Answered step by step

Verified Expert Solution

Question

1 Approved Answer

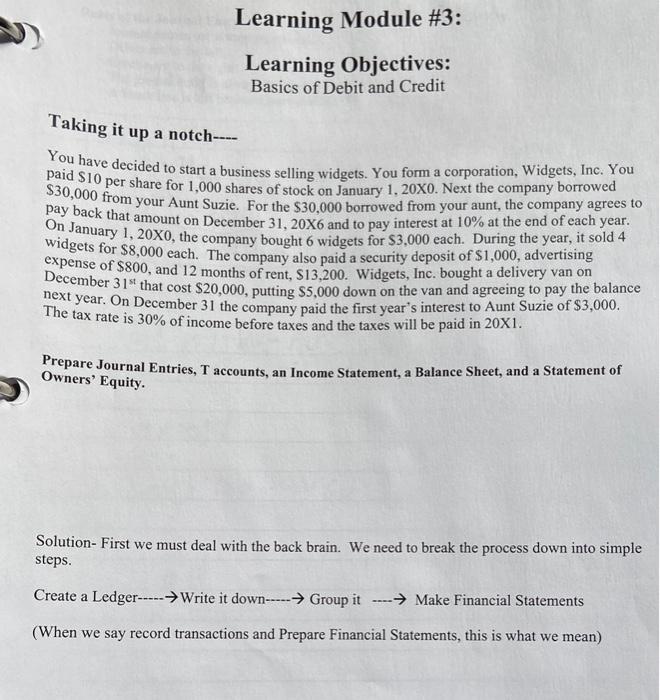

Taking it up a notch---- Learning Module #3: Learning Objectives: Basics of Debit and Credit You have decided to start a business selling widgets.

Taking it up a notch---- Learning Module #3: Learning Objectives: Basics of Debit and Credit You have decided to start a business selling widgets. You form a corporation, Widgets, Inc. You paid $10 per share for 1,000 shares of stock on January 1, 20X0. Next the company borrowed $30,000 from your Aunt Suzie. For the $30,000 borrowed from your aunt, the company agrees to Day back that amount on December 31, 20X6 and to pay interest at 10% at the end of each year. On January 1, 20X0, the company bought 6 widgets for $3,000 each. During the year, it sold 4 widgets for $8,000 each. The company also paid a security deposit of $1,000, advertising expense of $800, and 12 months of rent, $13,200. Widgets, Inc. bought a delivery van on December 31st that cost $20,000, putting $5,000 down on the van and agreeing to pay the balance next year. On December 31 the company paid the first year's interest to Aunt Suzie of $3,000. The tax rate is 30% of income before taxes and the taxes will be paid in 20X1. Prepare Journal Entries, T accounts, an Income Statement, a Balance Sheet, and a Statement of Owners' Equity. Solution- First we must deal with the back brain. We need to break the process down into simple steps. Create a Ledger-Write it down-Group it - Make Financial Statements (When we say record transactions and Prepare Financial Statements, this is what we mean)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started