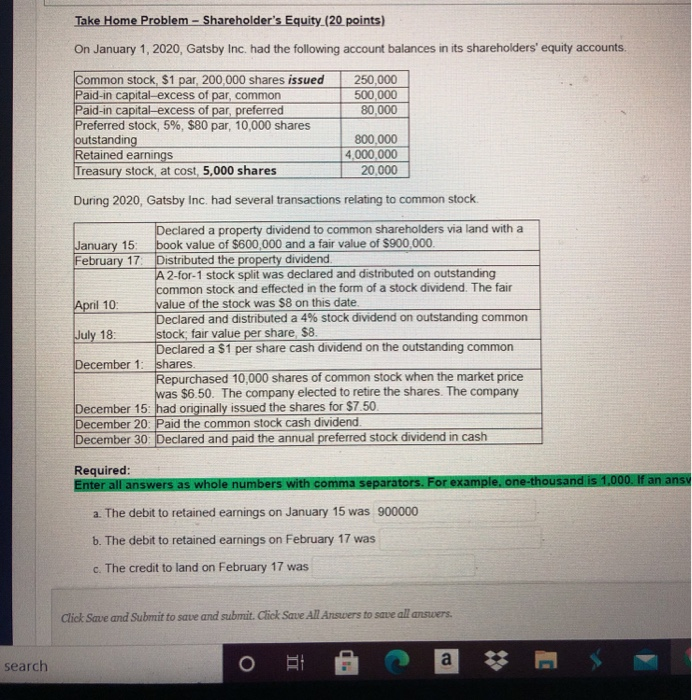

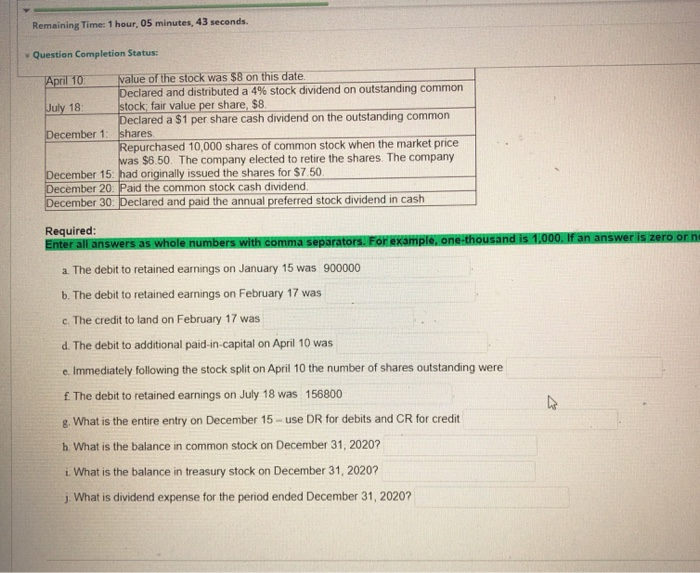

Take Home Problem - Shareholder's Equity_(20 points) On January 1, 2020, Gatsby Inc. had the following account balances in its shareholders' equity accounts. Common stock, S1 par, 200,000 shares issued 250,000 Paid-in capital excess of par, common 500,000 Paid-in capital-excess of par, preferred 80,000 Preferred stock, 5%, $80 par, 10,000 shares outstanding 800,000 Retained earnings 4,000,000 Treasury stock, at cost, 5,000 shares 20.000 During 2020, Gatsby Inc. had several transactions relating to common stock. Declared a property dividend to common shareholders via land with a January 15 book value of $600,000 and a fair value of $900,000 February 17 Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair April 10 value of the stock was $8 on this date. Declared and distributed a 4% stock dividend on outstanding common stock, fair value per share $8. Declared a $1 per share cash dividend on the outstanding common December 1: shares. Repurchased 10,000 shares of common stock when the market price was $6.50. The company elected to retire the shares. The company December 15: had originally issued the shares for $7.50. December 20: Paid the common stock cash dividend. December 30 Declared and paid the annual preferred stock dividend in cash July 18 Required: Enter all answers as whole numbers with comma separators. For example, one-thousand is 1,000. If an ansy a. The debit to retained earnings on January 15 was 900000 b. The debit to retained earnings on February 17 was c. The credit to land on February 17 was Click Save and Submit to save and submit. Click Save All Answers to save all answers. a search Remaining Time: 1 hour, 05 minutes, 43 seconds. Question Completion Status: April 10 July 18 value of the stock was $8 on this date Declared and distributed a 4% stock dividend on outstanding common stock fair value per share, $8. Declared a $1 per share cash dividend on the outstanding common December 1: shares Repurchased 10,000 shares of common stock when the market price was $6.50. The company elected to retire the shares. The company December 15: had originally issued the shares for $7.50 December 20 Paid the common stock cash dividend. December 30: Declared and paid the annual preferred stock dividend in cash Required: Enter all answers as whole numbers with comma separators. For example, one-thousand is 1.000. If an answer is zero or no a. The debit to retained earnings on January 15 was 900000 b. The debit to retained earnings on February 17 was c. The credit to land on February 17 was d. The debit to additional paid-in-capital on April 10 was e. Immediately following the stock split on April 10 the number of shares outstanding were f. The debit to retained earnings on July 18 was 156800 g. What is the entire entry on December 15 - use DR for debits and CR for credit h. What is the balance in common stock on December 31, 2020? i. What is the balance in treasury stock on December 31, 2020? j. What is dividend expense