Question

Tamara Soccorro is a real estate agent. She lives in a province that participates in the HST program at 13%. She earns commission income,

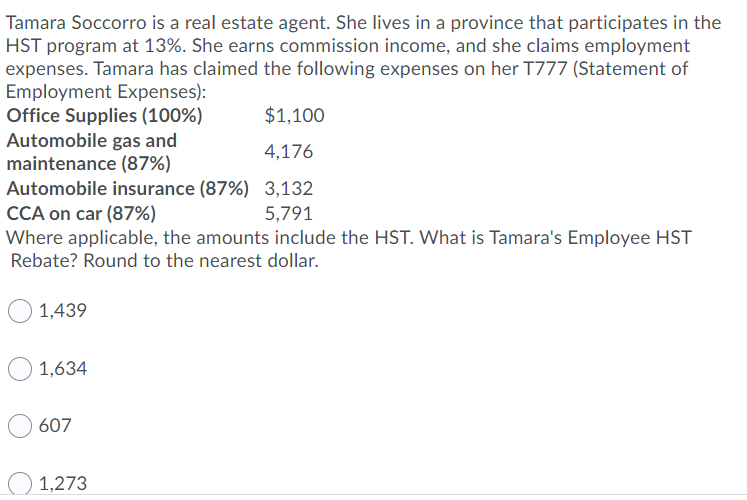

Tamara Soccorro is a real estate agent. She lives in a province that participates in the HST program at 13%. She earns commission income, and she claims employment expenses. Tamara has claimed the following expenses on her T777 (Statement of Employment Expenses): Office Supplies (100%) $1,100 Automobile gas and 4,176 maintenance (87%) Automobile insurance (87%) 3,132 5,791 CCA on car (87%) Where applicable, the amounts include the HST. What is Tamara's Employee HST Rebate? Round to the nearest dollar. 1,439 1,634 607 1,273

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Tamaras Employee HST Rebate we need to determine the total HS...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics A Decision Making Approach

Authors: David F. Groebner, Patrick W. Shannon, Phillip C. Fry

9th Edition

013302184X, 978-0133021844

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App