Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taffy Corporation (Taffy) was incorporated in 2011 when Mark Smith, Alice Chu and Sam MacDonald united their three existing companies in a business combination.

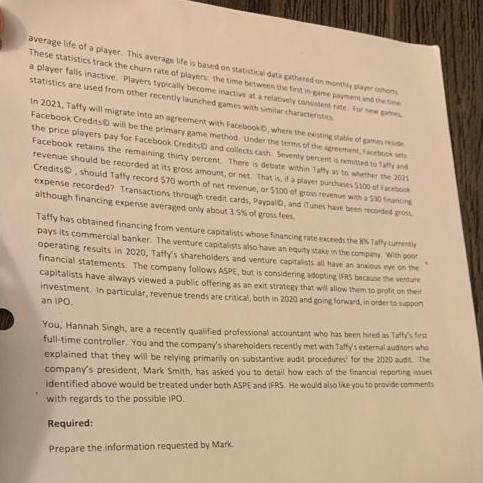

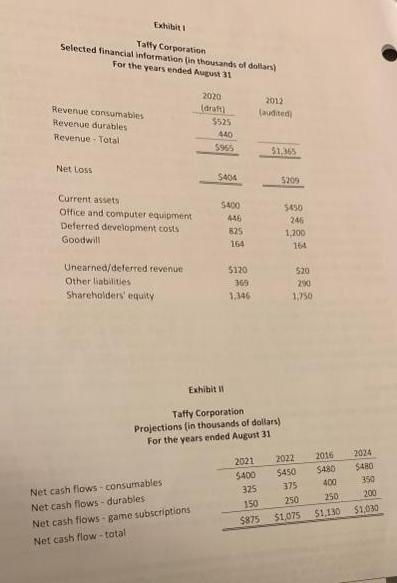

Taffy Corporation (Taffy) was incorporated in 2011 when Mark Smith, Alice Chu and Sam MacDonald united their three existing companies in a business combination. Taffy is named after Smith's cat, with the cat's picture used as the company logo Taffy is involved in on-line gaming. There are many marginal and small games to be found on-line, and many short-lived games. However, a big win "franchise" game can generate a billion dollars in lifetime gross bookings. Taffy and many others hope to develop a game of this magnitude. The goal is to produce an engaging multi-platform game that produces bold features to motivate players to play longer and, in turn, generate increased revenues for the developer. Taffy's games operate on-line and allow players to play for free. Players can purchase "virtual currency" to enhance their game in some fashion, and these in-app purchases are the source of Taffy's revenue. Credit cards, Paypal, and iTunes have been used to collect money for this virtual currency. It is now early October 2020, and Taffy is preparing its annual August 31 financial statements, which will again be audited. Selected financial information is included in Exhibit 1. A major issue in 2020 was that revenue failed to meet expectations in the latter part of the year. The company failed to retain players in three of its major games, and two new games failed to take off. Continued operating losses resulted. Management has embarked in cost-cutting, closing the two new games that did not meet expectations, and sacrificing plans for development of several future games, while preserving plans to develop two others. Of particular interest is a math game to be made available free through schools, with a subscription-based advanced game marketed to parents for their children to continue to use at home. This will be the first subscription-based game for Taffy. All of the deferred development costs at August 31, 2020 relate to the math game that will be heavily marketed in the upcoming weeks. Given the speed of change in the gaming industry, revenue-based cash-flow projections are only meaningful for a four-year period. Projections are presented in Exhibit II and are presumed to occur evenly throughout the year. The bulk of Taffy's existing revenue is from the sale of virtual goods to players in games that Taffy hosts on its servers. These virtual goods are categorized as two types: consumable and durable. Consumable goods like energy or life, are consumed by the player during the game. These goods last only a short period of time, often must be used immediately, and have no value to the player after being consumed. Durable goods, on the other hand, are accessible to a player over an extended period of time. Prior to 2020, Taffy felt that data did not exist to accurately differentiate revenue from consumable goods versus durable goods. It did, however, defer a nominal amount of revenue associated with the sale of virtual goods in one of its newer games. This revenue was allocated based on the estimated life of one of the games, as Taffy did not have the data to allocate the revenue based on how long the virtual goods would be used within the game.. However in 2020, data was compiled on the average playing period of paying players in Taffy's games. The two revenue streams were separated, with consumables revenue recognized immediately. Consistent with the policy of others in the industry, Taffy's revenue from durables is recognized over the Taffy Corporation 2 average life of a player. This average life is based on statistical data gathered on monthly player cons These statistics track the churn rate of players the time between the fint in game payment and the ne a player falls inactive. Players typically become inactive at a relatively consistent rate for new p statistics are used from other recently launched games with similar characteristics In 2021, Taffy will migrate into an agreement with Facebook, where the existing state of games reside Facebook Credits will be the primary game method. Under the terms of the agreement, Facebook st the price players pay for Facebook Credits and collects cash Seventy percent is remitted to Taffy and Facebook retains the remaining thirty percent. There is debate within Tafty us to whether the 2021 revenue should be recorded at its gross amount, or net. That is, if a player purchases $300 Credits, should Taffy record 570 worth of net revenue, or $100 of gross revenus with a $30 financing expense recorded? Transactions through credit cards, Paypalo, and iTunes have been recorded gros although financing expense averaged only about 3.5% of gross fees Taffy has obtained financing from venture capitalists whose financing rate exceeds the Tayumntly pays its commercial banker. The venture capitalists also have an equity stake in the company with poor operating results in 2020, Taffy's shareholders and venture capitalists all have an anxious eye on the financial statements. The company follows ASPE, but is considering adopting IFRS because the verdure capitalists have always viewed a public offering as an exit strategy that will allow them to profit on the investment. In particular, revenue trends are critical, both in 2020 and going forward, in order to suppor an IPO. You, Hannah Singh, are a recently qualified professional accountant who has been hired as Taffy's first full-time controller. You and the company's shareholders recently met with Taffy's external auditors who explained that they will be relying primarily on substantive audit procedures for the 2020 audit. The company's president, Mark Smith, has asked you to detail how each of the financial reporting intuel identified above would be treated under both ASPE and IFRS. He would also like you to provide comments with regards to the possible IPO. Required: Prepare the information requested by Mark Exhibit I Taffy Corporation Selected financial information (in thousands of dollars) For the years ended August 31 Revenue consumables Revenue durables Revenue - Total Net Loss Current assets Office and computer equipment Deferred development costs Goodwill Unearned/deferred revenue Other liabilities Shareholders' equity Net cash flows - consumables Net cash flows-durables 2020 (draft) $525 440 5965 Net cash flows-game subscriptions Net cash flow-total $404 $400 446 Exhibit II 164 5120 369 1,346 2012 (audited) Taffy Corporation Projections (in thousands of dollars) For the years ended August 31 $1,365 5209 $450 246 1,200 164 520 290 1,750 2021 2022 $400 $450 325 375 250 150 $875 $1,075 2016 $480 400 250 2024 $480 350 200 $1,130 $1,030

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To Mark Smith SubjectThe Financial Issues identified under both ASPE and IFRS Dear All The general issues that might be treated under both ASPE and IFRS are being listed below 1Revenue Recognition ASP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started