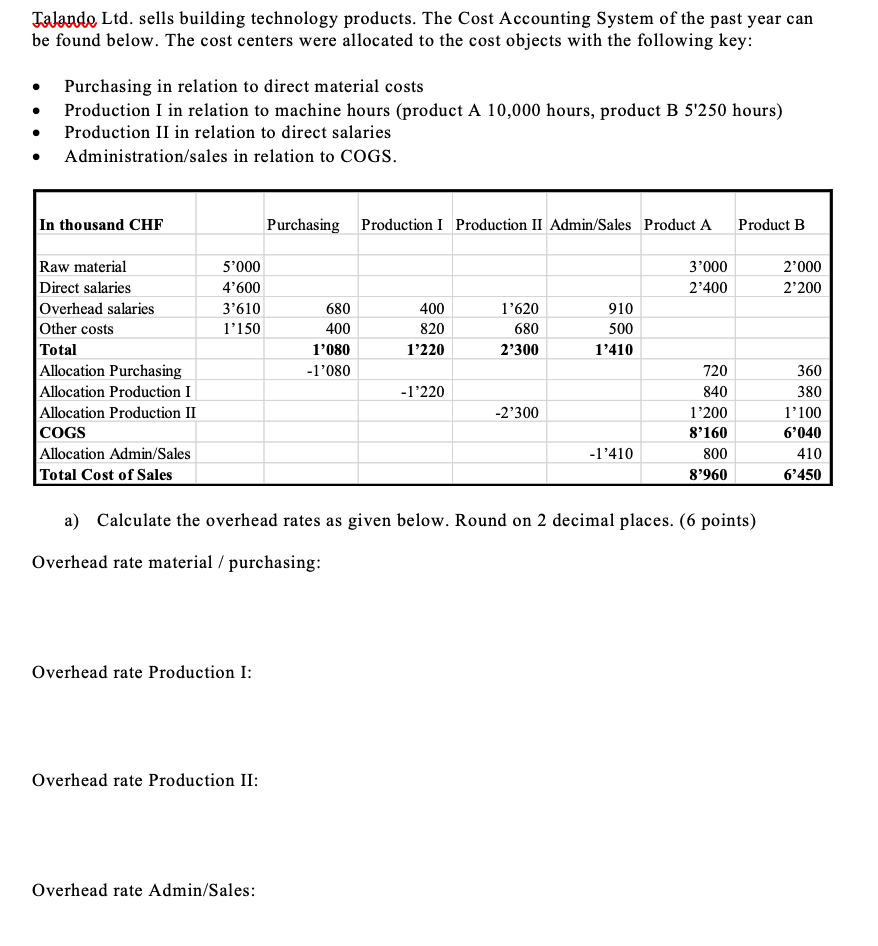

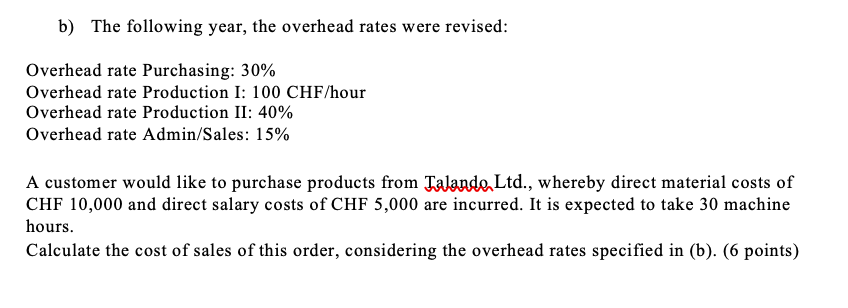

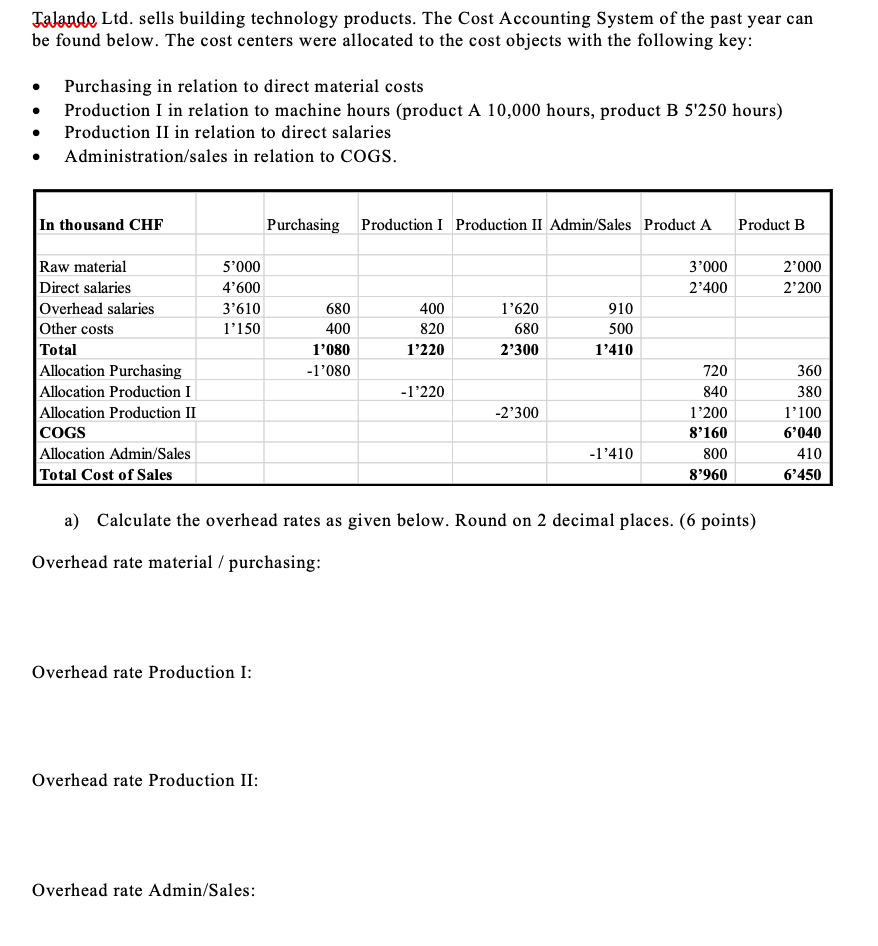

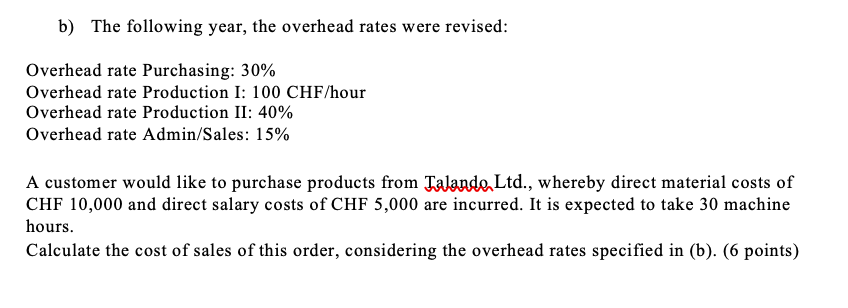

Talando Ltd. sells building technology products. The Cost Accounting System of the past year can be found below. The cost centers were allocated to the cost objects with the following key: Purchasing in relation to direct material costs Production I in relation to machine hours (product A 10,000 hours, product B 5'250 hours) Production II in relation to direct salaries Administration/sales in relation to COGS. In thousand CHF Raw material Direct salaries Overhead salaries Other costs Total Allocation Purchasing Allocation Production I Allocation Production II COGS Allocation Admin/Sales Total Cost of Sales 5'000 4'600 3'610 1'150 Overhead rate Production I: Overhead rate Production II: Purchasing Production I Production II Admin/Sales Product A Overhead rate Admin/Sales: 680 400 1'080 -1'080 400 820 1'220 -1'220 1'620 680 2'300 -2'300 910 500 1'410 -1'410 3'000 2'400 720 840 a) Calculate the overhead rates as given below. Round on 2 decimal places. (6 points) Overhead rate material / purchasing: 1'200 8'160 800 8'960 Product B 2'000 2'200 360 380 1'100 6'040 410 6'450 b) The following year, the overhead rates were revised: Overhead rate Purchasing: 30% Overhead rate Production I: 100 CHF/hour Overhead rate Production II: 40% Overhead rate Admin/Sales: 15% A customer would like to purchase products from Jalando Ltd., whereby direct material costs of CHF 10,000 and direct salary costs of CHF 5,000 are incurred. It is expected to take 30 machine hours. Calculate the cost