for the period ended December 31, 2020? Take Home Problem - Shareholder's Equity_(20 points) On January 1, 2020, Gatsby Inc. had the following account balances in its shareholders' equity accounts. Common stock, S1 par, 200,000 shares issued 250,000 Paid-in capital excess of par, common 500,000 Paid-in capital-excess of par, preferred 80,000 Preferred stock, 5%, $80 par, 10,000 shares outstanding 800,000 Retained earnings 4,000,000 Treasury stock, at cost, 5,000 shares 20.000 During 2020, Gatsby Inc. had several transactions relating to common stock. Declared a property dividend to common shareholders via land with a January 15 book value of $600,000 and a fair value of $900,000 February 17 Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair April 10 value of the stock was $8 on this date. Declared and distributed a 4% stock dividend on outstanding common stock, fair value per share $8. Declared a $1 per share cash dividend on the outstanding common December 1: shares. Repurchased 10,000 shares of common stock when the market price was $6.50. The company elected to retire the shares. The company December 15: had originally issued the shares for $7.50. December 20: Paid the common stock cash dividend. December 30 Declared and paid the annual preferred stock dividend in cash July 18 Required: Enter all answers as whole numbers with comma separators. For example, one-thousand is 1,000. If an ansy a. The debit to retained earnings on January 15 was 900000 b. The debit to retained earnings on February 17 was c. The credit to land on February 17 was Click Save and Submit to save and submit. Click Save All Answers to save all answers. a search Remaining Time: 1 hour, 05 minutes, 43 seconds. Question Completion Status: April 10 July 18 value of the stock was $8 on this date Declared and distributed a 4% stock dividend on outstanding common stock fair value per share, $8. Declared a $1 per share cash dividend on the outstanding common December 1: shares Repurchased 10,000 shares of common stock when the market price was $6.50. The company elected to retire the shares. The company December 15: had originally issued the shares for $7.50 December 20 Paid the common stock cash dividend. December 30: Declared and paid the annual preferred stock dividend in cash Required: Enter all answers as whole numbers with comma separators. For example, one-thousand is 1.000. If an answer is zero or no a. The debit to retained earnings on January 15 was 900000 b. The debit to retained earnings on February 17 was c. The credit to land on February 17 was d. The debit to additional paid-in-capital on April 10 was e. Immediately following the stock split on April 10 the number of shares outstanding were f. The debit to retained earnings on July 18 was 156800 g. What is the entire entry on December 15 - use DR for debits and CR for credit h. What is the balance in common stock on December 31, 2020? i. What is the balance in treasury stock on December 31, 2020? j. What is dividend expense for the period ended December 31, 2020