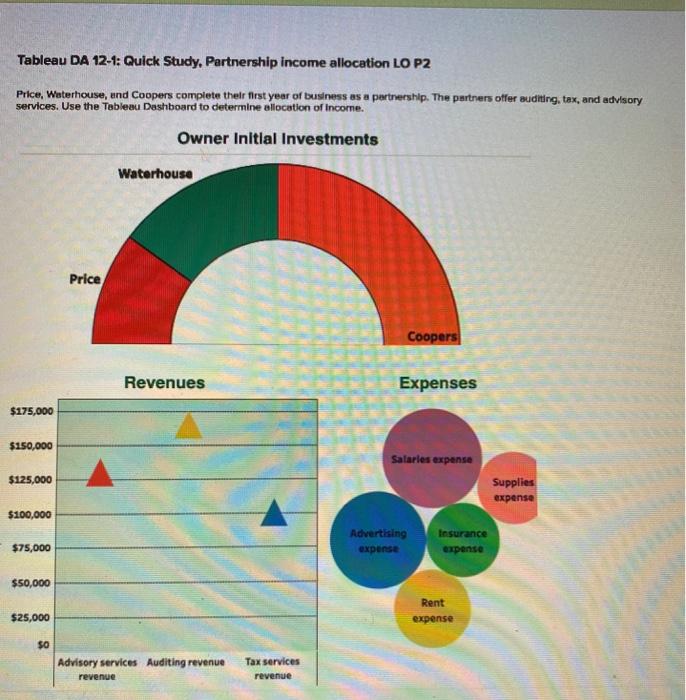

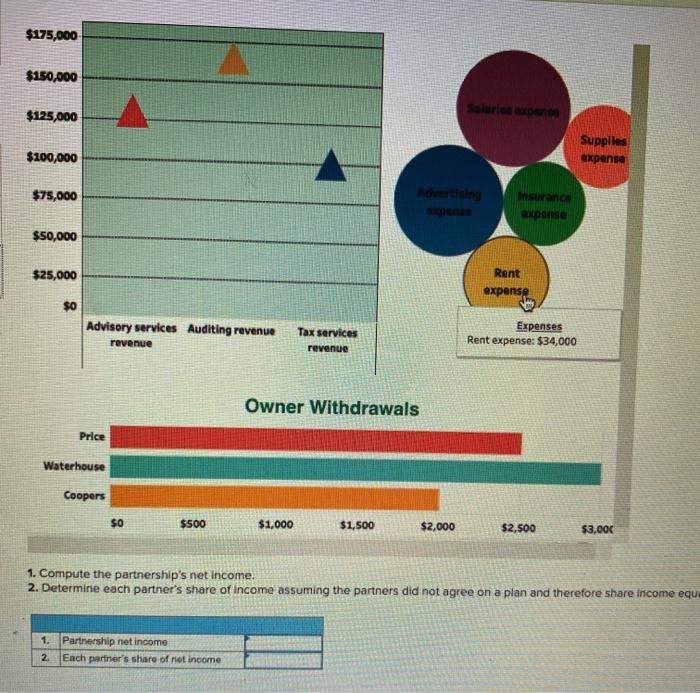

Tableau DA 12-1: Quick Study. Partnership income allocation LO P2 Price, Waterhouse, und Coopers complete their first year of business as a partnership. The partners offer auditing, tax, and advisory services. Use the Tableau Dashboard to determine allocation of income. Owner Initial Investments Waterhouse Price Coopers Revenues Expenses $175,000 $150,000 Salaries expense $125,000 Supplies expense $100,000 Advertising expense $75,000 Insurance expense $50,000 Rent $25,000 expense $0 Advisory services Auditing revenue revenue Tax services revenue $175,000 $150,000 $125,000 Salarles experte Supplies expense $100,000 $75,000 Advertising expense Insurance expanse $50,000 $25,000 Rent expense $0 Advisory services Auditing revenue Tax services revenue Expenses Rent expense: $34,000 revenue Owner Withdrawals Price Waterhouse Coopers $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1. Compute the partnership's net income. 2. Determine each partner's share of income assuming the partners did not agree on a plan and therefore share income equa 1. Partnership net income 2. Each partner's share of not income Tableau DA 12-1: Quick Study. Partnership income allocation LO P2 Price, Waterhouse, und Coopers complete their first year of business as a partnership. The partners offer auditing, tax, and advisory services. Use the Tableau Dashboard to determine allocation of income. Owner Initial Investments Waterhouse Price Coopers Revenues Expenses $175,000 $150,000 Salaries expense $125,000 Supplies expense $100,000 Advertising expense $75,000 Insurance expense $50,000 Rent $25,000 expense $0 Advisory services Auditing revenue revenue Tax services revenue $175,000 $150,000 $125,000 Salarles experte Supplies expense $100,000 $75,000 Advertising expense Insurance expanse $50,000 $25,000 Rent expense $0 Advisory services Auditing revenue Tax services revenue Expenses Rent expense: $34,000 revenue Owner Withdrawals Price Waterhouse Coopers $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 1. Compute the partnership's net income. 2. Determine each partner's share of income assuming the partners did not agree on a plan and therefore share income equa 1. Partnership net income 2. Each partner's share of not income