Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tanaka Machine Shop is considering a 4 year project to improve its production efficiency. Buying a new machine press for $445,000 is estimated to

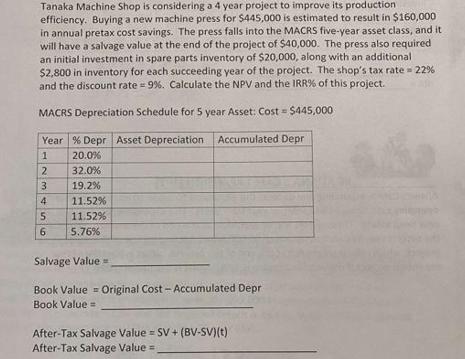

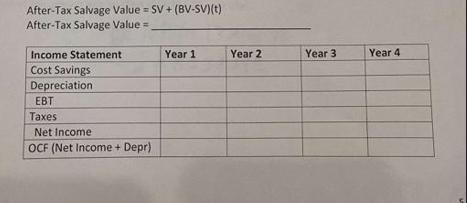

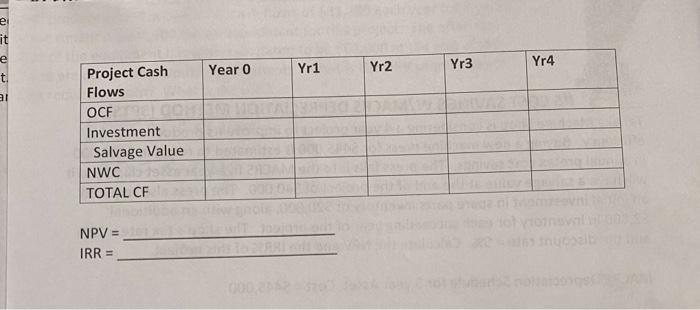

Tanaka Machine Shop is considering a 4 year project to improve its production efficiency. Buying a new machine press for $445,000 is estimated to result in $160,000 in annual pretax cost savings. The press falls into the MACRS five-year asset class, and it will have a salvage value at the end of the project of $40,000. The press also required an initial investment in spare parts inventory of $20,000, along with an additional $2,800 in inventory for each succeeding year of the project. The shop's tax rate=22% and the discount rate=9%. Calculate the NPV and the IRR % of this project. MACRS Depreciation Schedule for 5 year Asset: Cost $445,000 = Year % Depr Asset Depreciation Accumulated Depr 1 2 3 4 5 6 20.0% 32.0% 19.2% 11.52% 11.52% 5.76% Salvage Value= Book Value = Original Cost- Accumulated Depr Book Value= After-Tax Salvage Value = SV+(BV-SV)(t) After-Tax Salvage Value= After-Tax Salvage Value = SV + (BV-SV)(t) After-Tax Salvage Value = Income Statement Cost Savings Depreciation EBT Taxes Net Income OCF (Net Income + Depr) Year 1 Year 2 Year 3 Year 4 el it e t. al Project Cash Flows OCF198 Investment Salvage Value NWC TOTAL CF NPV = IRR = Year 0 Yr1 Yr2 Yr3 Yr4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started