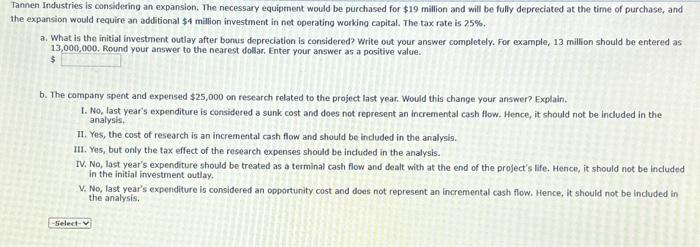

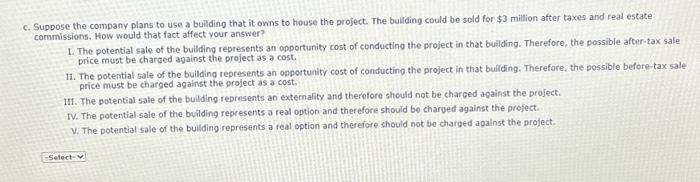

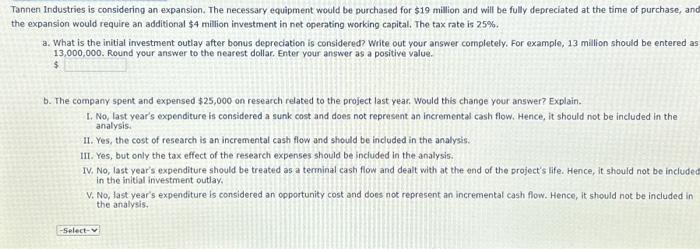

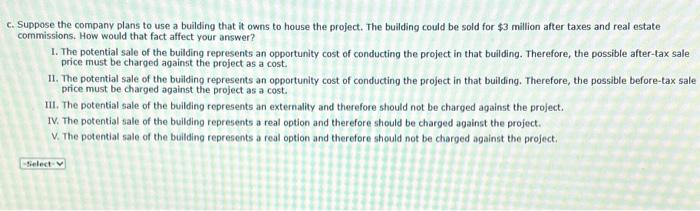

Tannen Industries is considering an expansion. The necessary equipment would be purchased for $19 million and will be fully depreciated at the time of purchase, and the expansion would require an additional $4 million investment in net operating working capital. The tax rate is 25%. a. What is the initial investment outlay after bonus depreciation is considered? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value. $ b. The company spent and expensed $25,000 on research related to the project last year. Would this change your answer? Explain. 1. No, last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. Yes, the cost of research is an incremental cash flow and should be induded in the analysis. III. Yes, but only the tax effect of the research expenses should be included in the analysis. IV. No, last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay. V. No, last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. c. Suppose the company plans to use a building that it owns to house the project. The building could be sold for $3 million after taxes and real estate commissions. How would that fact affect your answer? 1. The potential sale of the building represents an opportunity cost of conducting the project in that bullding. Therefore, the possible after-tax sale price must be charged against the project as a cost. 11. The potential sale of the building represents an opportunity cost of conducting the project in that bullding. Therefore, the possible before-tax sale price must be charged against the project as a cost. III. The potential sale of the building represents an externality and therofore should not be charged apainst the project. IV. The potential sale of the building represents a real option and therefore should be charged against the profect. V. The potential sale of the bullding represents a real option and therefore should not be charged against the project. Tannen Industries is considering an expansion. The necessary equipment would be purchased for $19 million and will be fully depreciated at the time of purchase, anc the expansion would require an additional $4 million investment in not operating working capital. The tax rate is 25%. a. What is the initial investment outlay after bonus depreciation is considered? Write out your answer completely, For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value. $ b. The company spent and expensed $25,000 on research related to the project last year. Would this change your answer? Explain. 1. No, last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. 11. Yes, the cost of research is an incremental cash flow and should be included in the analysis. III. Yes, but only the tax effect of the research expenses should be inciuded in the analysis. IV. No, last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be includes in the initial investment outlay, V. No, last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. c. Suppose the company plans to use a building that it owns to house the project. The building could be sold for $3 million after taxes and real estate commissions. How would that fact affect your answer? 1. The potential sale of the building represents an opportunity cost of conducting the project in that building. Therefore, the possible after-tax sale price must be charged against the project as a cost. II. The potential sale of the building represents an opportunity cost of conducting the project in that building. Therefore, the possible before-tax sale price must be charged against the project as a cost. III. The potential sale of the building represents an externality and therefore should not be charged against the project. IV. The potential sale of the building represents a real option and therefore should be charged against the project. V. The potential sale of the building represents a real option and therefore should not be charged against the project