Question

Taken Company adds a markup of 20% of cost on all merchandise shipped to the branch. It is then sold by the branch at

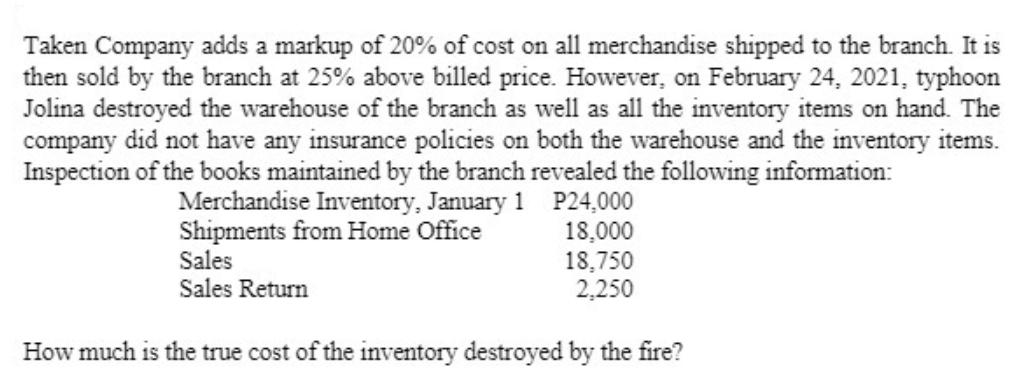

Taken Company adds a markup of 20% of cost on all merchandise shipped to the branch. It is then sold by the branch at 25% above billed price. However, on February 24, 2021, typhoon Jolina destroyed the warehouse of the branch as well as all the inventory items on hand. The company did not have any insurance policies on both the warehouse and the inventory items. Inspection of the books maintained by the branch revealed the following information: Merchandise Inventory, January 1 Shipments from Home Office Sales Sales Return P24,000 18,000 18,750 2,250 How much is the true cost of the inventory destroyed by the fire?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost of the inventory destroyed we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information for Decisions

Authors: John J. Wild

8th edition

125953300X, 978-1259533006

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App