Answered step by step

Verified Expert Solution

Question

1 Approved Answer

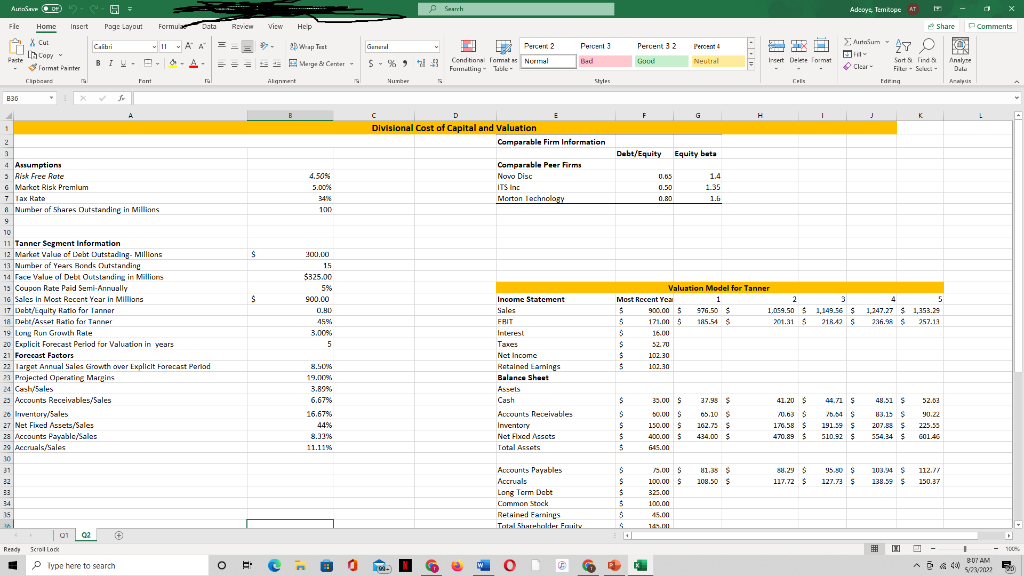

Tanner is a division of diversified company and is involved in providing technology services. In the attached Exam Excel Template file (Sheet Q2), all relevant

- Tanner is a division of diversified company and is involved in providing technology services. In the attached Exam Excel Template file (Sheet Q2), all relevant information needed to estimate the divisional cost of capital and price per share of Tanner has been provided. Specifically, information about peer firms capital structure and betas are provided in order to use the divisional cost of capital method to estimate cost of capital for Tanner. Further, projections for the next five years for the drivers of free cash flows are also provided.

- Using the divisional cost of capital method, estimate the Weighted Average Cost of Capital (WACC) for Tanner

- Using the Discounted Free Cash Flow Valuation Methodology, estimate the intrinsic price per share of Tanner.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started