Answered step by step

Verified Expert Solution

Question

1 Approved Answer

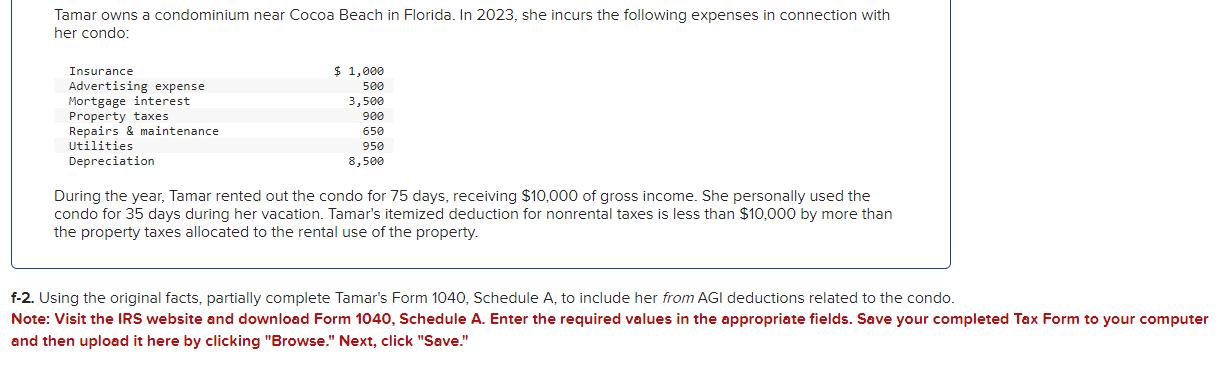

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation $ 1,000 500 3,500 900 650 950 8,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. f-2. Using the original facts, partially complete Tamar's Form 1040, Schedule A, to include her from AGI deductions related to the condo. Note: Visit the IRS website and download Form 1040, Schedule A. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started