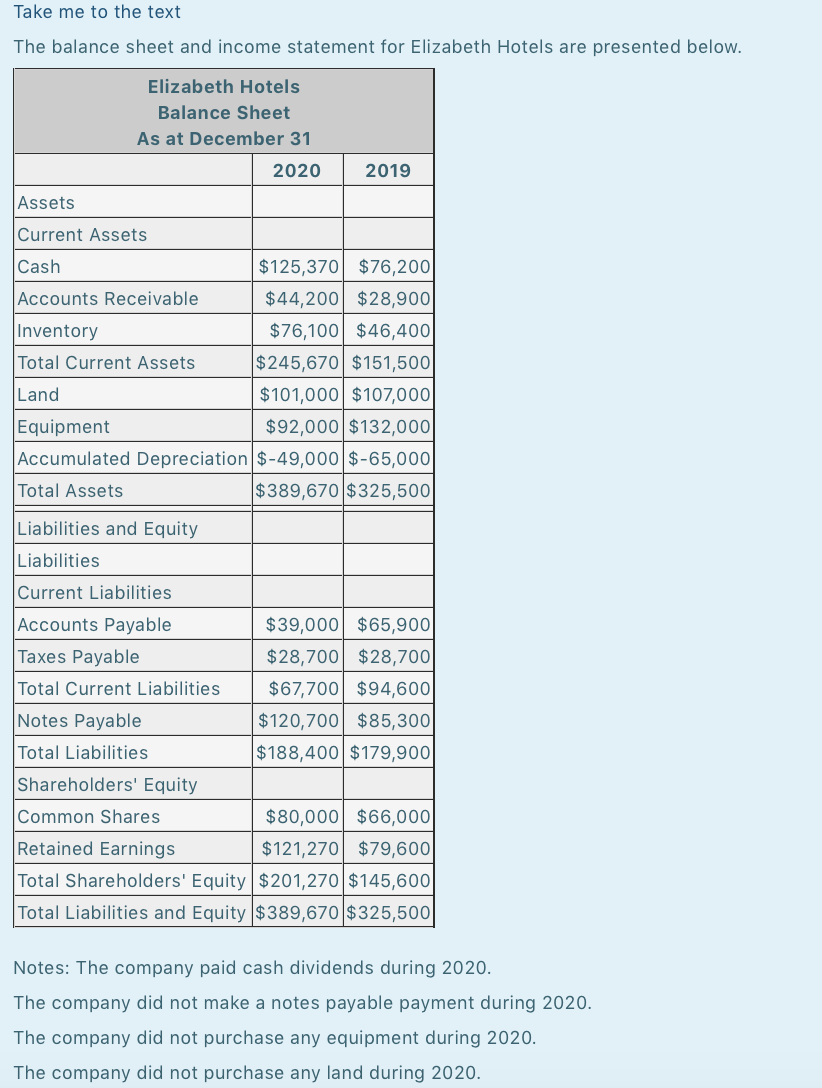

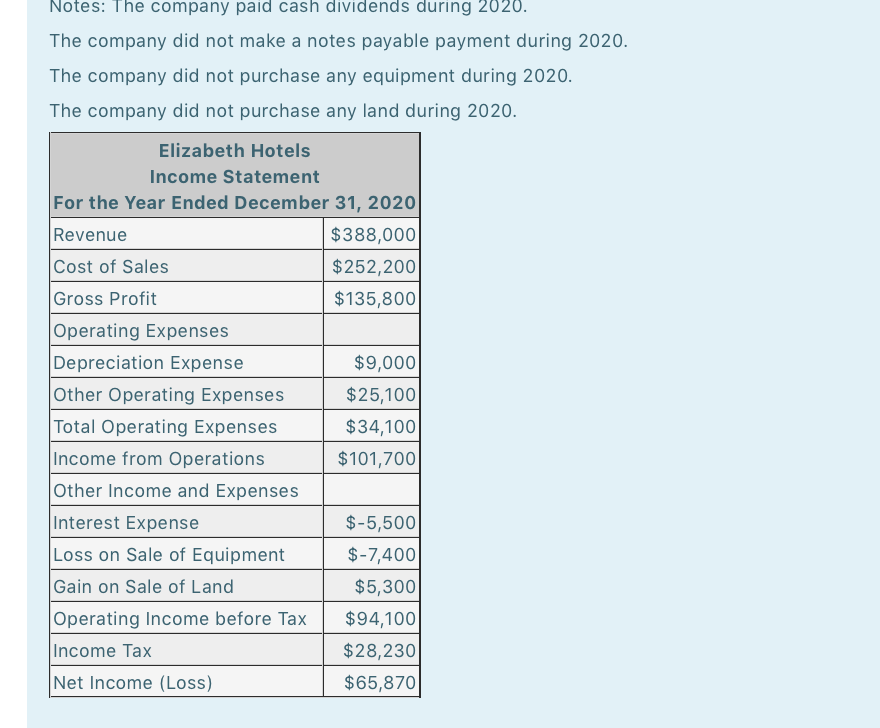

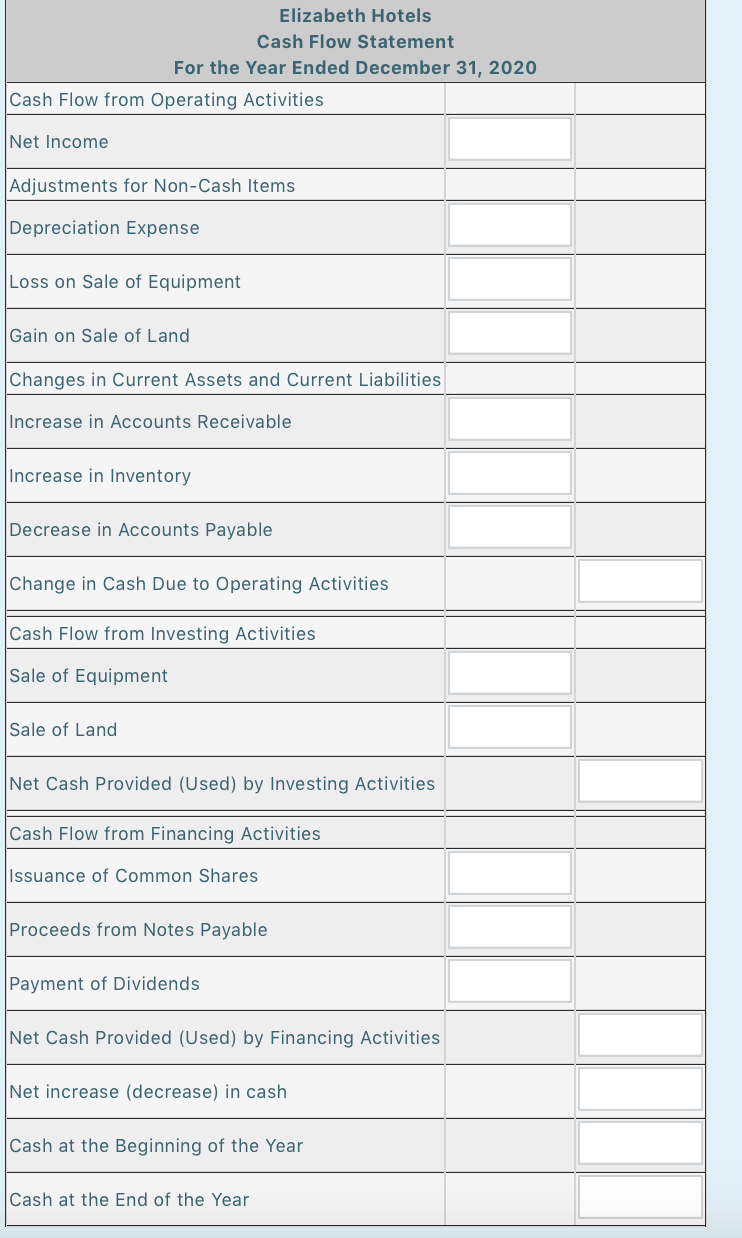

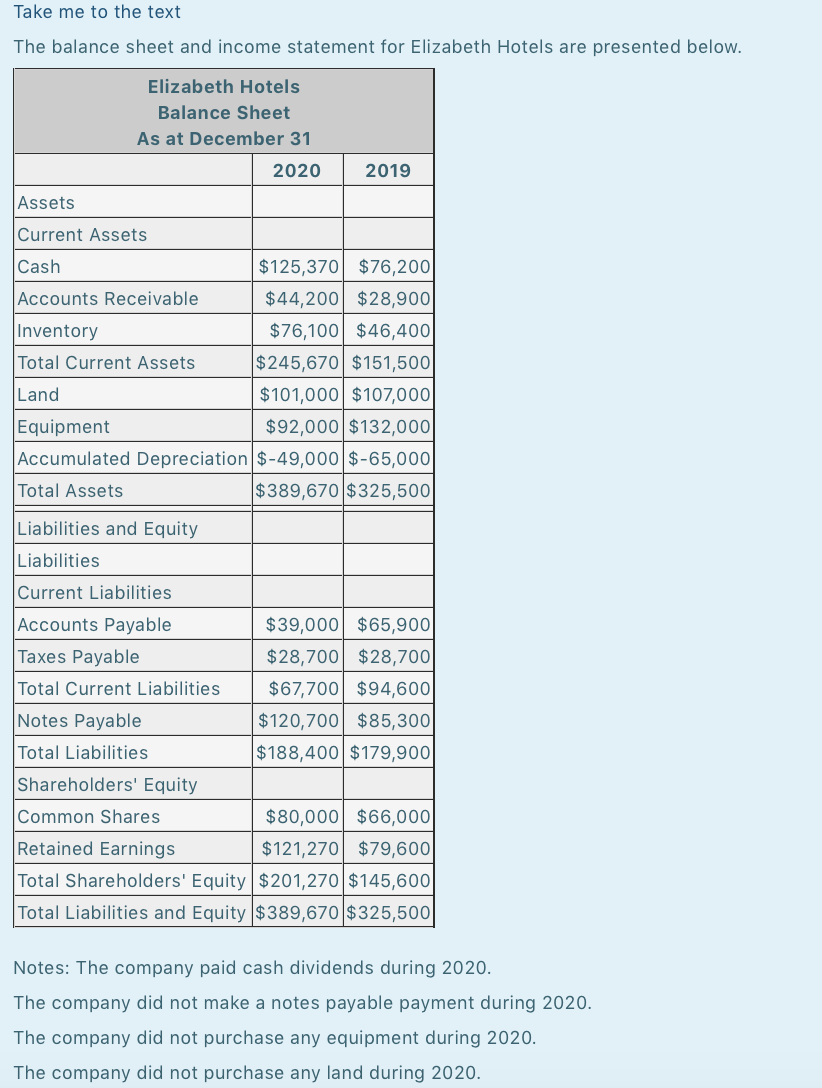

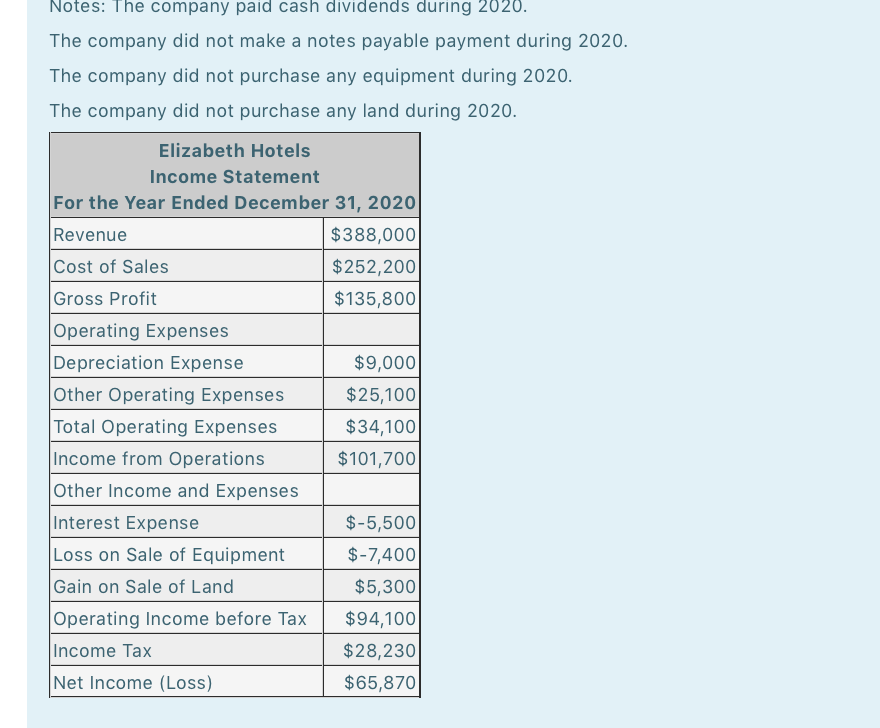

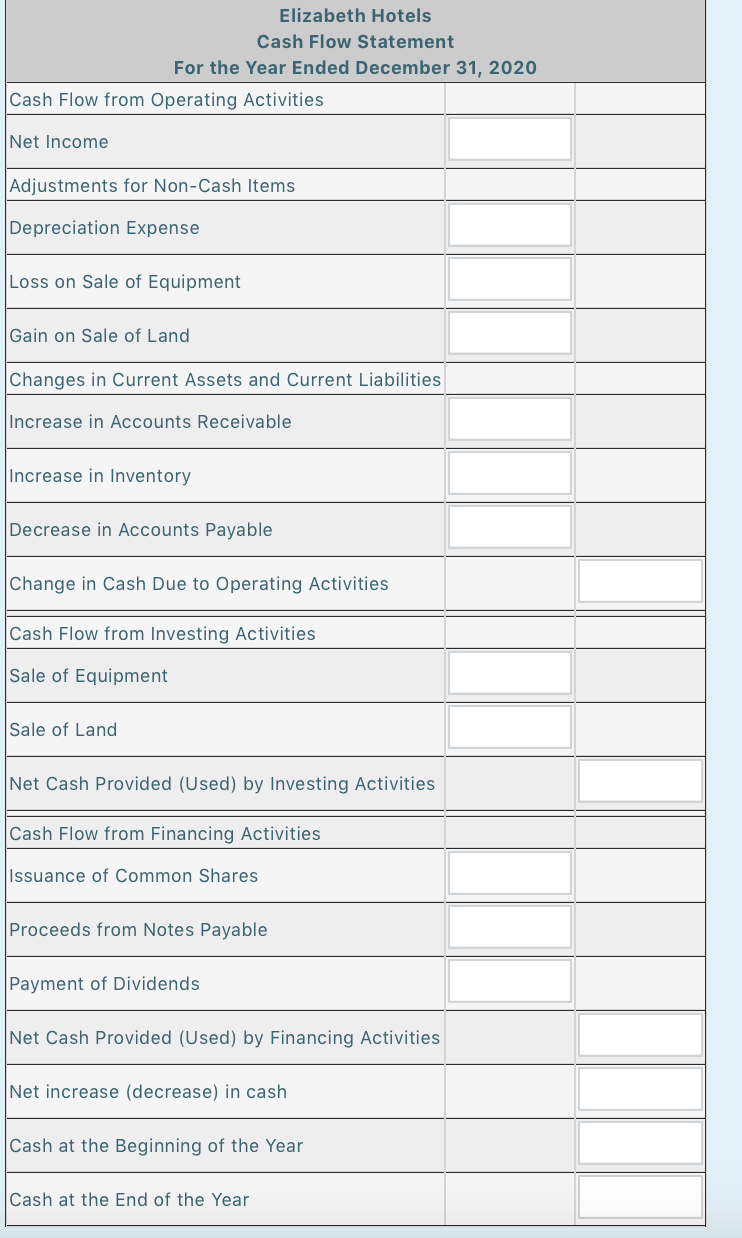

Take me to the text The balance sheet and income statement for Elizabeth Hotels are presented below. Elizabeth Hotels Balance Sheet As at December 31 2020 2019 Assets Current Assets Cash $125,370 $76,200 Accounts Receivable $44,200 $28,900 Inventory $76,100 $46,400 Total Current Assets $245,670 $ 151,500 Land $101,000 $107,000 Equipment $92,000 $132,000 Accumulated Depreciation $-49,000 $-65,000 Total Assets $389,670 $325,500 