Answered step by step

Verified Expert Solution

Question

1 Approved Answer

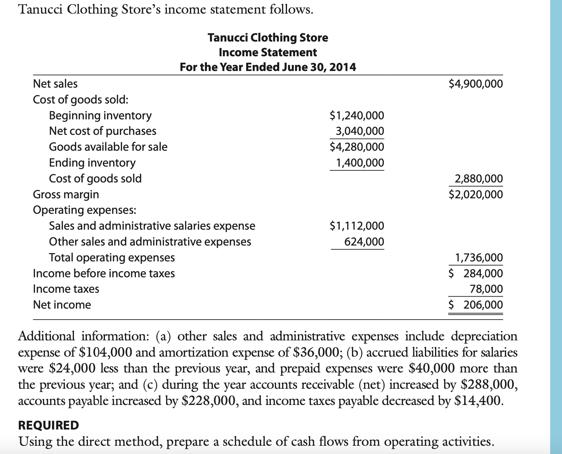

Tanucci Clothing Store's income statement follows. Tanucci Clothing Store Income Statement For the Year Ended June 30, 2014 Net sales Cost of goods sold:

Tanucci Clothing Store's income statement follows. Tanucci Clothing Store Income Statement For the Year Ended June 30, 2014 Net sales Cost of goods sold: Beginning inventory Net cost of purchases Goods available for sale Ending inventory Cost of goods sold Gross margin Operating expenses: Sales and administrative salaries expense Other sales and administrative expenses Total operating expenses Income before income taxes Income taxes Net income $1,240,000 3,040,000 $4,280,000 1,400,000 $1,112,000 624,000 $4,900,000 2,880,000 $2,020,000 1,736,000 $ 284,000 78,000 $ 206,000 Additional information: (a) other sales and administrative expenses include depreciation expense of $104,000 and amortization expense of $36,000; (b) accrued liabilities for salaries were $24,000 less than the previous year, and prepaid expenses were $40,000 more than the previous year; and (c) during the year accounts receivable (net) increased by $288,000, accounts payable increased by $228,000, and income taxes payable decreased by $14,400. REQUIRED Using the direct method, prepare a schedule of cash flows from operating activities.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

In using the direct method to prepare a schedule of cash flows from operating activities various steps will be followed and considered Given the Net s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6392a2cb32032_107736.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started