of sales of this order, considering the overhead rates specified in (b). (6 points) Talando Ltd. sells building technology products. The Cost Accounting System of the past year can be found below. The cost centers were allocated to the cost objects with the following key: Purchasing in relation to direct material costs Production I in relation to machine hours (product A 10,000 hours, product B 5'250 hours) Production II in relation to direct salaries Administration/sales in relation to COGS. In thousand CHF Raw material Direct salaries Overhead salaries Other costs Total Allocation Purchasing Allocation Production I Allocation Production II COGS Allocation Admin/Sales Total Cost of Sales 5'000 4'600 3'610 1'150 Overhead rate Production I: Overhead rate Production II: Purchasing Production I Production II Admin/Sales Product A Overhead rate Admin/Sales: 680 400 1'080 -1'080 400 820 1'220 -1'220 1'620 680 2'300 -2'300 910 500 1'410 -1'410 3'000 2'400 720 840 a) Calculate the overhead rates as given below. Round on 2 decimal places. (6 points) Overhead rate material / purchasing: 1'200 8'160 800 8'960 Product B 2'000 2'200 360 380 1'100 6'040 410 6'450 b) The following year, the overhead rates were revised: Overhead rate Purchasing: 30% Overhead rate Production I: 100 CHF/hour Overhead rate Production II: 40% Overhead rate Admin/Sales: 15% A customer would like to purchase products from Jalando Ltd., whereby direct material costs of CHF 10,000 and direct salary costs of CHF 5,000 are incurred. It is expected to take 30 machine hours. Calculate the cost of sales of this order, considering the overhead rates specified in (b). (6 points)