Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Take the side business that you described in Tax Assignments #2 and #3 and continue with the expense section of the Schedule C for

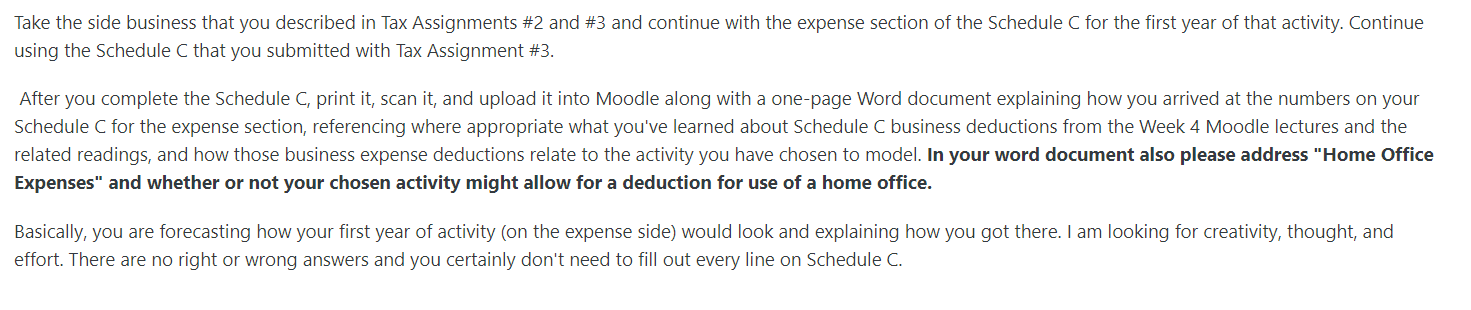

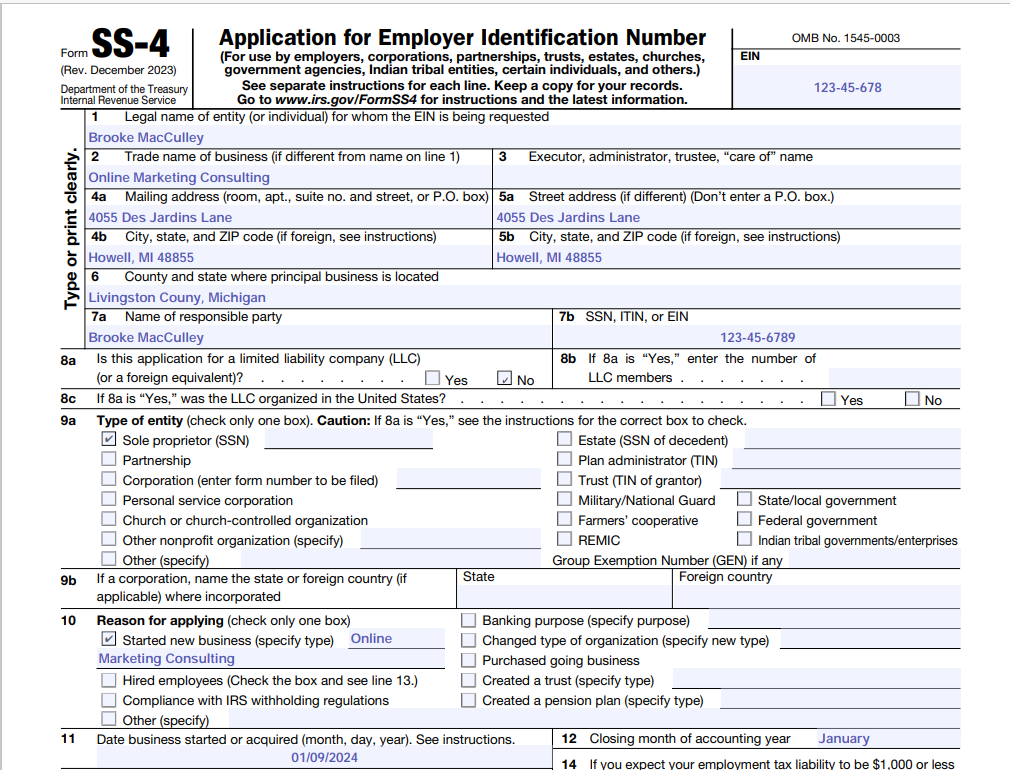

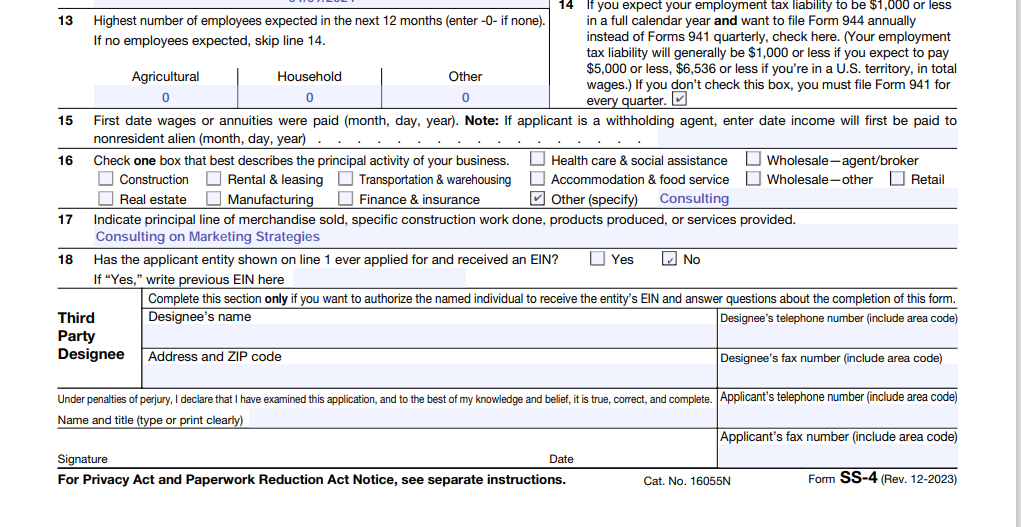

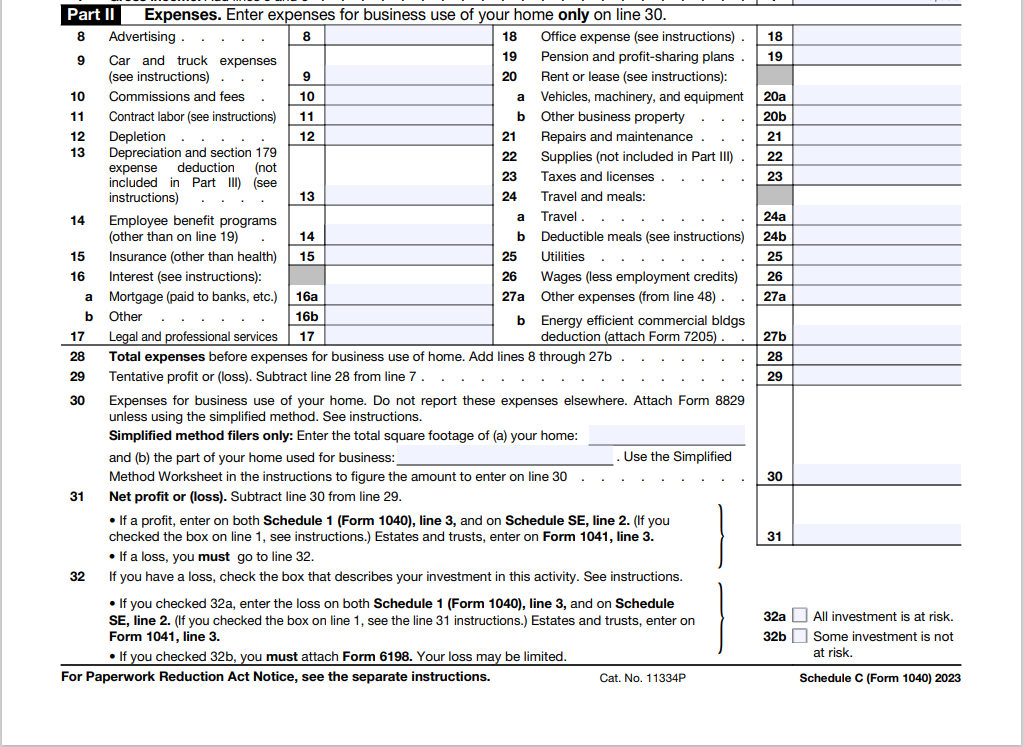

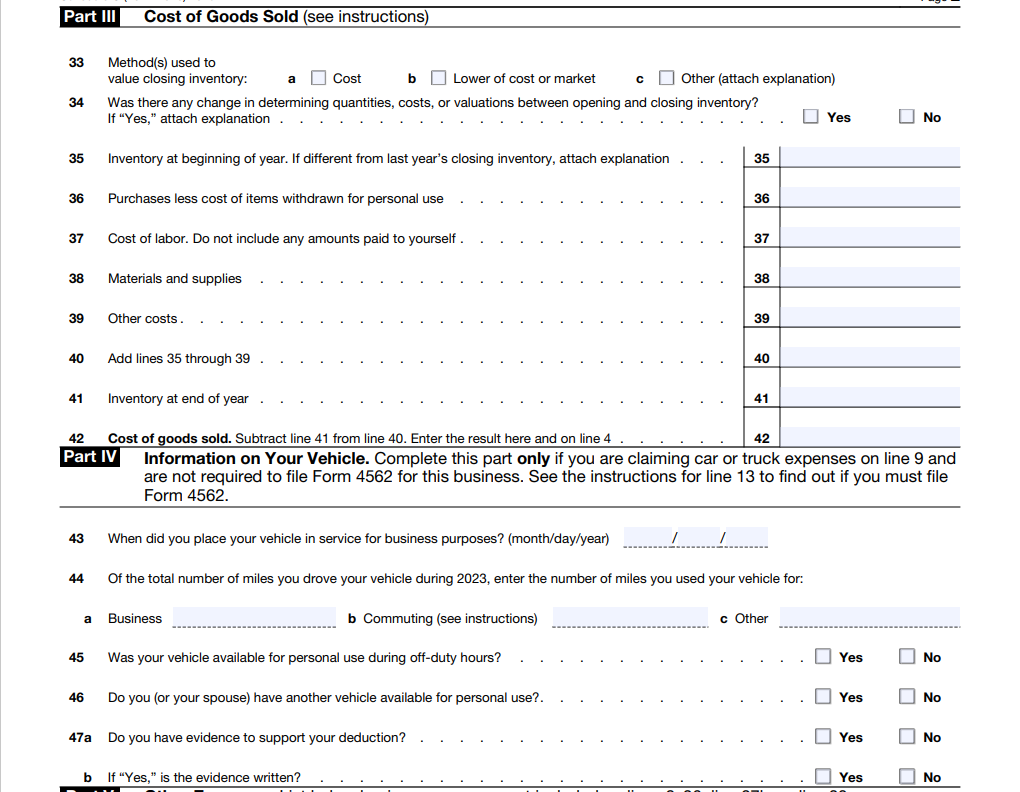

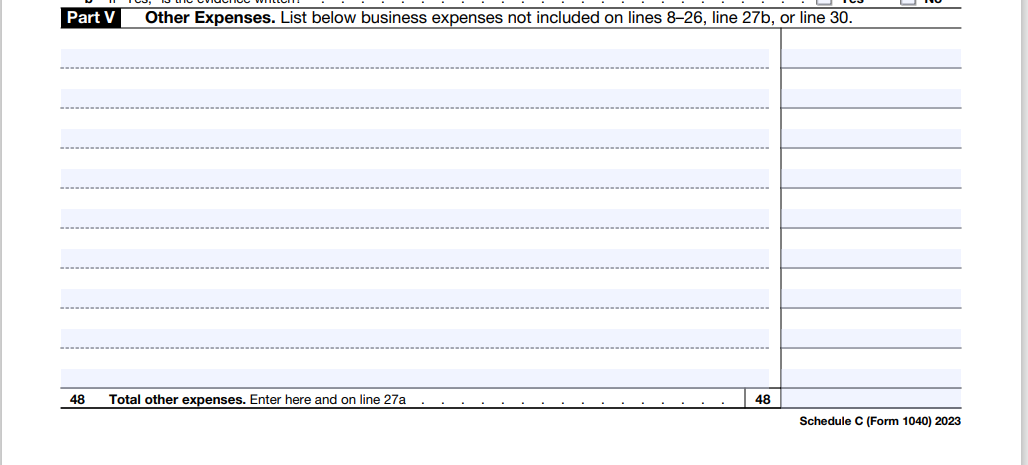

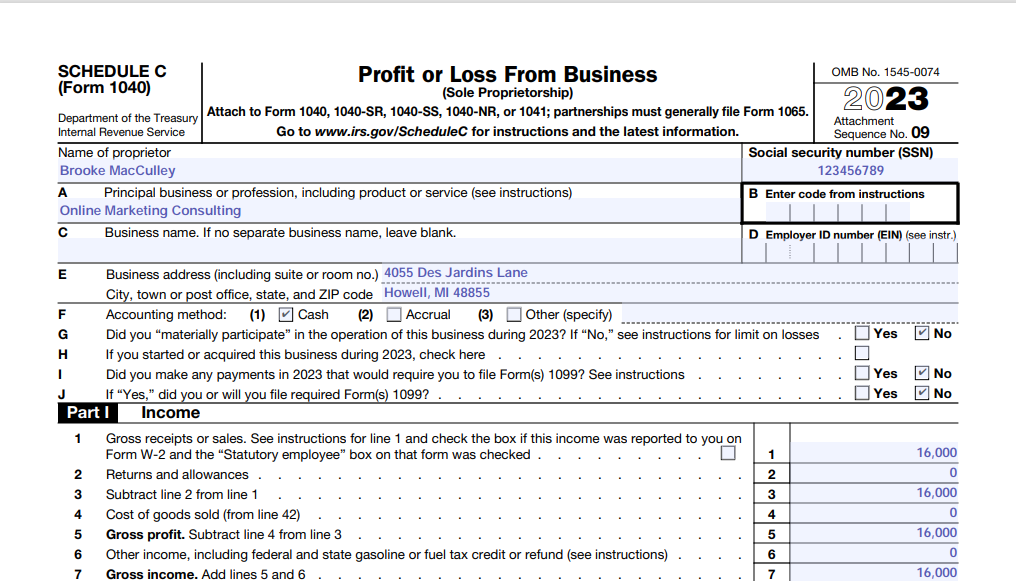

Take the side business that you described in Tax Assignments #2 and #3 and continue with the expense section of the Schedule C for the first year of that activity. Continue using the Schedule C that you submitted with Tax Assignment #3. After you complete the Schedule C, print it, scan it, and upload it into Moodle along with a one-page Word document explaining how you arrived at the numbers on your Schedule C for the expense section, referencing where appropriate what you've learned about Schedule C business deductions from the Week 4 Moodle lectures and the related readings, and how those business expense deductions relate to the activity you have chosen to model. In your word document also please address "Home Office Expenses" and whether or not your chosen activity might allow for a deduction for use of a home office. Basically, you are forecasting how your first year of activity (on the expense side) would look and explaining how you got there. I am looking for creativity, thought, and effort. There are no right or wrong answers and you certainly don't need to fill out every line on Schedule C. Projected budget for first year: Marketing and Advertising: $5,000 Website Development and Maintenance: $1,500 Professional Development and Training: $2,000 Networking Events and Memberships: $1,500 Software and Tools: $1,000 Office and Administrative Expenses: $2,500 Insurance and Legal Fees: $1,000 Miscellaneous Expenses: $1,500 Total Budget: $16,000 Form SS-4 (Rev. December 2023) Department of the Treasury Internal Revenue Service Type or print clearly. Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, certain individuals, and others.) See separate instructions for each line. Keep a copy for your records. Go to www.irs.gov/FormSS4 for instructions and the latest information. Legal name of entity (or individual) for whom the EIN is being requested Brooke MacCulley 1 2 OMB No. 1545-0003 EIN Trade name of business (if different from name on line 1) 3 Executor, administrator, trustee, "care of" name Online Marketing Consulting 4a 123-45-678 Mailing address (room, apt., suite no. and street, or P.O. box) 5a Street address (if different) (Don't enter a P.O. box.) 4055 Des Jardins Lane 4b City, state, and ZIP code (if foreign, see instructions) Howell, MI 48855 6 County and state where principal business is located Livingston Couny, Michigan 7a Name of responsible party Brooke MacCulley 4055 Des Jardins Lane 5b City, state, and ZIP code (if foreign, see instructions) Howell, MI 48855 7b SSN, ITIN, or EIN 123-45-6789 8a Is this application for a limited liability company (LLC) (or a foreign equivalent)? Yes No 8b If 8a is "Yes," enter the number of LLC members. Yes No 8c If 8a is "Yes," was the LLC organized in the United States?. 9a Type of entity (check only one box). Caution: If 8a is "Yes," see the instructions for the correct box to check. Sole proprietor (SSN) Corporation (enter form number to be filed) Partnership Personal service corporation Church or church-controlled organization Other nonprofit organization (specify) Other (specify) 9b If a corporation, name the state or foreign country (if State applicable) where incorporated 10 Reason for applying (check only one box) Estate (SSN of decedent) Plan administrator (TIN) Trust (TIN of grantor) Military/National Guard Farmers' cooperative REMIC State/local government Federal government Indian tribal governments/enterprises Group Exemption Number (GEN) if any Foreign country 11 Started new business (specify type) Online Marketing Consulting Hired employees (Check the box and see line 13.) Compliance with IRS withholding regulations Other (specify) Banking purpose (specify purpose) Changed type of organization (specify new type) Purchased going business Created a trust (specify type) Created a pension plan (specify type) 12 Closing month of accounting year Date business started or acquired (month, day, year). See instructions. 