Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Take me to the text Raman Company paid $197,000 to purchase a portfolio of debt investments on March 1, 2020. Management's intention is to

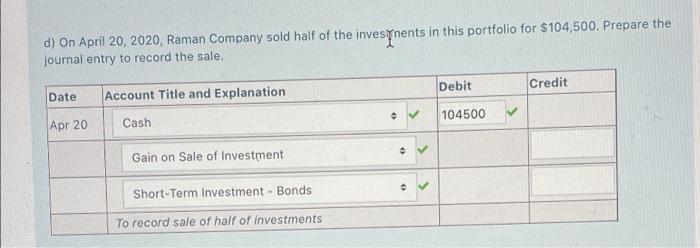

Take me to the text Raman Company paid $197,000 to purchase a portfolio of debt investments on March 1, 2020. Management's intention is to hold them for less than one year. Management does not intend to hold any debt investments until their maturity in this portfolio. Do not enter dollar signs or commas in the input boxes. For transactions with more than one debit or credit, enter the accounts in alphabetical order. Required a) Prepare the journal entry to record the purchase of these debt securities. Date Account Title and Explanation Debit Credit Mar 1 Short-Term investment - Bonds 197000 Cash 197000 To record purchase of investments b) On March 15, 2020, Raman Company received interest of$1,600 from the debt investments in this portfolio. Prepare the journal entry to record the receipt of ikerest. Date Account Title and Explanation Debit Credit Mar 15 Cash 1600 Interest Revenue 1600 To record receipt of interest c) The fair value of the portfolio at Raman Company's year end on March 31, 2020 was $214,000. Prepare the journal entry to record the fair value adjustment. Account Title and Explanation Debit Credit Date Mar 31 Valuation Allowance for Fair Value Adjustment v 17000 Unrealized Gain on Fair Value Adjustment 17000 To record fair value adjustment d) On April 20, 2020, Raman Company sold half of the investnents in this portfolio for $104,500. Prepare the journal entry to record the sale. Date Account Title and Explanation Debit Credit Apr 20 Cash 104500 Gain on Sale of Investment Short-Term Investment - Bonds To record sale of half of investments

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculations Cost value of sale of bonds 197000 x 12 9850...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started