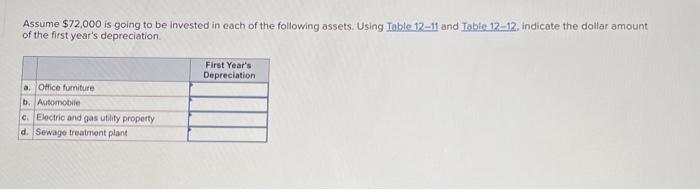

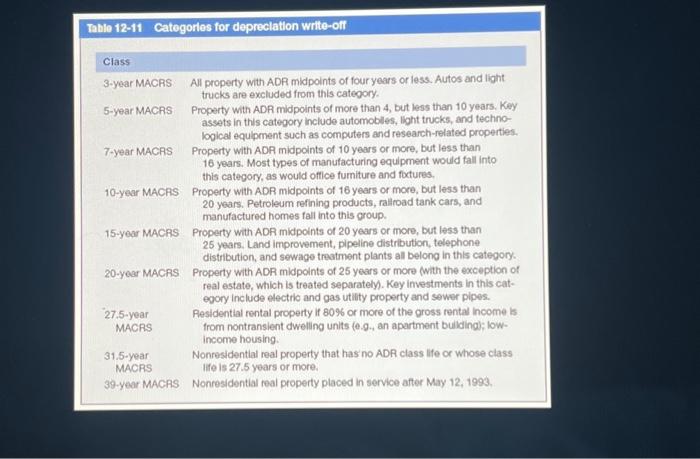

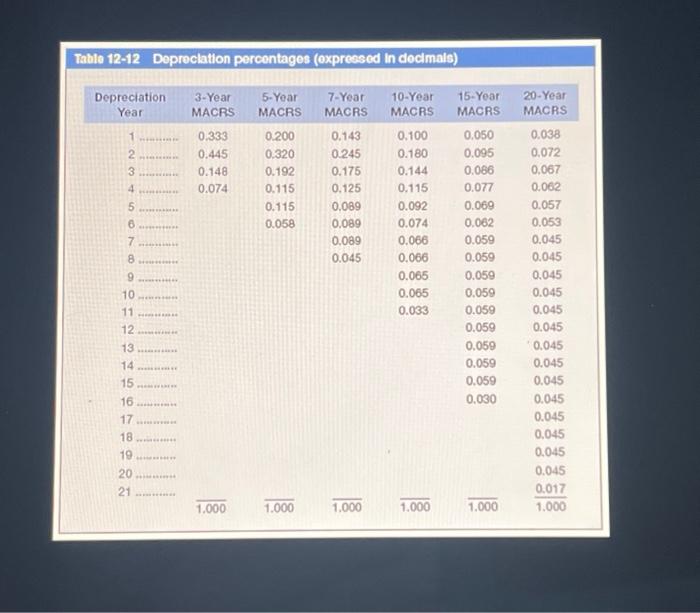

Tablo 12-11 Catogorles for depreclation write-off Class 3-year MACRS 5-year MACRS 7-year MACAS 10-year MACRS 15-yoar MACRS 20-year MACRS 27.5-year MACRS 31.5-year MACRS 39-year MACRS All property with ADA midpoints of four years or less. Autos and light trucks are excluded from this category. Property with ADA midpoints of more than 4, but less than 10 years. Key assets in this category include automobles, light trucks, and technological equipment such as computers and research-related properties. Property with ADA midpoints of 10 years or more, but less than 16 years. Most types of manufacturing equipment would fall into this category, as would offlce fumiture and foxtures. Property with ADR midpoints of 16 years or more, but less than 20 years. Petroleum refining products, rallroad tank cars, and manufactured homes fall into this group. Property with ADR midpoints of 20 years or more, but less than 25 years. Land improwement, pipeline distribution, telephone distribution, and sewage treatment plants all belong in this category. Property with ADR midpoints of 25 years or more (with the exception of real estate, which is treated separately). Key investments in this category include electric and gas utility property and sewer pipes. Residential rental property if 80% or more of the gross rental income is from nontransient dwelling units (e.g., an apartment buliding); lowincome housing. Nonresidential real property that has no ADA class life whose class life is 27.5 years or more. Nonresidential real property placed in service after May 12, 1993. Tablo 12-12 Doproclation percentages (oxpressed in docimals) \begin{tabular}{|c|c|c|c|c|c|c|} \hline DepreciationYear & 3-YearMACRS & 5.YearMACRS & 7-YearMACRS & 10-YearMACRS & 15-YearMACRS & 20-YearMACRS \\ \hline 1 . & 0.333 & 0.200 & 0.143 & 0.100 & 0.050 & 0.038 \\ \hline 2. & 0.445 & 0.320 & 0.245 & 0.180 & 0.095 & 0.072 \\ \hline 3 & 0.148 & 0.192 & 0.175 & 0.144 & 0.086 & 0.067 \\ \hline 4 n.t......... & 0.074 & 0.115 & 0.125 & 0.115 & 0.077 & 0.062 \\ \hline & & 0.115 & 0,089 & 0.092 & 0.069 & 0.057 \\ \hline 6 . . +. & & 0.058 & 0.089 & 0.074 & 0.062 & 0.053 \\ \hline 7 & & & 0.089 & 0.066 & 0.059 & 0.045 \\ \hline 8 . & & & 0.045 & 0.066 & 0.059 & 0.045 \\ \hline 9 -......t. & & & & 0.065 & 0.059 & 0.045 \\ \hline 10 . & & & & 0.065 & 0.059 & 0.045 \\ \hline 11 & & & & 0.033 & 0.059 & 0.045 \\ \hline 12 & & & & & 0.059 & 0.045 \\ \hline 13 & & & & & 0.059 & 0.045 \\ \hline 14 & & & & & 0.059 & 0.045 \\ \hline 15 & & & & & 0.059 & 0.045 \\ \hline 16 & & & & & 0.030 & 0.045 \\ \hline 17 & & & & & & 0.045 \\ \hline 18 . ...t & & & & & & 0.045 \\ \hline 19 & & & & , & & 0.045 \\ \hline 20 & & & & & & 0.045 \\ \hline 21 & & & & & & 0.017 \\ \hline & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 \\ \hline \end{tabular} Assume $72,000 is going to be invested in each of the following assets. Using Table 12-11 and Table 12-12, indicate the dollar amount of the first year's depreciation