Question

Take me to the text On May 1, 2019, Quikk-Mart received a shipment of T-shirts from Bornstar Clothing for an event. The invoice amounted

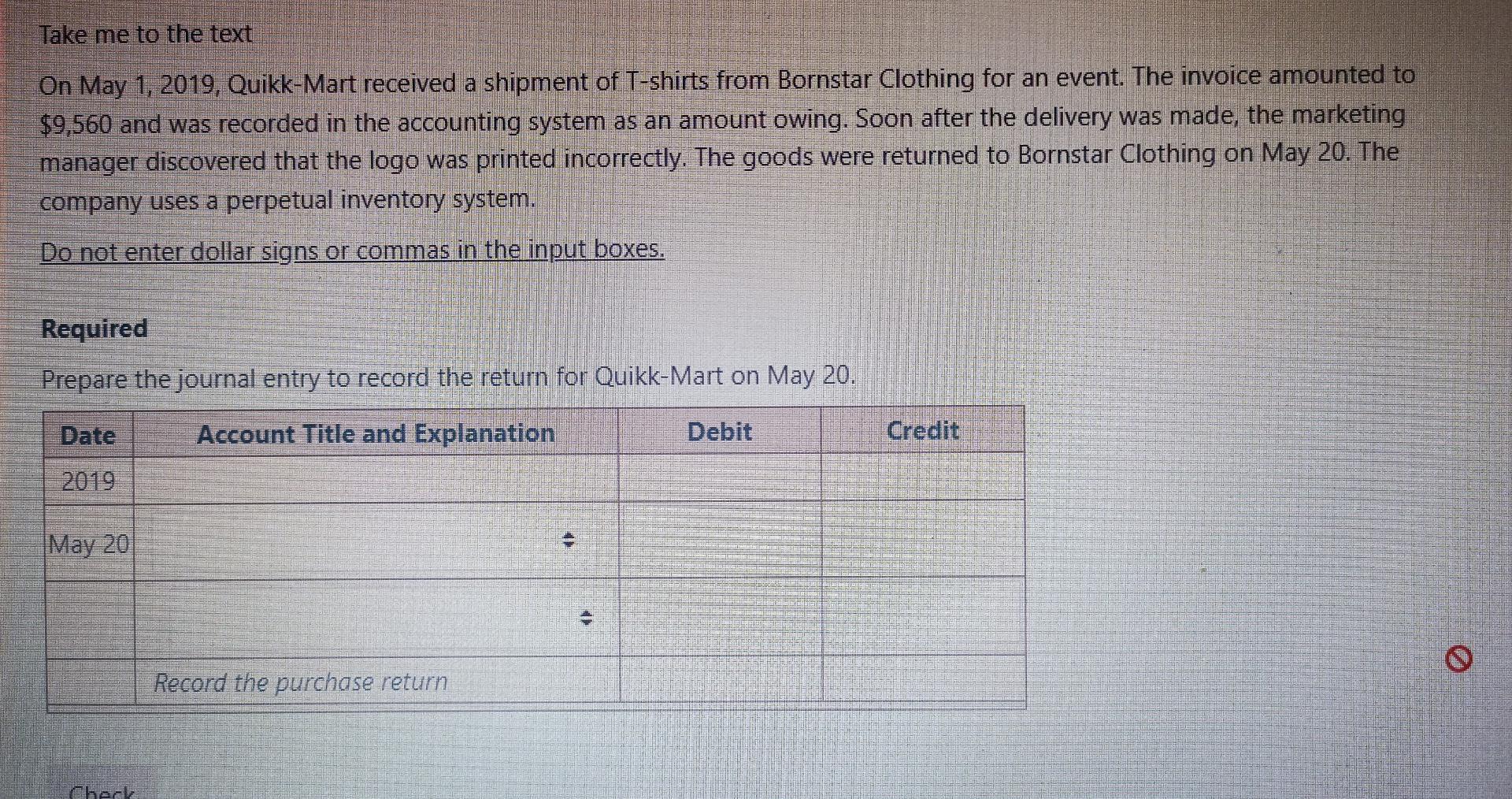

Take me to the text On May 1, 2019, Quikk-Mart received a shipment of T-shirts from Bornstar Clothing for an event. The invoice amounted to $9,560 and was recorded in the accounting system as an amount owing. Soon after the delivery was made, the marketing manager discovered that the logo was printed incorrectly. The goods were returned to Bornstar Clothing on May 20. The company uses a perpetual inventory system. Do not enter dollar signs or commas in the input boxes. Required Prepare the journal entry to record the retum for Quikk-Mart on May 20. Date Account Title and Explanation Debit Credit 2019 May 20 Record the purchase return Chack

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry for quikk mart Date Account Dr Cr 20190520 Accounts Payable 9560 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App