Answered step by step

Verified Expert Solution

Question

1 Approved Answer

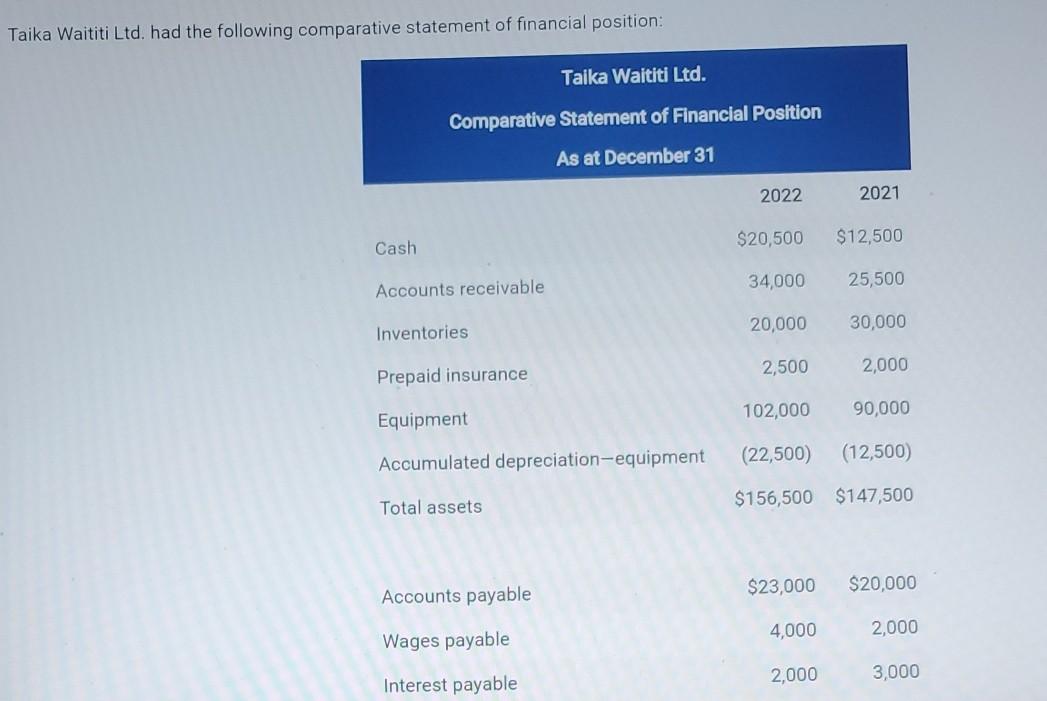

Taika Waititi Ltd. had the following comparative statement of financial position: Taika Waititi Ltd. Comparative Statement of Financial Position As at December 31 2022

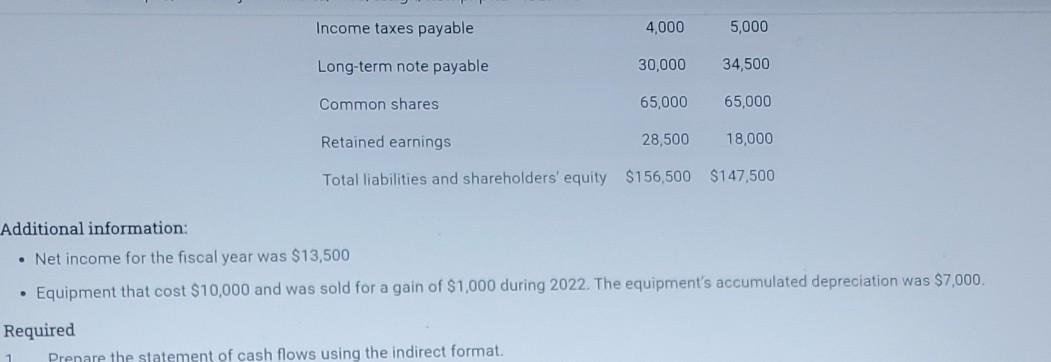

Taika Waititi Ltd. had the following comparative statement of financial position: Taika Waititi Ltd. Comparative Statement of Financial Position As at December 31 2022 2021 Cash $20,500 $12,500 Accounts receivable 34,000 25,500 Inventories 20,000 30,000 Prepaid insurance 2,500 2,000 Equipment 102,000 90,000 Accumulated depreciation-equipment (22,500) (12,500) Total assets $156,500 $147,500 Accounts payable $23,000 $20,000 Wages payable 4,000 2,000 Interest payable 2,000 3,000 Income taxes payable 4,000 5,000 Long-term note payable 30,000 34,500 Common shares 65,000 65,000 Retained earnings 28,500 18,000 Total liabilities and shareholders' equity $156,500 $147,500 Additional information: Net income for the fiscal year was $13,500 Equipment that cost $10,000 and was sold for a gain of $1,000 during 2022. The equipment's accumulated depreciation was $7,000. Required 1 Prenare the statement of cash flows using the indirect format.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Cash Flow as per AS3 Particulars Details Amount Cash flow from operating activity Net Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6365b59b0d8a3_240581.pdf

180 KBs PDF File

6365b59b0d8a3_240581.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started