Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Take AAA=0 Problem 3. (20 pts) Two designs, A and B, are being considered by a company in Kentucky. They use a (AAA + 3)%

Take AAA=0

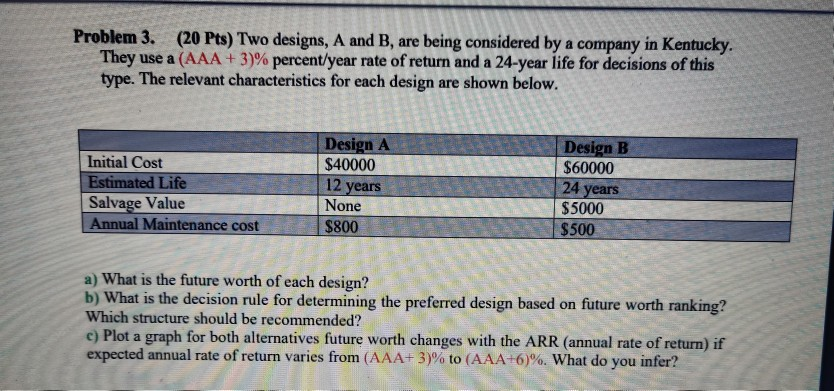

Problem 3. (20 pts) Two designs, A and B, are being considered by a company in Kentucky. They use a (AAA + 3)% percent/year rate of return and a 24-year life for decisions of this type. The relevant characteristics for each design are shown below. Design A 2 / Initial Cost Estimated Life Salvage Value Annual Maintenance cost $40000 12 years None $800 Design B $60000 24 years $ 5000 $500 7 / a) What is the future worth of each design? b) What is the decision rule for determining the preferred design based on future worth ranking? Which structure should be recommended? c) Plot a graph for both alternatives future worth changes with the ARR (annual rate of return) if expected annual rate of return varies from (AAA+3)% to (AAA+6)%. What do you inferStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started