Answered step by step

Verified Expert Solution

Question

1 Approved Answer

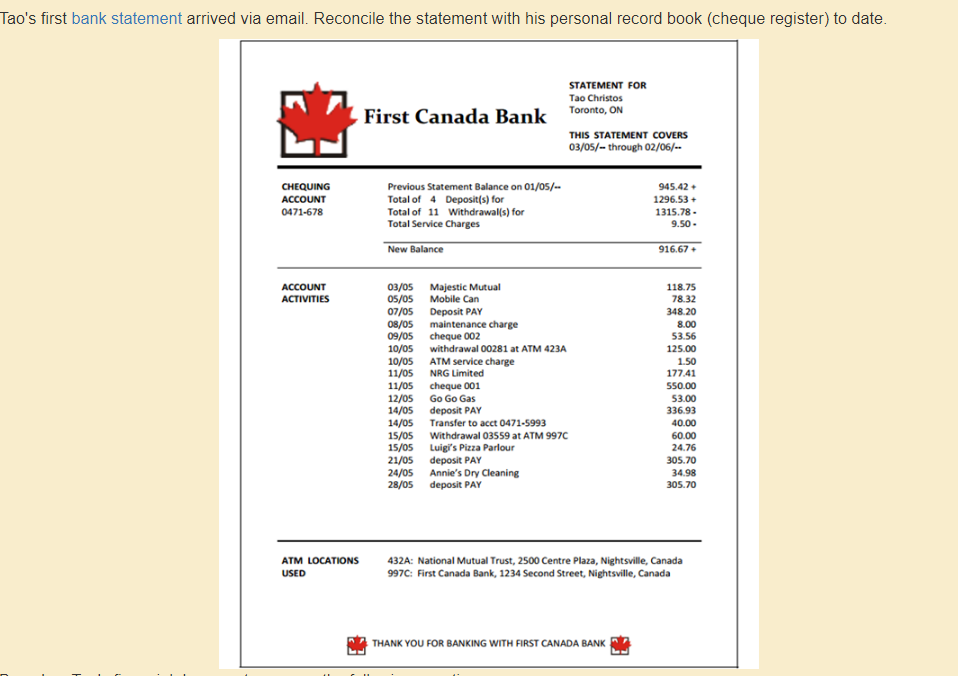

Tao's first bank statement arrived via email. Reconcile the statement with his personal record book (cheque register) to date. CHEQUING ACCOUNT 0471-678 ACCOUNT ACTIVITIES

