Answered step by step

Verified Expert Solution

Question

1 Approved Answer

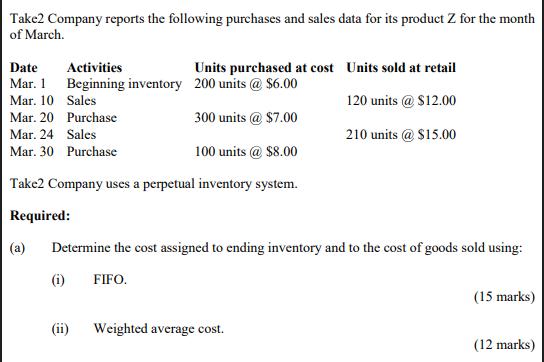

Take2 Company reports the following purchases and sales data for its product Z for the month of March. Date Mar. 1 Activities Units purchased

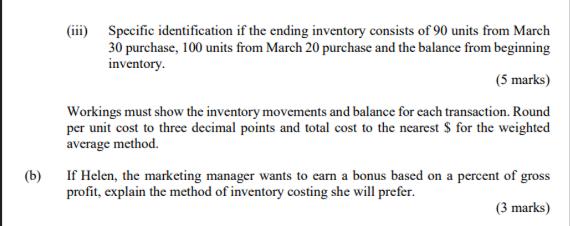

Take2 Company reports the following purchases and sales data for its product Z for the month of March. Date Mar. 1 Activities Units purchased at cost Units sold at retail Beginning inventory 200 units @ $6.00 Mar. 10 Sales 120 units @ $12.00 Mar. 20 Purchase 300 units @ $7.00 Mar. 24 Sales 210 units @ $15.00 Mar. 30 Purchase 100 units @ $8.00 Take2 Company uses a perpetual inventory system. Required: (a) Determine the cost assigned to ending inventory and to the cost of goods sold using: (i) FIFO. (ii) Weighted average cost. (15 marks) (12 marks) (b) (iii) Specific identification if the ending inventory consists of 90 units from March 30 purchase, 100 units from March 20 purchase and the balance from beginning inventory. (5 marks) Workings must show the inventory movements and balance for each transaction. Round per unit cost to three decimal points and total cost to the nearest $ for the weighted average method. If Helen, the marketing manager wants to earn a bonus based on a percent of gross profit, explain the method of inventory costing she will prefer. (3 marks)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the cost assigned to ending inventory and the cost of goods sold using FIFO and weighted average cost methods lets calculate the values s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started