Fees,DepreciationProperty Taxes,InsuranceFees & Dues,TOTAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started