01/09/2024 January 14 If you expect your employment tax liability to be $1,000 or less 13 Highest number of employees expected in the next 12 months (enter -0- if none). If no employees expected, skip line 14. Agricultural 0 Household 0 15 16 Other 0 14 If you expect your employment tax liability to be $1,000 or less in a full calendar year and want to file Form 944 annually instead of Forms 941 quarterly, check here. (Your employment tax liability will generally be $1,000 or less if you expect to pay $5,000 or less, $6,536 or less if you're in a U.S. territory, in total wages.) If you don't check this box, you must file Form 941 for every quarter. First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to nonresident alien (month, day, year) Check one box that best describes the principal activity of your business. Construction Real estate Rental & leasing Manufacturing Transportation & warehousing Finance & insurance Health care & social assistance Accommodation & food service Other (specify) Consulting Wholesale-agent/broker Wholesale-other Retail 17 Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided. Consulting on Marketing Strategies 18 Has the applicant entity shown on line 1 ever applied for and received an EIN? If "Yes," write previous EIN here Yes No Third Party Complete this section only if you want to authorize the named individual to receive the entity's EIN and answer questions about the completion of this form. Designee's name Designee's telephone number (include area code) Designee Address and ZIP code Designee's fax number (include area code) Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. Applicant's telephone number (include area code) Name and title (type or print clearly) Applicant's fax number (include area code) Form SS-4 (Rev. 12-2023) Date Signature For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 16055N Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. 