Answered step by step

Verified Expert Solution

Question

1 Approved Answer

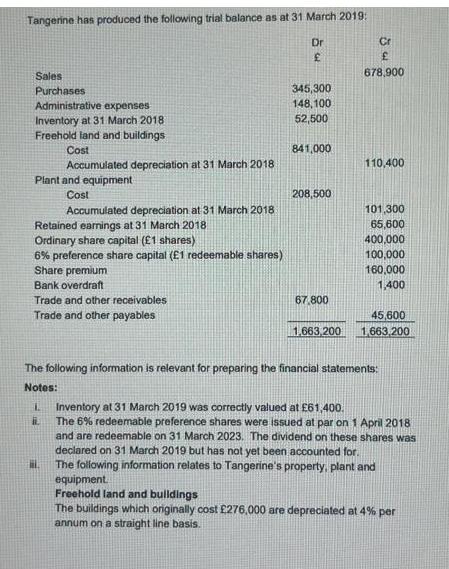

Tangerine has produced the following trial balance as at 31 March 2019: Dr Sales Purchases Administrative expenses Inventory at 31 March 2018 Freehold land

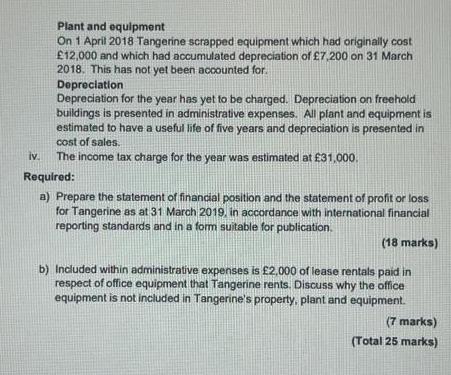

Tangerine has produced the following trial balance as at 31 March 2019: Dr Sales Purchases Administrative expenses Inventory at 31 March 2018 Freehold land and buildings Cost Plant and equipment Cost Accumulated depreciation at 31 March 2018 Retained earnings at 31 March 2018 Ordinary share capital (1 shares) 6% preference share capital (1 redeemable shares) Share premium Bank overdraft Trade and other receivables Trade and other payables L H Accumulated depreciation at 31 March 2018 i 345,300 148,100 52,500 841,000 208,500 67,800 1,663,2001 Cr 678,900 110,400 The following information is relevant for preparing the financial statements: Notes: 101,300 65,600 400,000 100,000 160,000 1,400 45,600 1,663,200 Inventory at 31 March 2019 was correctly valued at 61,400. The 6% redeemable preference shares were issued at par on 1 April 2018 and are redeemable on 31 March 2023. The dividend on these shares was declared on 31 March 2019 but has not yet been accounted for. The following information relates to Tangerine's property, plant and equipment. Freehold land and buildings The buildings which originally cost 276,000 are depreciated at 4% per annum on a straight line basis. iv. Plant and equipment On 1 April 2018 Tangerine scrapped equipment which had originally cost 12,000 and which had accumulated depreciation of 7,200 on 31 March 2018. This has not yet been accounted for. Depreciation Depreciation for the year has yet to be charged. Depreciation on freehold buildings is presented in administrative expenses. All plant and equipment is estimated to have a useful life of five years and depreciation is presented in cost of sales. The income tax charge for the year was estimated at 31,000. Required: a) Prepare the statement of financial position and the statement of profit or loss for Tangerine as at 31 March 2019, in accordance with international financial reporting standards and in a form suitable for publication. (18 marks) b) Included within administrative expenses is 2,000 of lease rentals paid in respect of office equipment that Tangerine rents. Discuss why the office equipment is not included in Tangerine's property, plant and equipment. (7 marks) (Total 25 marks)

Step by Step Solution

★★★★★

3.28 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

As calculated above C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started