Question

Tacoma Hospital has three support departments and four patient services departments. The direct costs to each of the support departments are as follows: Direct Costs

Tacoma Hospital has three support departments and four patient services departments. The direct costs to each of the support departments are as follows:

| Direct Costs | Cost Driver | |

| General Administration | $2,000,000 | Patient Services Revenue |

| Facilities | $5,000,000 | Space (square feet) |

| Financial Services | $3,000,000 | Patient Services Revenue |

| Total | $10,000,000 |

|

The patient services revenue and space utilization (square feet) for each department are as follows:

| Patient Services Revenue | Space (square feet) | |

| Routine Care | $30,000,000 | 400,000 |

| Intensive Care | $4,000,000 | 40,000 |

| Diagnostic Services | $6,000,000 | 60,000 |

| Other Services | $10,000,000 | 100,000 |

| Total | $50,000,000 | 600,000 |

Assume that the hospital uses the direct method for cost allocation. Furthermore, the cost driver for general administration and financial services is patient services revenue, while the cost driver for facilities is space utilization.

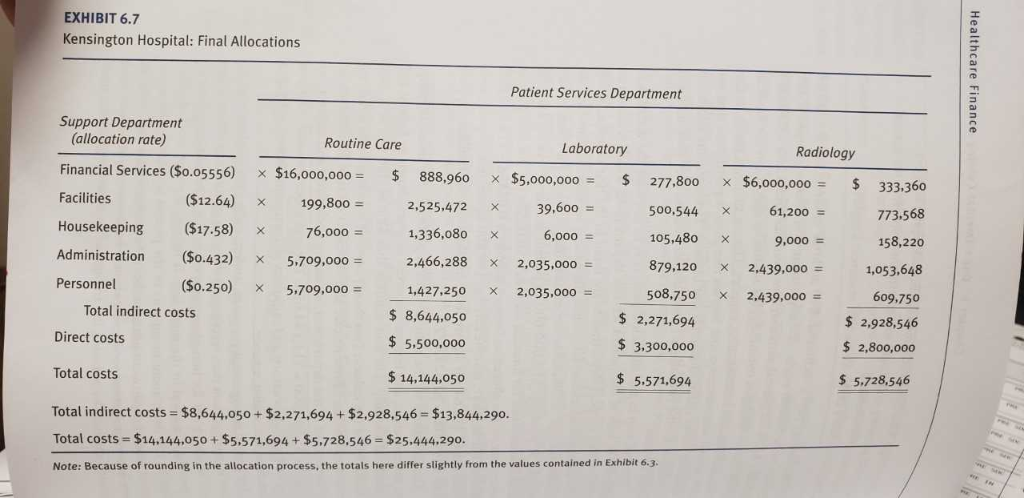

a. Use an allocation table similar to Exhibit 6.7 to allocate the hospitals overhead costs to the patient services departments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started