Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Takalani is now 2 0 years old. Takalani's monthly salary after tax is R 4 5 , 0 0 0 per month. Takalani would like

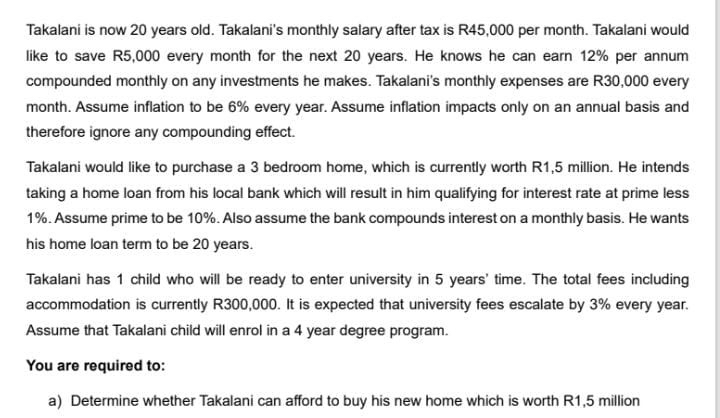

Takalani is now years old. Takalani's monthly salary after tax is per month. Takalani would like to save R every month for the next years. He knows he can earn per annum compounded monthly on any investments he makes. Takalani's monthly expenses are R every month. Assume inflation to be every year. Assume inflation impacts only on an annual basis and therefore ignore any compounding effect.

Takalani would like to purchase a bedroom home, which is currently worth R million. He intends taking a home loan from his local bank which will result in him qualifying for interest rate at prime less Assume prime to be Also assume the bank compounds interest on a monthly basis. He wants his home loan term to be years.

Takalani has child who will be ready to enter university in years' time. The total fees including accommodation is currently R It is expected that university fees escalate by every year. Assume that Takalani child will enrol in a year degree program.

You are required to:

a Determine whether Takalani can afford to buy his new home which is worth R million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started