8 18 Office expense (see instructions). 18 9 Car and truck expenses 19 Pension and profit-sharing plans. 19 (see instructions) 9 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) 11 b Other business property ... 20b 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part III). 22 expense deduction (not included in Part III) (see 23 Taxes and licenses. 23 instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel .. 24a (other than on line 19) 14 b Deductible meals (see instructions) 24b 15 Insurance (other than health) 15 25 Utilities 25 16 Interest (see instructions): 26 Wages (less employment credits) 26 a Mortgage (paid to banks, etc.) 16a 27a Other expenses (from line 48). 27a b Other 16b 17 Legal and professional services 17 b Energy efficient commercial bldgs deduction (attach Form 7205). 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27b. 28 29 Tentative profit or (loss). Subtract line 28 from line 7... 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: Use the Simplified 31 Method Worksheet in the instructions to figure the amount to enter on line 30 Net profit or (loss). Subtract line 30 from line 29. 30 If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions.) Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity. See instructions. If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P 31 32a 32b All investment is at risk. Some investment is not at risk. Schedule C (Form 1040) 2023 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: 34 a Cost b Lower of cost or market Other (attach explanation) Yes No Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation. 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation 35 36 Purchases less cost of items withdrawn for personal use 36 37 Cost of labor. Do not include any amounts paid to yourself. 37 38 Materials and supplies 38 39 Other costs. 