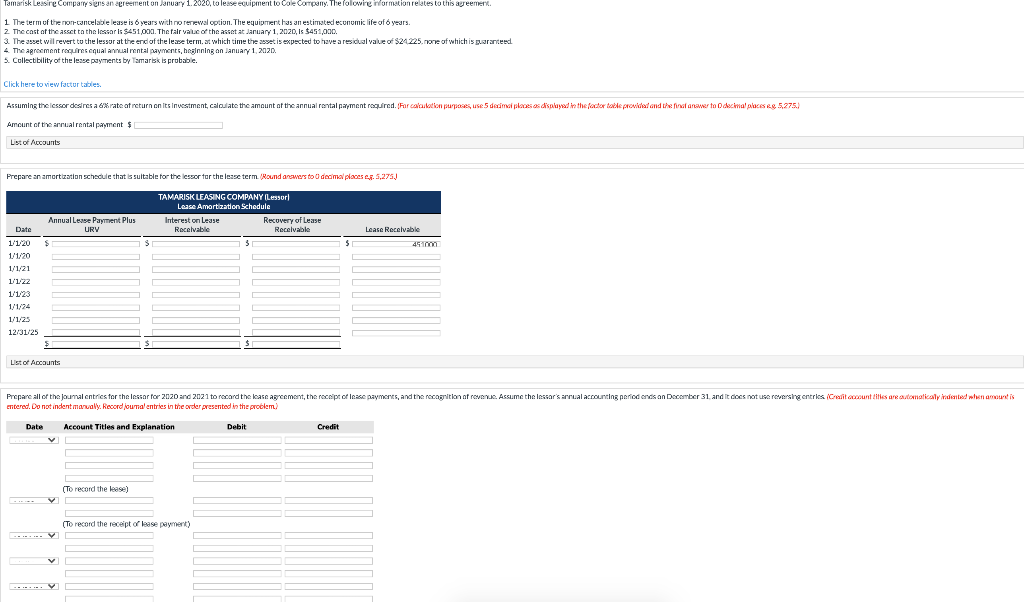

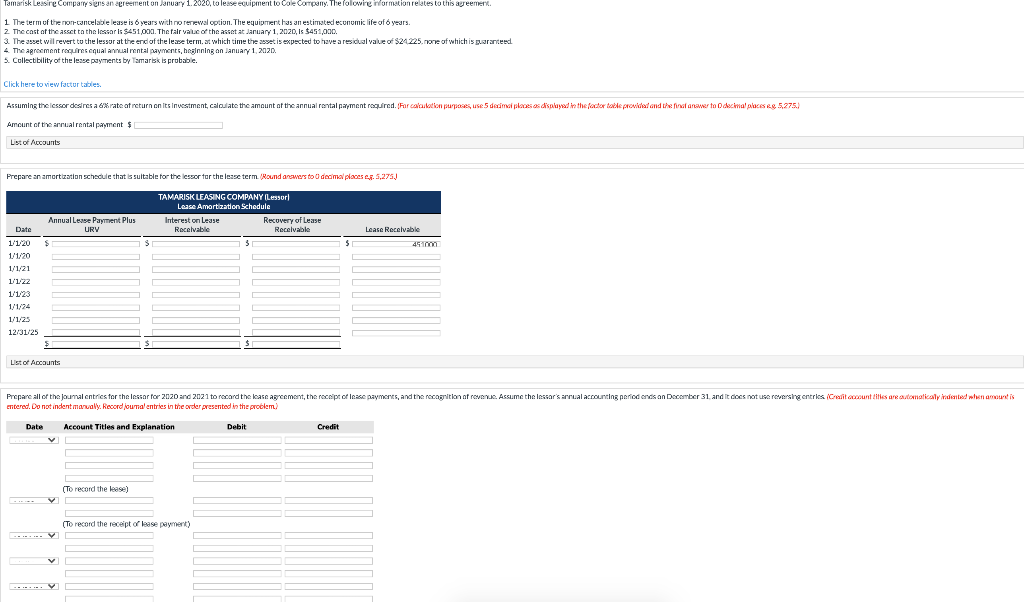

Tamarisk Lessire Company sins anereement on January 1.2020,tolease equipment to Cole Company. The folosire information relates to this agreement 1 The term of the nor-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2 The cast of the asset to the lessor $451,000. The talr value of the asset at January 1, 2020, Is $451,000. 3. The asset will revert to the lessor at the end of the lease term. at which time the set is expected to have a residual value of $24225. none of which is guaranteed 4. The agreement requires equal Annual rental payments, beginning on January 1, 2020. 5. Collectibility of the lesse payments by Tamarisk is probable. Click here to view factur tables Assuming the lessor desines a&xrate at return on its investment, calculate the amount of the annual rental payment required. Forcallation purposes, use 5 decimal places as displayed in the factor to le provided and the final anwer to decimal places eg 5275.) Amount of the annual rental payment $ List of Accounts Prepare an amortization schedule that is suitable for the lessor for the lesse term 'Round answers to decimal places Sp.5,275.) TAMARISK LEASING COMPANY Lessor Lease Amortization Schedule Interest on Lease Recovery of Lease Receivable Recevable Annual Lease Payment Plus URV Lease Receivable $ $ 450 Date 1/1/20 1/1/20 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 12/31/25 List of Accounts Prepare all of the journal entries for the lessar for 2020 and 2021 to record the case agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessar's annual accounting period ends on December 31, and it does not use reversing entries. (Creditccount dities are automatically indicated when amount is mbered. Do not indentmarvaly. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (To record the lease) (To record the receipt or lease payment) V Tamarisk Lessire Company sins anereement on January 1.2020,tolease equipment to Cole Company. The folosire information relates to this agreement 1 The term of the nor-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2 The cast of the asset to the lessor $451,000. The talr value of the asset at January 1, 2020, Is $451,000. 3. The asset will revert to the lessor at the end of the lease term. at which time the set is expected to have a residual value of $24225. none of which is guaranteed 4. The agreement requires equal Annual rental payments, beginning on January 1, 2020. 5. Collectibility of the lesse payments by Tamarisk is probable. Click here to view factur tables Assuming the lessor desines a&xrate at return on its investment, calculate the amount of the annual rental payment required. Forcallation purposes, use 5 decimal places as displayed in the factor to le provided and the final anwer to decimal places eg 5275.) Amount of the annual rental payment $ List of Accounts Prepare an amortization schedule that is suitable for the lessor for the lesse term 'Round answers to decimal places Sp.5,275.) TAMARISK LEASING COMPANY Lessor Lease Amortization Schedule Interest on Lease Recovery of Lease Receivable Recevable Annual Lease Payment Plus URV Lease Receivable $ $ 450 Date 1/1/20 1/1/20 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 12/31/25 List of Accounts Prepare all of the journal entries for the lessar for 2020 and 2021 to record the case agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessar's annual accounting period ends on December 31, and it does not use reversing entries. (Creditccount dities are automatically indicated when amount is mbered. Do not indentmarvaly. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit (To record the lease) (To record the receipt or lease payment) V