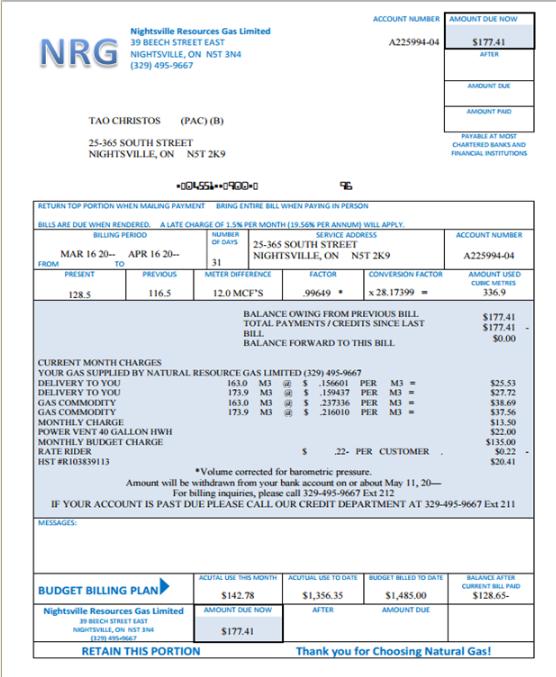

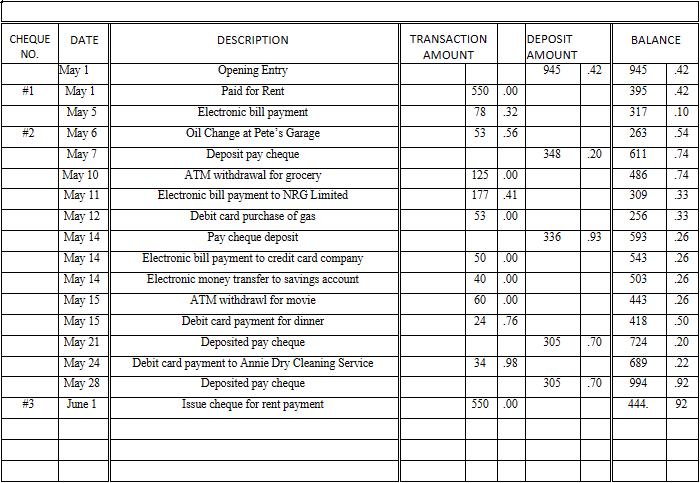

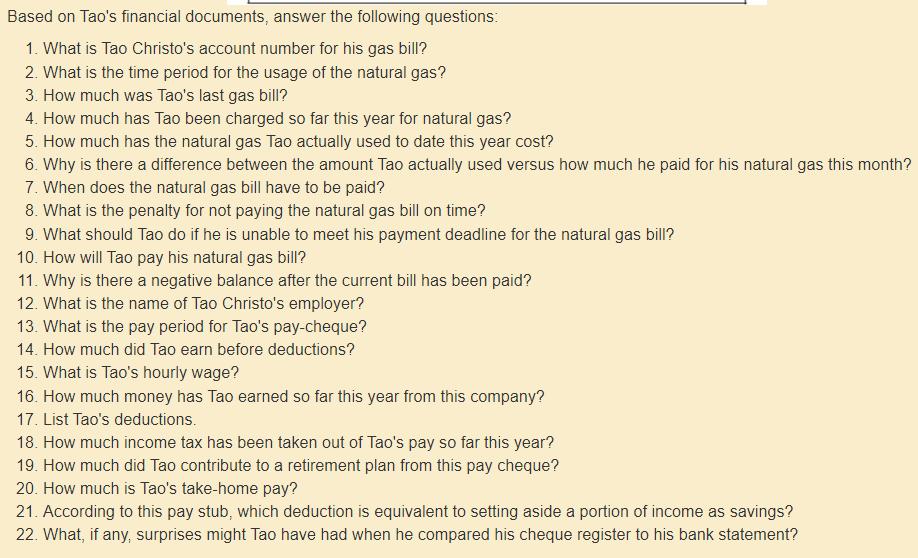

Tao's first bank statement arrived via email. Reconcile the statement with his personal record book (cheque register) to date. CHEQUING ACCOUNT 0471-678 ACCOUNT ACTIVITIES ATM LOCATIONS USED First Canada Bank Previous Statement Balance on 01/05/-- Total of 4 Deposit(s) for Total of 11 Withdrawal(s) for Total Service Charges New Balance 03/05 05/05 07/05 08/05 09/05 10/05 10/05 11/05 11/05 12/05 14/05 14/05 15/05 15/05 21/05 24/05 28/05 Majestic Mutual Mobile Can Deposit PAY maintenance charge cheque 002 withdrawal 00281 at ATM 423A ATM service charge NRG Limited cheque 001 Go Go Gas deposit PAY Transfer to acct 0471-5993 STATEMENT FOR Tao Christos Toronto, ON Withdrawal 03559 at ATM 997C Luigi's Pizza Parlour deposit PAY Annie's Dry Cleaning deposit PAY THIS STATEMENT COVERS 03/05/- through 02/06/-- 945.42 + 1296.53 + 1315.78- 9.50- THANK YOU FOR BANKING WITH FIRST CANADA BANK 916.67 + 118.75 78.32 348.20 8.00 53.56 125.00 1.50 177.41 550.00 53.00 336.93 40.00 60.00 24.76 305.70 34.98 305.70 432A: National Mutual Trust, 2500 Centre Plaza, Nightsville, Canada 997C: First Canada Bank, 1234 Second Street, Nightsville, Canada NRG FROM TAO CHRISTOS (PAC) (B) 25-365 SOUTH STREET NIGHTSVILLE, ON NST 2K9 PRESENT 128.5 Nightsville Resources Gas Limited 39 BEECH STREET EAST NIGHTSVILLE, ON NST 3N4 (329) 495-9667 004551-0900-0 76 RETURN TOP PORTION WHEN MAILING PAYMENT BRING ENTIRE BILL WHEN PAYING IN PERSON BILLS ARE DUE WHEN RENDERED ALATE CHARGE OF 1.5% PER MONTH (19.56% PER ANNUM) WILL APPLY. BILLING PERIOD SERVICE ADDRESS MAR 16 20 APR 16 20- TO GAS COMMODITY GAS COMMODITY PREVIOUS 116.5 MONTHLY CHARGE POWER VENT 40 GALLON HWH MONTHLY BUDGET CHARGE RATE RIDER HST #R103839113 NUMBER OF DAYS CURRENT MONTH CHARGES YOUR GAS SUPPLIED BY NATURAL RESOURCE GAS LIMITED (329) 495-9667 DELIVERY TO YOU DELIVERY TO YOU BUDGET BILLING PLAN Nightsville Resources Gas Limited 39 BEECH STREET EAST 31 METER DIFFERENCE 12.0 MCF'S NIGHTSVILLE, ON NST IN (329) 495-0667 RETAIN THIS PORTION 25-365 SOUTH STREET NIGHTSVILLE, ON NST 2K9 FACTOR 99649. ACUTAL USE THIS MONTH ACCOUNT NUMBER AMOUNT DUE NOW BALANCE OWING FROM PREVIOUS BILL TOTAL PAYMENTS/CREDITS SINCE LAST BALANCE FORWARD TO THIS BILL A225994-04 $142.78 AMOUNT DUE NOW 1630 M3 $ 156601 PER M3- 173.9 M3 159437 PER M3 = 163.0 M3 173.9 M3 $ S $ 237336 PER M3 = 216010 PER M3 - $177.41 CONVERSION FACTOR x 28.17399- ACUTUAL USE TO DATE $1,356,35 AFTER 22 PER CUSTOMER BUDGET BILLED TO DATE $177.41 AFTER S *Volume corrected for barometric pressure. Amount will be withdrawn from your bank account on or about May 11, 20- For billing inquiries, please call 329-495-9667 Ext 212 IF YOUR ACCOUNT IS PAST DUE PLEASE CALL OUR CREDIT DEPARTMENT AT 329-495-9667 Ext 211 MESSAGES $1,485,00 AMOUNT DUE AMOUNT DUE AMOUNT PAID PAYABLE AT MOST CHARTERED