Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tamarisk Corporation purchased a tract of unimproved land for $627,000. This land was improved and subdivided into building lots at an additional cost of $120,000.

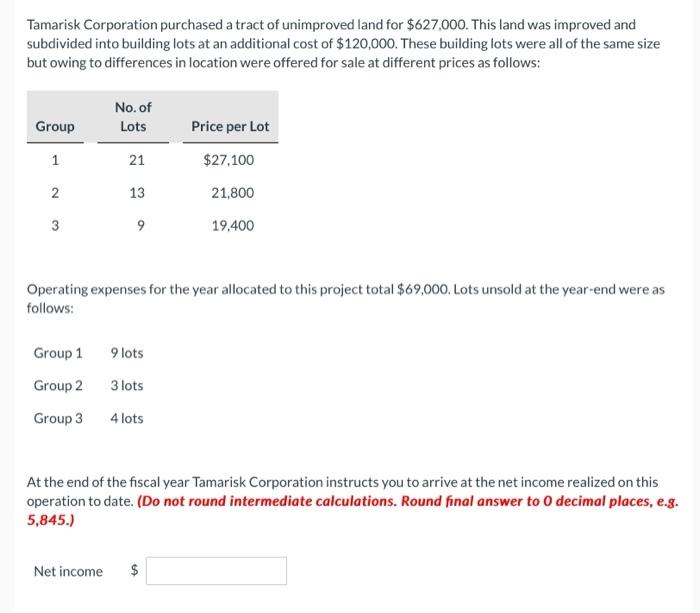

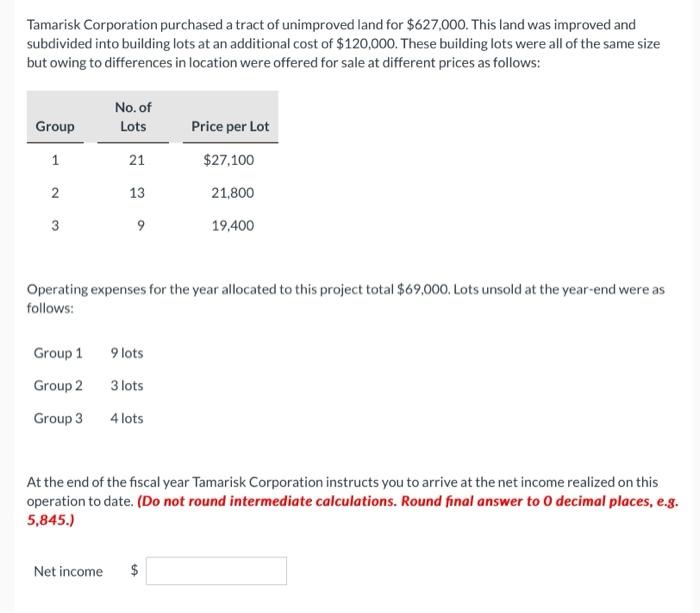

Tamarisk Corporation purchased a tract of unimproved land for $627,000. This land was improved and subdivided into building lots at an additional cost of $120,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows: Group 1 2 3 Group 1 Group 2 Group 3 No. of Lots 21 Net income 13 9 Operating expenses for the year allocated to this project total $69,000. Lots unsold at the year-end were as follows: 9 lots 3 lots Price per Lot $27,100 21,800 4 lots 19,400 At the end of the fiscal year Tamarisk Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,845.)

answer question please.

Tamarisk Corporation purchased a tract of unimproved land for $627,000. This land was improved and subdivided into building lots at an additional cost of $120,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows: Operating expenses for the year allocated to this project total $69,000. Lots unsold at the year-end were as follows: At the end of the fiscal year Tamarisk Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,845.) Net income $ Tamarisk Corporation purchased a tract of unimproved land for $627,000. This land was improved and subdivided into building lots at an additional cost of $120,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows: Operating expenses for the year allocated to this project total $69,000. Lots unsold at the year-end were as follows: At the end of the fiscal year Tamarisk Corporation instructs you to arrive at the net income realized on this operation to date. (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,845.) Net income $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started