Answered step by step

Verified Expert Solution

Question

1 Approved Answer

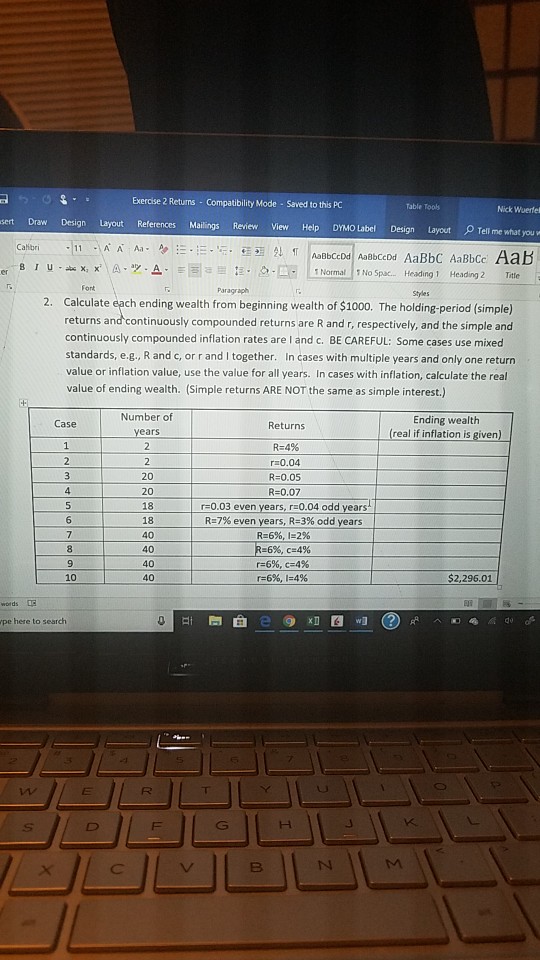

Table Tooh Nick Wuerfel Exercise 2 Returns Compatibility Mode - Saved to this PC Review View Help DYMO Label Design Layout Tell me what you

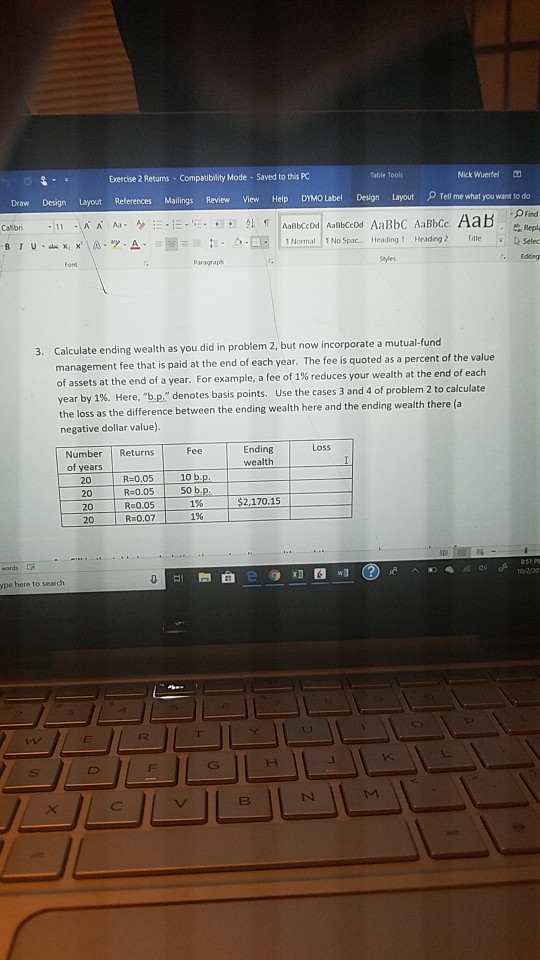

Table Tooh Nick Wuerfel Exercise 2 Returns Compatibility Mode - Saved to this PC Review View Help DYMO Label Design Layout Tell me what you want to do Draw Design Layout References Mailings O Find Repla 8 1 u.mx, x,IA. :E 0,CE Edeng Paragraph 3. Calculate ending wealth as you did in problem 2, but now incorporate a mutual-fund management fee that is paid at the end of each year. The fee is quoted as a percent of the value of assets at the end of a year. For example, a fee of 1% reduces your wealth at the end of each year by 1%. Here, .b.p' denotes basis points. Use the cases 3 and 4 of problem 2 to calculate the loss as the difference between the ending wealth here and the ending wealth there (a negative dollar value Number Returns R-0.05 Loss Ending wealth of years 20 20 10 b $2,170.15 R 0.05 R 0.07 196 20 pe here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started