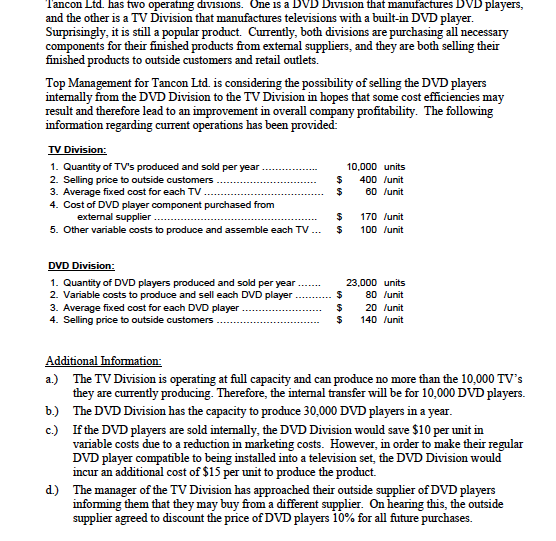

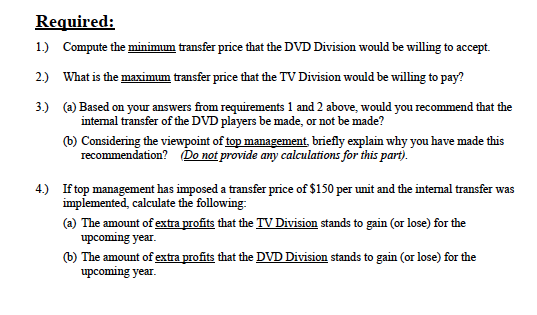

Tancon Ltd. has two operating divisions. One is a DVD Division that manufactures DVD players, and the other is a TV Division that manufactures televisions with a built-in DVD player. Surprisingly, it is still a popular product. Currently, both divisions are purchasing all necessary components for their finished products from extemal suppliers, and they are both selling their finished products to outside customers and retail outlets. Top Management for Tancon Ltd. is considering the possibility of selling the DVD players internally from the DVD Division to the TV Division in hopes that some cost efficiencies may result and therefore lead to an improvement in overall company profitability. The following information regarding current operations has been provided TV Division: 1. Quantity of TV's produced and sold per year 10,000 units 2. Selling price to outside customers $ 400 /unit 3. Average fixed cost for each TV $ 60 /unit 4. Cost of DVD player component purchased from external supplier ... $ 170 /unit 5. Other variable costs to produce and assemble each TV... 100 /unit $ DVD Division: 1. Quantity of DVD players produced and sold per year 2. Variable costs to produce and sell each DVD player 3. Average fixed cost for each DVD player 4. Selling price to outside customers $ $ $ 23,000 units 80 /unit 20 /unit 140 /unit Additional Information: a.) The TV Division is operating at full capacity and can produce no more than the 10.000 TV's they are currently producing. Therefore, the intemal transfer will be for 10,000 DVD players. b.) The DVD Division has the capacity to produce 30,000 DVD players in a year. c.) If the DVD players are sold internally, the DVD Division would save $10 per unit in variable costs due to a reduction in marketing costs. However, in order to make their regular DVD player compatible to being installed into a television set, the DVD Division would incur an additional cost of $15 per unit to produce the product. d) The manager of the TV Division has approached their outside supplier of DVD players informing them that they may buy from a different supplier. On hearing this, the outside supplier agreed to discount the price of DVD players 10% for all future purchases. Required: 1.) Compute the minimum transfer price that the DVD Division would be willing to accept. 2.) What is the maximum transfer price that the TV Division would be willing to pay? 3.) (2) Based on your answers from requirements 1 and 2 above, would you recommend that the internal transfer of the DVD players be made, or not be made? 6) Considering the viewpoint of top management, briefly explain why you have made this recommendation? Do not provide any calculations for this part). 4.) If top management has imposed a transfer price of $150 per unit and the internal transfer was implemented, calculate the following: (a) The amount of extra profits that the TV Division stands to gain (or lose) for the upcoming year. 6) The amount of extra profits that the DVD Division stands to gain (or lose) for the upcoming year