Liabilities and Equity Liabilities Current Liabilities Accounts Payable $39,000 $65,900 Taxes Payable $28,700 $28,700 Total Current Liabilities $67,700 $94,600 Notes Payable $120,700 $85,300 Total Liabilities $188,400 $179,900 Shareholders' Equity Common Shares $80,000 $66,000 Retained Earnings $121,270 $79,600 Total Shareholders' Equity $ 201,270 $145,600 Total Liabilities and Equity $389,670 $325,500 Notes: The company paid cash dividends during 2020. The company did not make a notes payable payment during 2020. The company did not purchase any equipment during 2020. The company did not purchase any land during 2020. Notes: The company paid cash dividends during 2020. The company did not make a notes payable payment during 2020. The company did not purchase any equipment during 2020. The company did not purchase any land during 2020. Elizabeth Hotels Income Statement For the Year Ended December 31, 2020 Revenue $388,000 Cost of Sales $252,200 Gross Profit $135,800 Operating Expenses Depreciation Expense $9,000 Other Operating Expenses $25,100 Total Operating Expenses $34,100 Income from Operations $ 101,700 Other Income and Expenses Interest Expense $-5,500 Loss on Sale of Equipment $-7,400 Gain on Sale of Land $5,300 Operating Income before Tax $94,100 Income Tax $28,230 Net Income (Loss) $ 65,870 Elizabeth Hotels Cash Flow Statement For the Year Ended December 31, 2020 Cash Flow from Operating Activities Net Income Adjustments for Non-Cash Items Depreciation Expense Loss on Sale of Equipment Gain on Sale of Land Changes in Current Assets and Current Liabilities Increase in Accounts Receivable Increase in Inventory Decrease in Accounts Payable Change in Cash Due to Operating Activities Cash Flow from Investing Activities Sale of Equipment Sale of Land Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities Issuance of Common Shares Proceeds from Notes Payable Payment of Dividends Net Cash Provided (Used) by Financing Activities Net increase (decrease in cash Cash at the Beginning of the Year Cash at the End of the Year