Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tai Hing Construction Limited (Tai Hing) specializes in the construction of sports ground and child playground for more than 10 years. Tai Hing is

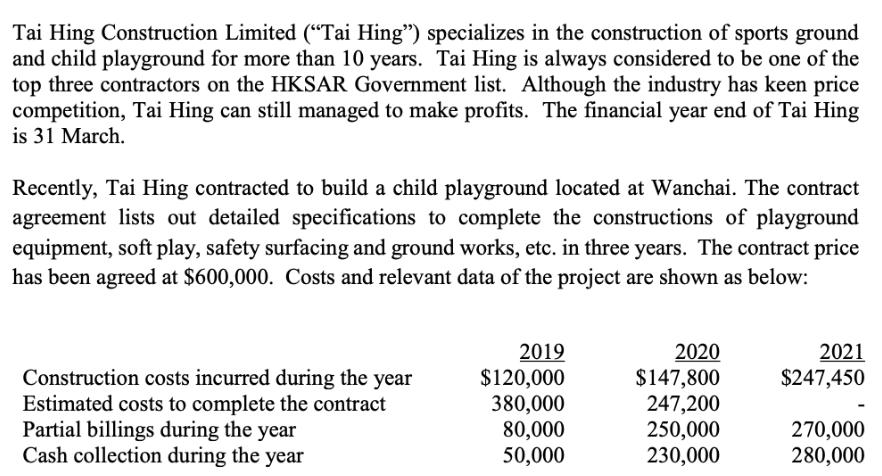

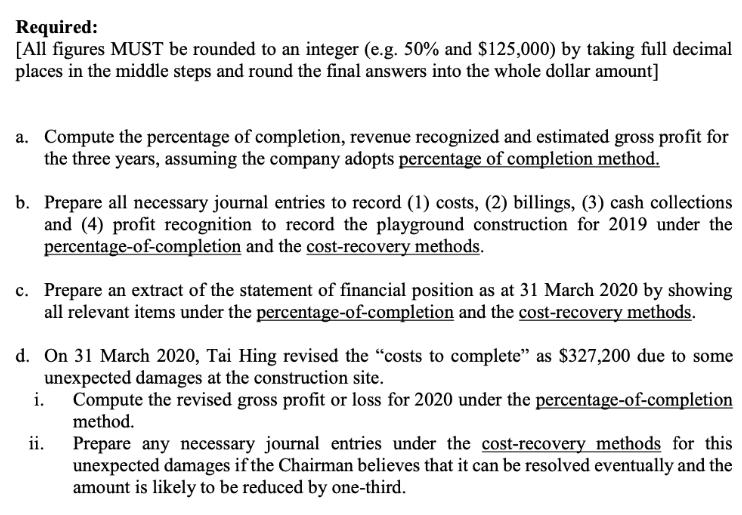

Tai Hing Construction Limited ("Tai Hing") specializes in the construction of sports ground and child playground for more than 10 years. Tai Hing is always considered to be one of the top three contractors on the HKSAR Government list. Although the industry has keen price competition, Tai Hing can still managed to make profits. The financial year end of Tai Hing is 31 March. Recently, Tai Hing contracted to build a child playground located at Wanchai. The contract agreement lists out detailed specifications to complete the constructions of playground equipment, soft play, safety surfacing and ground works, etc. in three years. The contract price has been agreed at $600,000. Costs and relevant data of the project are shown as below: Construction costs incurred during the year Estimated costs to complete the contract Partial billings during the year Cash collection during the year 2019 $120,000 380,000 80,000 50,000 2020 $147,800 247,200 250,000 230,000 2021 $247,450 270,000 280,000 Required: [All figures MUST be rounded to an integer (e.g. 50% and $125,000) by taking full decimal places in the middle steps and round the final answers into the whole dollar amount] a. Compute the percentage of completion, revenue recognized and estimated gross profit for the three years, assuming the company adopts percentage of completion method. b. Prepare all necessary journal entries to record (1) costs, (2) billings, (3) cash collections and (4) profit recognition to record the playground construction for 2019 under the percentage-of-completion and the cost-recovery methods. c. Prepare an extract of the statement of financial position as at 31 March 2020 by showing all relevant items under the percentage-of-completion and the cost-recovery methods. d. On 31 March 2020, Tai Hing revised the "costs to complete" as $327,200 due to some unexpected damages at the construction site. i. Compute the revised gross profit or loss for 2020 under the percentage-of-completion method. Prepare any necessary journal entries under the cost-recovery methods for this unexpected damages if the Chairman believes that it can be resolved eventually and the amount is likely to be reduced by one-third. ii.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the percentage of completion revenue recognized and estimated gross profit for the three years assuming the company adopts percentage of completion method 2019 120000 500000 24 2020 120000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started