Question

TanVan Corp. operates under conditions of uncertainty. The firms' cash flows depend on the state of the economy. The odds that the economy will

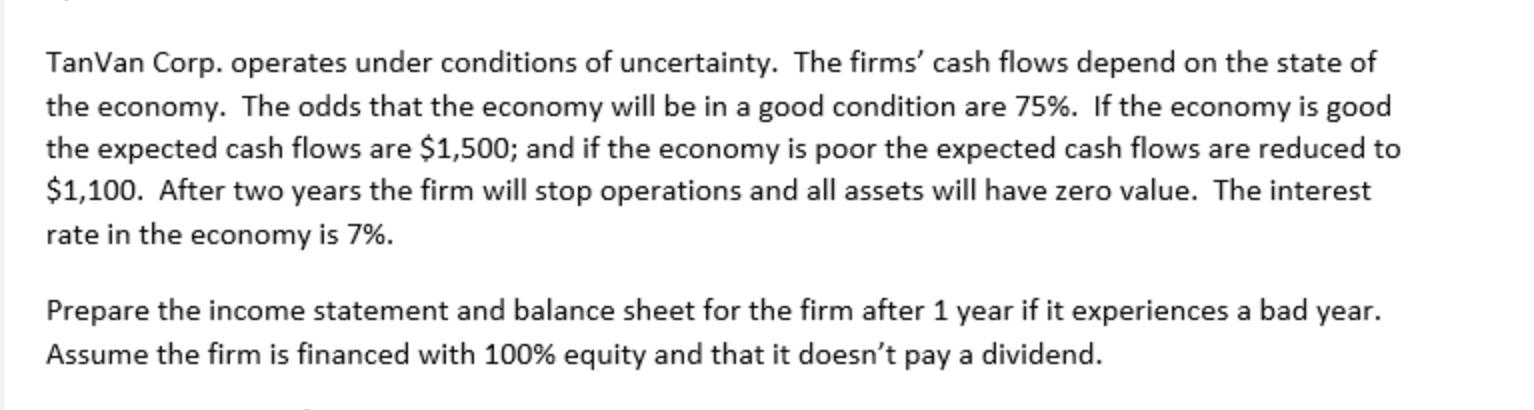

TanVan Corp. operates under conditions of uncertainty. The firms' cash flows depend on the state of the economy. The odds that the economy will be in a good condition are 75%. If the economy is good the expected cash flows are $1,500; and if the economy is poor the expected cash flows are reduced to $1,100. After two years the firm will stop operations and all assets will have zero value. The interest rate in the economy is 7%. Prepare the income statement and balance sheet for the firm after 1 year if it experiences a bad year. Assume the firm is financed with 100% equity and that it doesn't pay a dividend.

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Solution If company face bad year in after first year the e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis Using Financial Accounting Information

Authors: Charles H. Gibson

13th edition

1285401603, 1133188796, 9781285401607, 978-1133188797

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App