39 40 Add lines 35 through 39 40 41 Inventory at end of year 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4. Part IV 43 44 42 Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. When did you place your vehicle in service for business purposes? (month/day/year) Of the total number of miles you drove your vehicle during 2023, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) 45 Was your vehicle available for personal use during off-duty hours? 46 Do you (or your spouse) have another vehicle available for personal use?. 47a Do you have evidence to support your deduction? b If "Yes," is the evidence written? c Other Yes Yes Yes Yes No OP No No No Part V Other Expenses. List below business expenses not included on lines 8-26, line 27b, or line 30. 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040) 2023 SCHEDULE C (Form 1040) Profit or Loss From Business (Sole Proprietorship) Department of the Treasury Attach to Form 1040, 1040-SR, 1040-SS, 1040-NR, or 1041; partnerships must generally file Form 1065. Internal Revenue Service Name of proprietor Brooke MacCulley Go to www.irs.gov/ScheduleC for instructions and the latest information. A Principal business or profession, including product or service (see instructions) Online Marketing Consulting Business name. If no separate business name, leave blank. OMB No. 1545-0074 2023 Attachment Sequence No. 09 Social security number (SSN) 123456789 B Enter code from instructions D Employer ID number (EIN) (see instr.) E F G H Business address (including suite or room no.) 4055 Des Jardins Lane City, town or post office, state, and ZIP code Howell, MI 48855 Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate" in the operation of this business during 2023? If "No," see instructions for limit on losses If you started or acquired this business during 2023, check here . . Did you make any payments in 2023 that would require you to file Form(s) 1099? See instructions If "Yes," did you or will you file required Form(s) 1099? . Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 2 Returns and allowances. 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 7 Gross income. Add lines 5 and 6 -234567 1 0000 Yes No Yes No Yes No 16,000 0 16,000 0 16,000 0 16,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started