BANKS AND FINANCIAL INSTITUTIONS ACCOUNT NUMBER A225994-04 AMOUNT USED CUBIC METRES 336.9 $177.41 $177.41 $0.00 $25.53 $27.72 $38.69 $37.56 $13.50 $22.00 $135.00 $0.22 $20.41 BALANCE AFTER CURRENT BILL PAID $128.65- Thank you for Choosing Natural Gas! CHEQUE DATE NO. #1 #2 # 3 May 1 May 1 May 5 May 6 May 7 May 10 May 11 May 12 May 14 May 14 May 14 May 15 May 15 May 21 May 24 May 28 June 1 DESCRIPTION Opening Entry Paid for Rent Electronic bill payment Oil Change at Pete's Garage Deposit pay cheque ATM withdrawal for grocery Electronic bill payment to NRG Limited Debit card purchase of gas Pay cheque deposit Electronic bill payment to credit card company Electronic money transfer to savings account ATM withdrawl for movie Debit card payment for dinner Deposited pay cheque Debit card payment to Annie Dry Cleaning Service Deposited pay cheque Issue cheque for rent payment TRANSACTION AMOUNT 550.00 78 53 32 56 125.00 177 41 53 34 8 .00 50 40 60 .00 24 .76 18 18 18 .00 .00 .98 550.00 DEPOSIT AMOUNT 945 .42 348 336 .93 305 20 305 .70 .70 BALANCE 945 395 317 263 611 486 256 593 543 309 33 443 42 42 .10 54 724 FEA8888888 74 994 74 444. 503 26 33 26 26 418 .50 26 689 22 .20 92 92 Based on Tao's financial documents, answer the following questions: 1. What is Tao Christo's account number for his gas bill? 2. What is the time period for the usage of the natural gas? 3. How much was Tao's last gas bill? 4. How much has Tao been charged so far this year for natural gas? 5. How much has the natural gas Tao actually used to date this year cost? 6. Why is there a difference between the amount Tao actually used versus how much he paid for his natural gas this month? 7. When does the natural gas bill have to be paid? 8. What is the penalty for not paying the natural gas bill on time? 9. What should Tao do if he is unable to meet his payment deadline for the natural gas bill? 10. How will Tao pay his natural gas bill? 11. Why is there a negative balance after the current bill has been paid? 12. What is the name of Tao Christo's employer? 13. What is the pay period for Tao's pay-cheque? 14. How much did Tao earn before deductions? 15. What is Tao's hourly wage? 16. How much money has Tao earned so far this year from this company? 17. List Tao's deductions. 18. How much income tax has been taken out of Tao's pay so far this year? 19. How much did Tao contribute to a retirement plan from this pay cheque? 20. How much is Tao's take-home pay? 21. According to this pay stub, which deduction is equivalent to setting aside a portion of income as savings? 22. What, if any, surprises might Tao have had when he compared his cheque register to his bank statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To reconcile Taos bank statement with his personal record book lets go through the provided information and answer the questions 1 Tao Christos accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started