Answered step by step

Verified Expert Solution

Question

1 Approved Answer

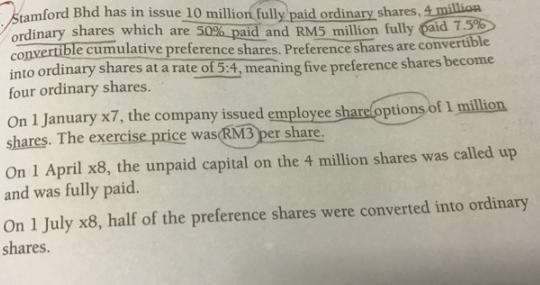

tamford Bhd has in issue 10 million fully paid ordinary shares, 4 million ordinary shares which are 50% paid and RM5 million fully paid

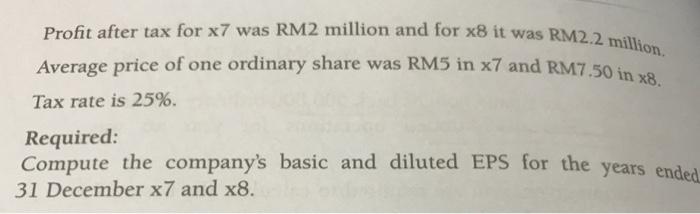

tamford Bhd has in issue 10 million fully paid ordinary shares, 4 million ordinary shares which are 50% paid and RM5 million fully paid 7.5% convertible cumulative preference shares. Preference shares are convertible into ordinary shares at a rate of 5:4, meaning five preference shares become four ordinary shares. On 1 January x7, the company issued employee share options of 1 million shares. The exercise price was(RM3 per share. On 1 April x8, the unpaid capital on the 4 million shares was called up and was fully paid. On 1 July x8, half of the preference shares were converted into ordinary shares. Profit after tax for x7 was RM2 million and for x8 it was RM2.2 million. Average price of one ordinary share was RM5 in x7 and RM7.50 in an Tax rate is 25%. Required: Compute the company's basic and diluted EPS for the years ended 31 December x7 and x8.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of basic EPS and Diluted EPS Perlod of Da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started