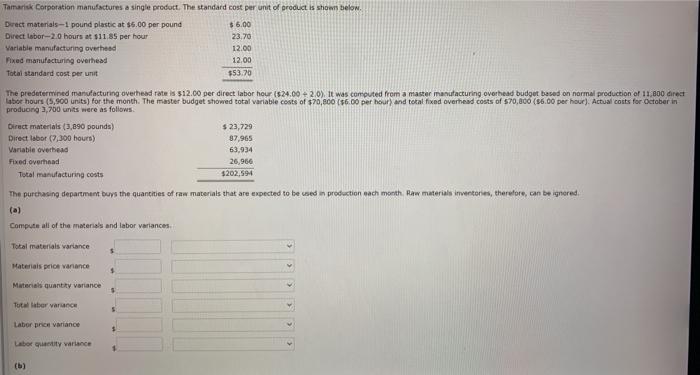

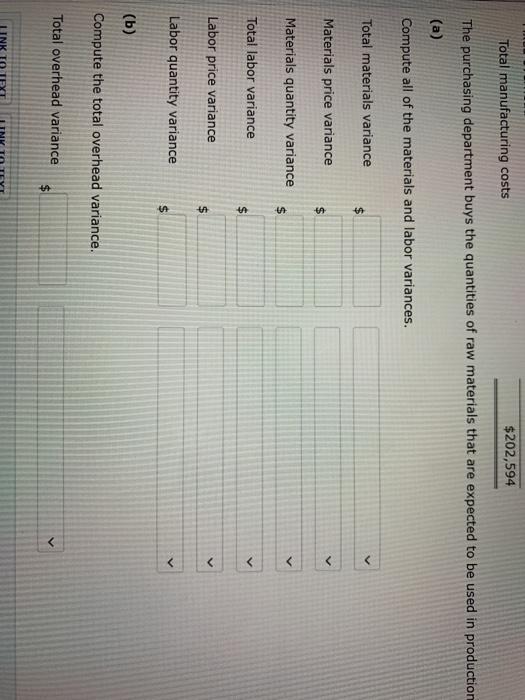

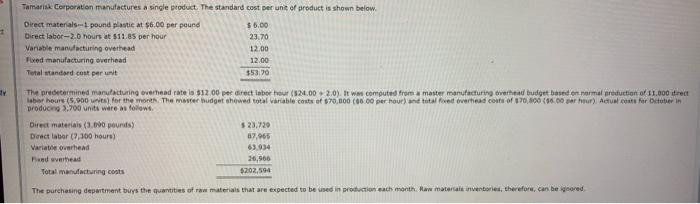

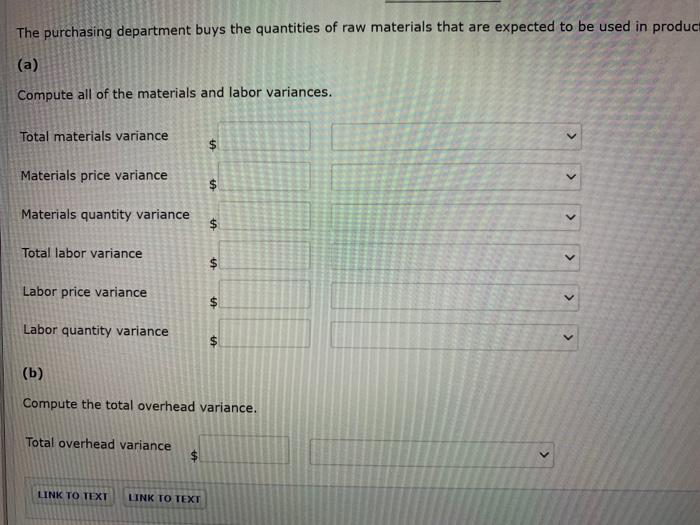

Tamaris Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-1 pound plastic at $6,00 per pound $6.00 Direct labor-2.0 hours at $11.85 per hour 23.70 Variable manufacturing overhead 12.00 Fixed manufacturing overhead 12.00 Total standard cost peruut $53.70 The predetermined manufacturing overhead rate is $12.00 per direct labor hour ($24.00 2.0). It was computed from a master manufacturing overhead budget based on normal production of 11 B00 direct labor hours (5,900 units) for the month. The master budget showed total variable costs of $70,800 ($6.00 per hour) and total fixed overhead costs of 570,000 ($6.00 per hour). Actual costs for October in producing 3,700 units were as follows Direct materials (3,090 pounds) $ 23,729 Direct labor (7,300 hours) 87,965 Variable overhead 63,934 Fixed overhead 26,966 Total manufacturing costs $202,50 The purchasing department buys the quantities of raw materials that are expected to be used in production each month raw materials inventories, therefore, can be ignored (a) Compute all of the materials and labor variances Total materiais variance Materiais price variance Material quantay variance Tota labor varan 5 Labor price variance $ Laborty walance Total manufacturing costs $ 202,594 The purchasing department buys the quantities of raw materials that are expected to be used in production (a) Compute all of the materials and labor variances. Total materials variance $ Materials price variance $ Materials quantity variance $ Total labor variance $ Labor price variance $ Labor quantity variance $ (b) Compute the total overhead variance. Total overhead variance $ Tamaris Corporation manufactures a single product. The standard cost per unit of product is shown below Direct materials-pound plastic at $6.00 per pound $5.00 Direct labor-2.0 hours at $11.85 per hour 23.70 Variable manufacturing overhead 12.00 Fired manufacturing overhead 12.00 Total standard cost per unit $53.70 The predetermined manufacturing overhead rate is $12.00 per direct labor hour (520.00 2.0). It was computed from a master manufacturing overhead budget based on normal production of 11.000 drea labor hours (5.900 it for the month The master budget showed total variable costs of $70.000 (86.00 per hour) and total food verhead coats of 170,800 ($6.00 per hour) Actual costs for October in producng 3.700 units were as follows Direct materiais (3.690 pounds) $ 23,729 Drect labor (7,300 hours) 87.965 Variatie overhead 63.934 w werthead 26,960 Total manufacturing costs $202,594 The purchasing department buy the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be red The purchasing department buys the quantities of raw materials that are expected to be used in product (a) Compute all of the materials and labor variances. Total materials variance $ Materials price variance $ Materials quantity variance V $ $ Total labor variance > $ Labor price variance $ (b) Compute the total overhead variance. Total overhead variance