Tabletop External Auditors are currently completing the audit of Star Enterprises, Inc. a manufacturer of specialized astronomy and stargazing equipment with sales throughout the

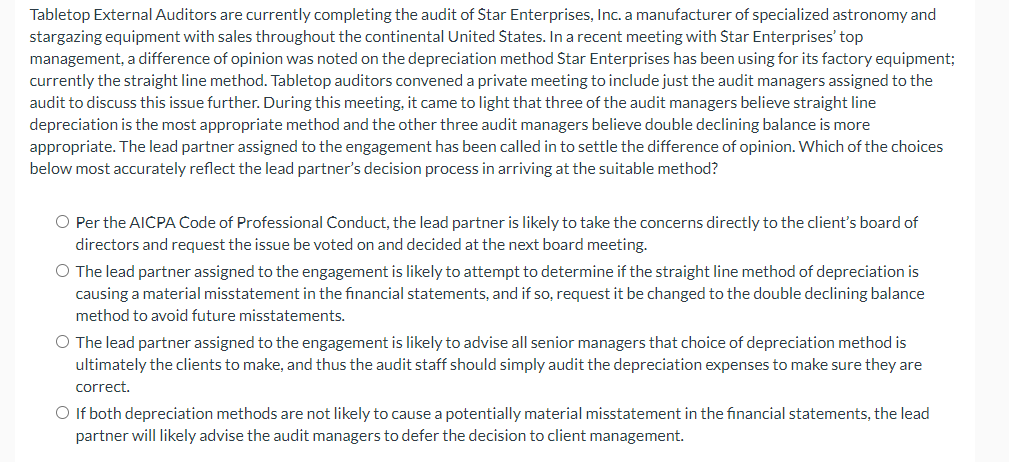

Tabletop External Auditors are currently completing the audit of Star Enterprises, Inc. a manufacturer of specialized astronomy and stargazing equipment with sales throughout the continental United States. In a recent meeting with Star Enterprises' top management, a difference of opinion was noted on the depreciation method Star Enterprises has been using for its factory equipment; currently the straight line method. Tabletop auditors convened a private meeting to include just the audit managers assigned to the audit to discuss this issue further. During this meeting, it came to light that three of the audit managers believe straight line depreciation is the most appropriate method and the other three audit managers believe double declining balance is more appropriate. The lead partner assigned to the engagement has been called in to settle the difference of opinion. Which of the choices below most accurately reflect the lead partner's decision process in arriving at the suitable method? O Per the AICPA Code of Professional Conduct, the lead partner is likely to take the concerns directly to the client's board of directors and request the issue be voted on and decided at the next board meeting. O The lead partner assigned to the engagement is likely to attempt to determine if the straight line method of depreciation is causing a material misstatement in the financial statements, and if so, request it be changed to the double declining balance method to avoid future misstatements. O The lead partner assigned to the engagement is likely to advise all senior managers that choice of depreciation method is ultimately the clients to make, and thus the audit staff should simply audit the depreciation expenses to make sure they are correct. O If both depreciation methods are not likely to cause a potentially material misstatement in the financial statements, the lead partner will likely advise the audit managers to defer the decision to client management.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below If both depreciation metho...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started