Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tangent Inc. purchased the following two intangible assets during the year. A patent was purchased on March 3 1 for $ 3 0 , 0

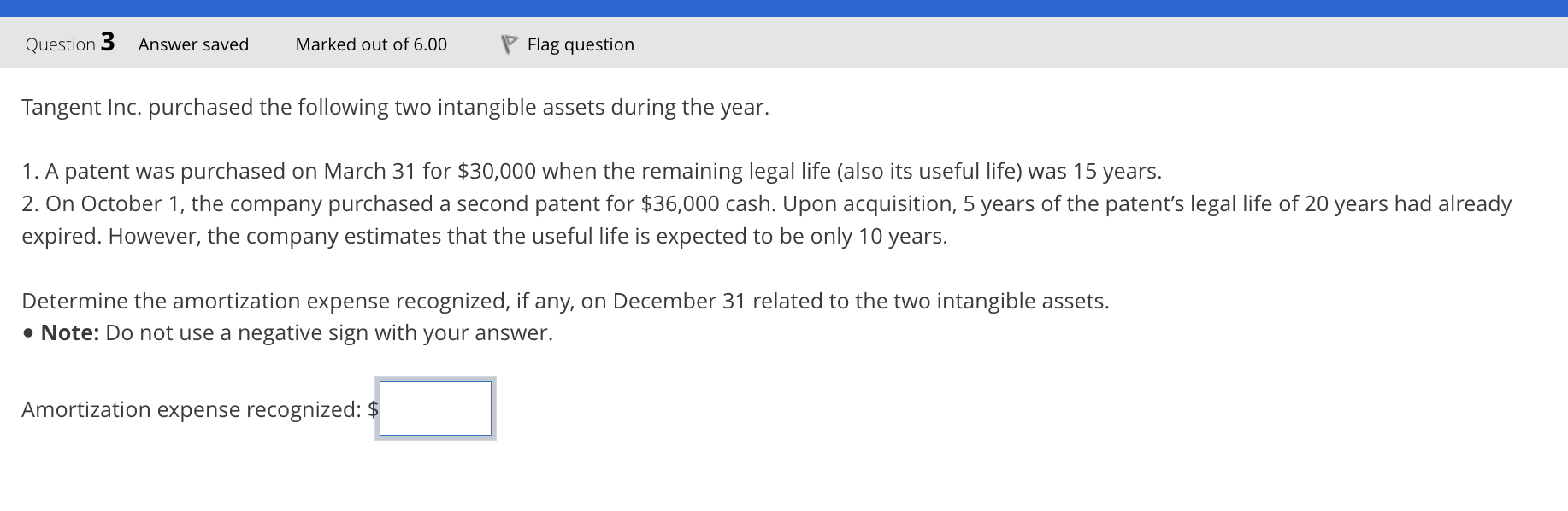

Tangent Inc. purchased the following two intangible assets during the year.

A patent was purchased on March for $ when the remaining legal life also its useful life was years.

On October the company purchased a second patent for $ cash. Upon acquisition, years of the patent's legal life of years had already

expired. However, the company estimates that the useful life is expected to be only years.

Determine the amortization expense recognized, if any, on December related to the two intangible assets.

Note: Do not use a negative sign with your answer.

Amortization expense recognized: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started