Answered step by step

Verified Expert Solution

Question

1 Approved Answer

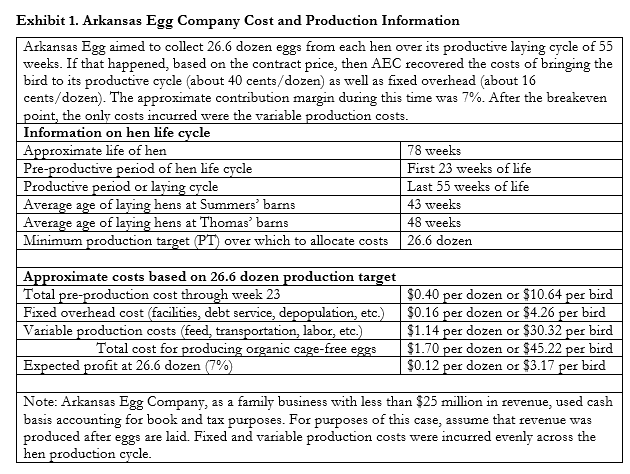

Taking into account the data in Exhibit 1, prepare a table that calculates when a hen is spent under normal conditions such as the CCF

- Taking into account the data in Exhibit 1, prepare a table that calculates when a hen is spent under normal conditions such as the CCF Brands contract, or that could be used to decide when it is no longer profitable to continue egg production. That is, create a model with formulas for which you can easily vary inputs, such as price, profit, or variable costs (such as in question 2 below). Use the output template provided below. (Hint: Distinguish between relevant and non-relevant costs. Determine the estimated revenue per dozen and weekly production costs first.)

|

Week(s) | # Eggs per Hen/Week |

# Weeks | Dozen Eggs Laid | Marginal Costs | Marginal Revenue | Contribution to Profit |

| 1-23 | n/a | 23 | 0 | $(10.64) | $0 | $(10.64) |

| 24 | 3 | 1 | 0.25 |

|

|

|

| 25 | 4 | 1 | 0.33 |

|

|

|

| 26 | 5 | 1 | 0.42 |

|

|

|

| 27-28 | 6 | 2 | 1.00 |

|

|

|

| 29-39 | 7 | 11 | 6.42 |

|

|

|

| 40-64 | 6 | 25 | 12.50 |

|

|

|

| 65-76 | 5 | 12 | 5.00 |

|

|

|

| 77 | 4 | 1 | 0.33 |

|

|

|

| 78 | 3 | 1 | 0.25 |

|

|

|

- Based on the model that you developed in question 1, and assuming that hens are already laying, how sensitive is the model to changes in expected contract profit? In variable costs? What course of action does the model indicate should be taken when contribution margin is negative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started