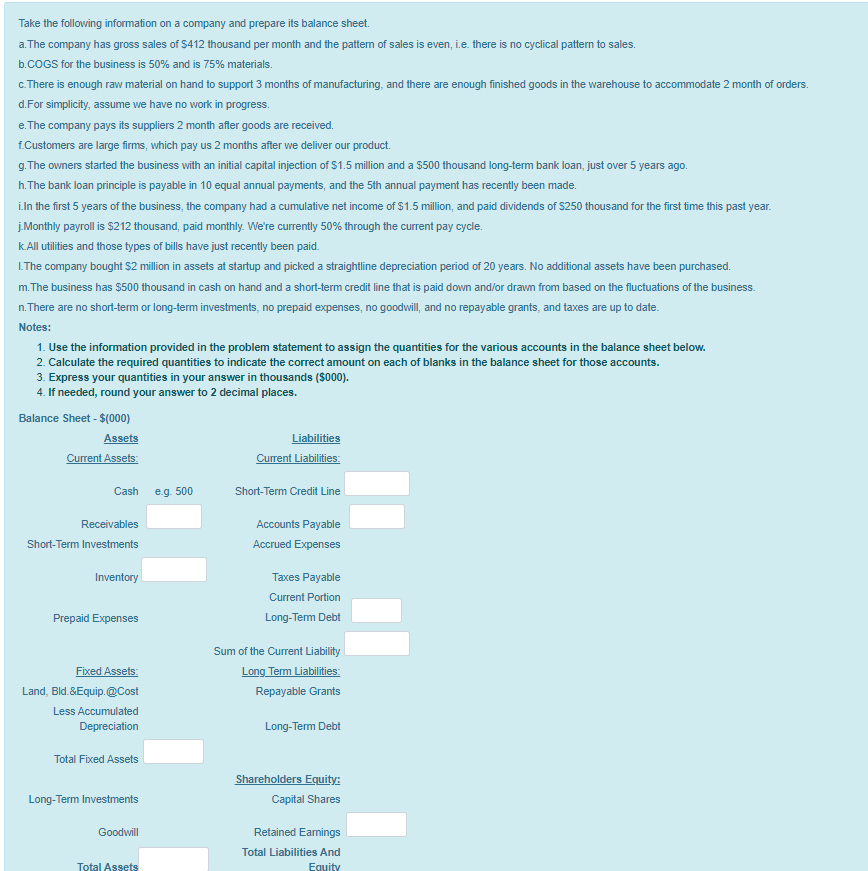

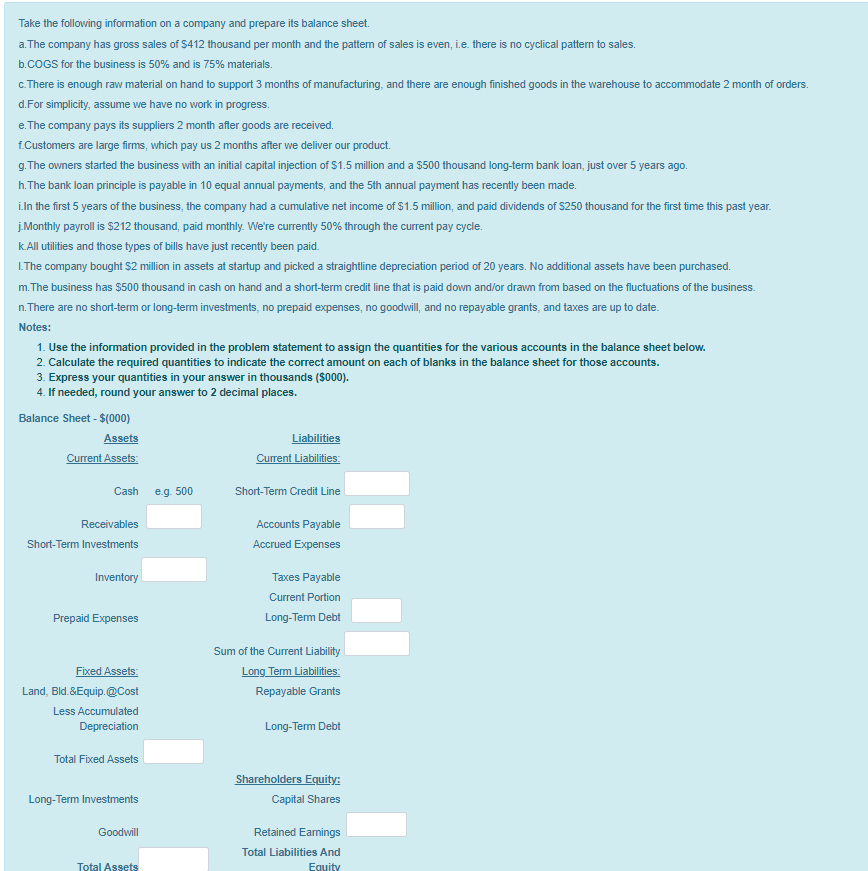

Take the following information on a company and prepare its balance sheet.

a.The company has gross sales of $412 thousand per month and the pattern of sales is even, i.e. there is no cyclical pattern to sales.

b.COGS for the business is 50% and is 75% materials.

c.There is enough raw material on hand to support 3 months of manufacturing, and there are enough finished goods in the warehouse to accommodate 2 month of orders.

d.For simplicity, assume we have no work in progress.

e.The company pays its suppliers 2 month after goods are received.

