Question

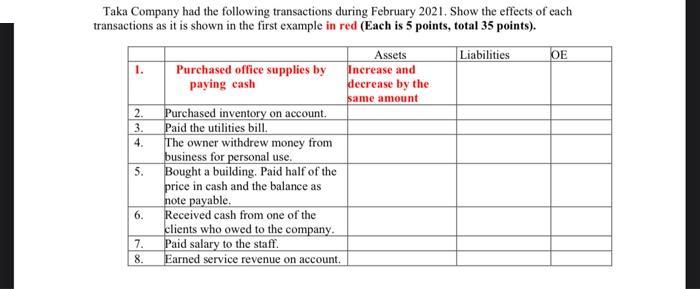

Taka Company had the following transactions during February 2021. Show the effects of each transactions as it is shown in the first example in

Taka Company had the following transactions during February 2021. Show the effects of each transactions as it is shown in the first example in red (Each is 5 points, total 35 points). Liabilities 1. 2. 3. 4. 5. 6. 7. 8. Assets Purchased office supplies by Increase and paying cash decrease by the same amount Purchased inventory on account. Paid the utilities bill. The owner withdrew money from business for personal use. Bought a building. Paid half of the price in cash and the balance as note payable. Received cash from one of the clients who owed to the company. Paid salary to the staff. Earned service revenue on account. OE

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 The accounting equation states that the assets should be equal to the liabilities plus owners equity hence total assets equal to liabilities p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental financial accounting concepts

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward

8th edition

978-007802536, 9780077648831, 0078025362, 77648838, 978-0078025365

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App