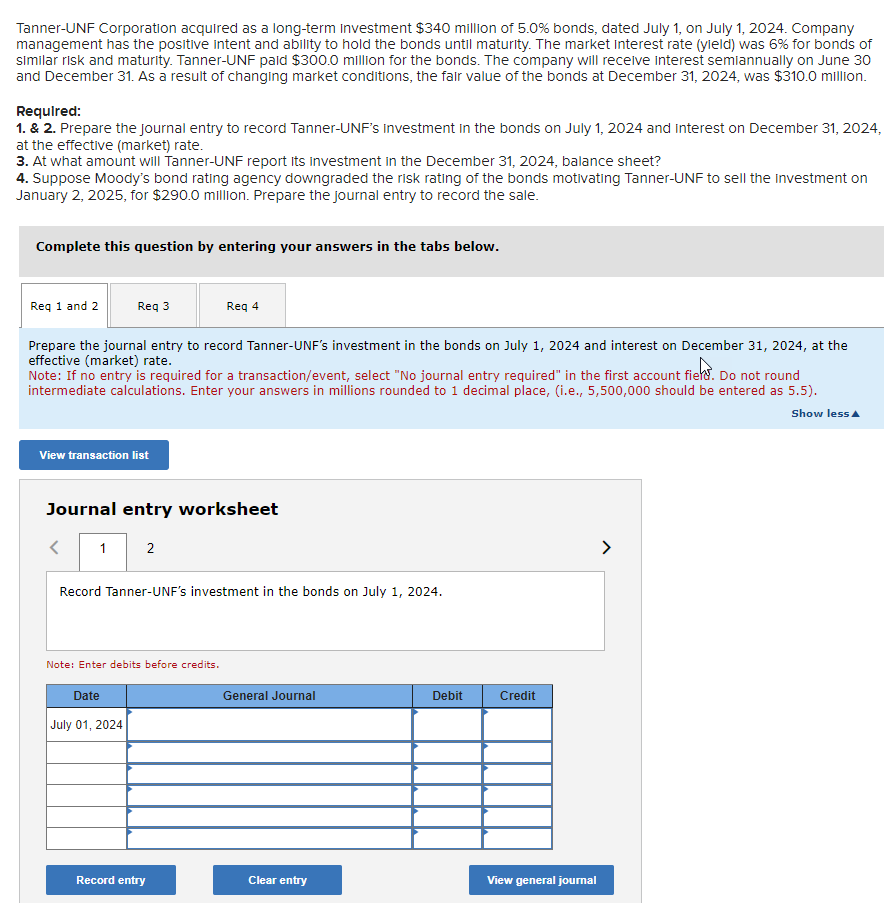

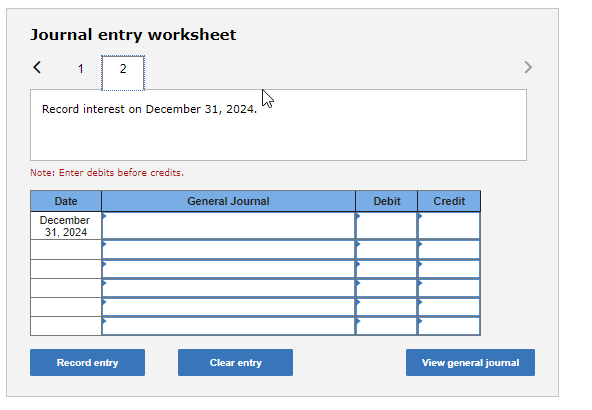

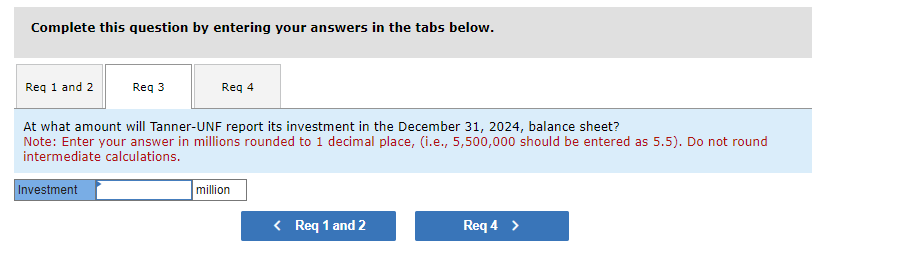

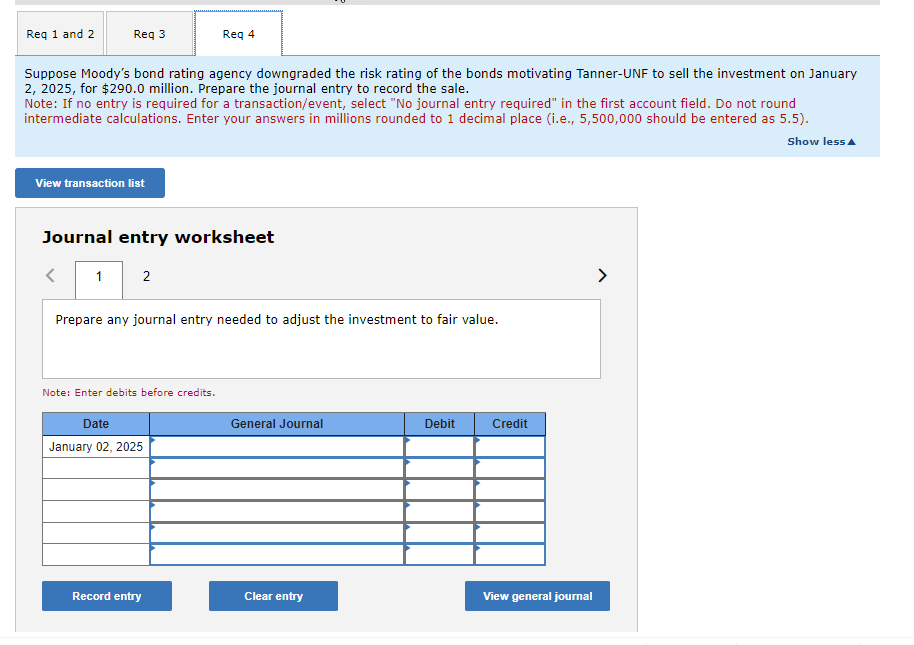

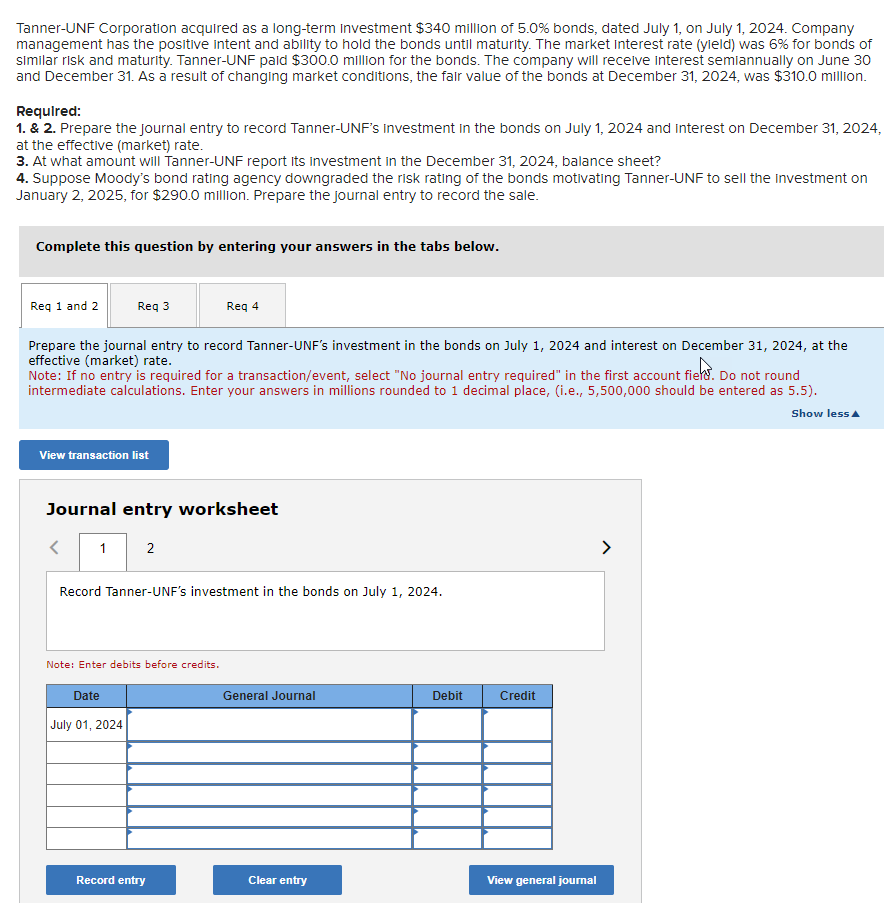

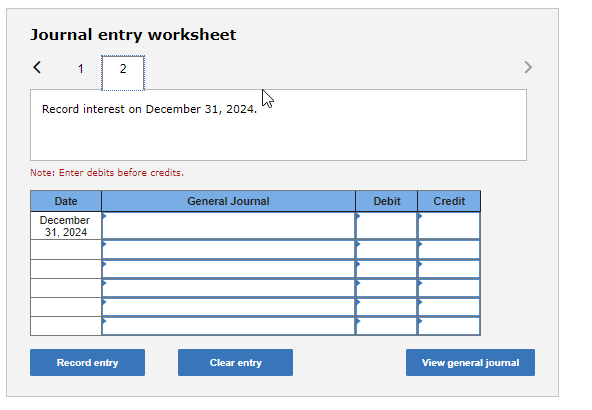

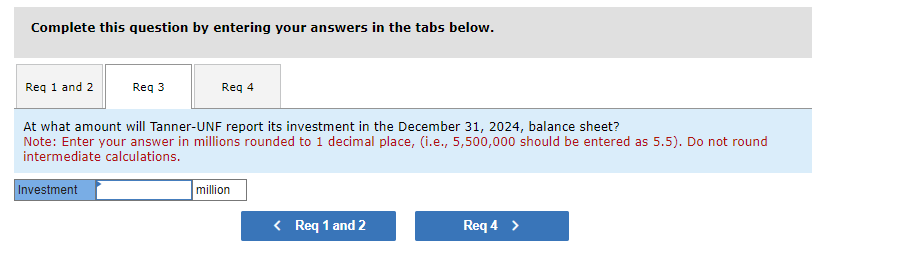

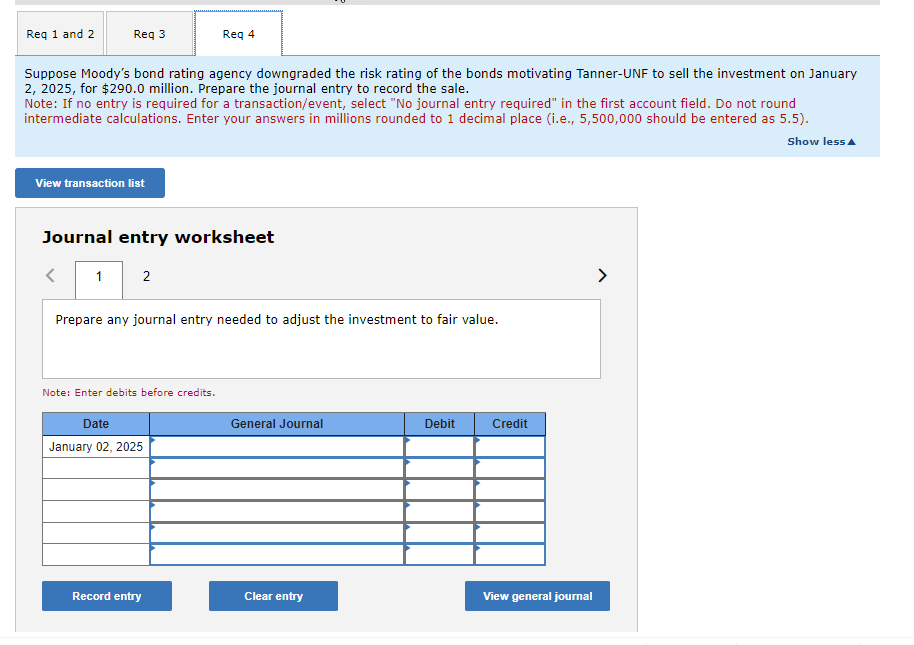

Tanner-UNF Corporation acquired as a long-term Investment $340 million of 5.0% bonds, dated July 1, on July 1 , 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yleld) was 6% for bonds of similar risk and maturity. Tanner-UNF paid $300.0 million for the bonds. The company will recelve interest semIannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31,2024 , was $310.0 million. Required: 1. \& 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1,2024 and interest on December 31,2024 , at the effective (market) rate. 3. At what amount will Tanner-UNF report its investment in the December 31,2024 , balance sheet? 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $290.0 million. Prepare the journal entry to record the sale. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fiek. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Record Tanner-UNF's investment in the bonds on July 1, 2024. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. At what amount will Tanner-UNF report its investment in the December 31, 2024, balance sheet? Note: Enter your answer in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). Do not round intermediate calculations. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2 , 2025, for $290.0 million. Prepare the journal entry to record the sale. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Show less Journal entry worksheet Prepare any journal entry needed to adjust the investment to fair value. Note: Enter debits before credits