f.Customers are large firms, which pay us 2 months after we deliver our product.

g.The owners started the business with an initial capital injection of $1.5 million and a $500 thousand long-term bank loan, just over 5 years ago.

h.The bank loan principle is payable in 10 equal annual payments, and the 5th annual payment has recently been made.

i.In the first 5 years of the business, the company had a cumulative net income of $1.5 million, and paid dividends of $250 thousand for the first time this past year.

j.Monthly payroll is $212 thousand, paid monthly. We're currently 50% through the current pay cycle.

k.All utilities and those types of bills have just recently been paid.

l.The company bought $2 million in assets at startup and picked a straightline depreciation period of 20 years. No additional assets have been purchased.

m.The business has $500 thousand in cash on hand and a short-term credit line that is paid down and/or drawn from based on the fluctuations of the business.

n.There are no short-term or long-term investments, no prepaid expenses, no goodwill, and no repayable grants, and taxes are up to date.

Take the following information on a company and prepare its balance sheet. a. The company has gross sales of S412 thousand per month and the pattern of sales is even, i.e. there is no cyclical pattern to sales. b.COGS for the business is 50% and is 75% materials. c. There is enough raw material on hand to support 3 months of manufacturing, and there are enough finished goods in the warehouse to accommodate 2 month of orders. d.For simplicity, assume we have no work in progress. e. The company pays its suppliers 2 month after goods are received. f. Customers are large firms, which pay us 2 months after we deliver our product. g. The owners started the business with an initial capital injection of S1.5 million and a $500 thousand long-term bank loan, just over 5 years ago. h. The bank loan principle is payable in 10 equal annual payments, and the Sth annual payment has recently been made. i.In the first 5 years of the business, the company had a cumulative net income of $1.5 million, and paid dividends of S250 thousand for the first time this past year. j. Monthly payroll is $212 thousand, paid monthly. We're currently 50% through the current pay cycle. k. All utilities and those types of bills have just recently been paid. L. The company bought S2 million in assets at startup and picked a straightline depreciation period of 20 years. No additional assets have been purchased. m. The business has $500 thousand in cash on hand and a short-term credit line that is paid down and/or drawn from based on the fluctuations of the business. n. There are no short-term or long-term investments, no prepaid expenses, no goodwill, and no repayable grants, and taxes are up to date. Notes: 1. Use the information provided in the problem statement to assign the quantities for the various accounts in the balance sheet below. 2. Calculate the required quantities to indicate the correct amount on each of blanks in the balance sheet for those accounts. 3. Express your quantities in your answer in thousands ($000). 4. If needed, round your answer to 2 decimal places. Balance Sheet - $(000) Assets Liabilities Current Assets Current Liabilities: Cash eg. 500 Short-Term Credit Line Receivables Short-Term Investments Accounts Payable Accrued Expenses Inventory Taxes Payable Current Portion Long-Term Debt Prepaid Expenses Fixed Assets Land, Bld. &Equip. Cost Less Accumulated Depreciation Sum of the Current Liability Long Term Liabilities: Repayable Grants Long-Term Debt Total Fixed Assets Shareholders Equity: Capital Shares Long-Term Investments Goodwill Retained Earnings Total Liabilities And Equity Total Assets Take the following information on a company and prepare its balance sheet. a. The company has gross sales of S412 thousand per month and the pattern of sales is even, i.e. there is no cyclical pattern to sales. b.COGS for the business is 50% and is 75% materials. c. There is enough raw material on hand to support 3 months of manufacturing, and there are enough finished goods in the warehouse to accommodate 2 month of orders. d.For simplicity, assume we have no work in progress. e. The company pays its suppliers 2 month after goods are received. f. Customers are large firms, which pay us 2 months after we deliver our product. g. The owners started the business with an initial capital injection of S1.5 million and a $500 thousand long-term bank loan, just over 5 years ago. h. The bank loan principle is payable in 10 equal annual payments, and the Sth annual payment has recently been made. i.In the first 5 years of the business, the company had a cumulative net income of $1.5 million, and paid dividends of S250 thousand for the first time this past year. j. Monthly payroll is $212 thousand, paid monthly. We're currently 50% through the current pay cycle. k. All utilities and those types of bills have just recently been paid. L. The company bought S2 million in assets at startup and picked a straightline depreciation period of 20 years. No additional assets have been purchased. m. The business has $500 thousand in cash on hand and a short-term credit line that is paid down and/or drawn from based on the fluctuations of the business. n. There are no short-term or long-term investments, no prepaid expenses, no goodwill, and no repayable grants, and taxes are up to date. Notes: 1. Use the information provided in the problem statement to assign the quantities for the various accounts in the balance sheet below. 2. Calculate the required quantities to indicate the correct amount on each of blanks in the balance sheet for those accounts. 3. Express your quantities in your answer in thousands ($000). 4. If needed, round your answer to 2 decimal places. Balance Sheet - $(000) Assets Liabilities Current Assets Current Liabilities: Cash eg. 500 Short-Term Credit Line Receivables Short-Term Investments Accounts Payable Accrued Expenses Inventory Taxes Payable Current Portion Long-Term Debt Prepaid Expenses Fixed Assets Land, Bld. &Equip. Cost Less Accumulated Depreciation Sum of the Current Liability Long Term Liabilities: Repayable Grants Long-Term Debt Total Fixed Assets Shareholders Equity: Capital Shares Long-Term Investments Goodwill Retained Earnings Total Liabilities And Equity Total Assets