Question

Tara estimates that the BUILDING will Depreciate at a rate of $12,000 per year and the Equipment at a rate of $4,000 per year .

- Tara estimates that the BUILDING will Depreciate at a rate of $12,000 per year and the Equipment at a rate of $4,000 per year . Record the Depreciation for the year for both the Building and Equipment.

- Tara determines that 40% of the Unearned Revenue has now been earned by year end:

$22.000 x 40% = $8,800

3. The ending (UNUSED) Supplies value is estimated to be $3,800.-$8,000 = $4,200

4. Tara realizes she neglected (FORGOT...OOPS) to record interest revenue of $8,900 that was earned but not yet RECEIVED by Dec 31st.

5. The Prepaid Insurance Policy is for 12 months dated July 1st, 2022...record the adjustment for 6 months ending Dec 31st 2022. $24,000/12 Mos = $2,000 x 6 months = $12,000 used up

6. Tara has not yet paid $3,450 to her employees for salaries owed but not yet paid (Payable) at the end of the month of Dec 31st 2023.

REQUIRED: Record the Adjustments in the Journal...all accounts needed are included in the Trial Balance

- Keira's Kitten Company had the following transactions for the month of July....their 1st month of operation:

a. Keira invests $150,000 of her own cash in the company as a GIFT for STOCK

b. Keira purchases $4,200 of Office Supplies on Account Payable

c. Keira borrows $510,000 in Cash from the bank on a long-term Note Payable for 5 years.

d. Keira purchases a BUILDING for $200,000 paying $60,000 in cash and borrowing the remaining $140,000 on a Mortgage Payable

e. Keira earns $34,000 in Revenue on Account Receivable

f. Keira pays salaries of $3,750

g. Keira Pays a DIVIDEND of $650 in cash.

Chart of Accounts:

ASSETS:

Cash, Accounts Receivable, Office Supplies, Building

Liabilities:

Bank Note Payable, Mortgage Payable

Owner's Equity:

STOCK,

DIVIDEND

Revenue,

Salary Expense

Required:

Analyze the Transactions and Record them in the Journal

Post from the Journal to the Ledgers

Prepare a Trial Balance

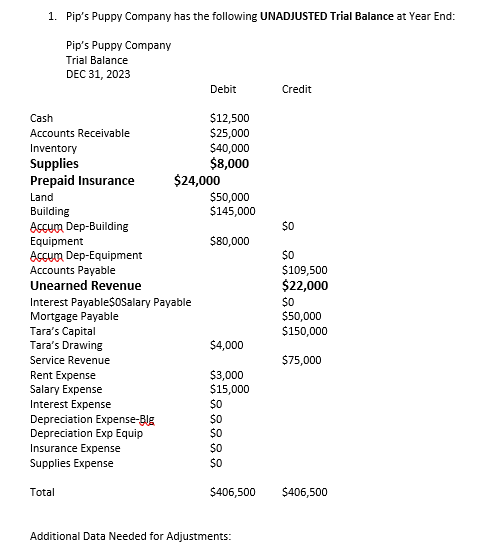

1. Pip's Puppy Company has the following UNADJUSTED Trial Balance at Year End: Pip's Puppy Company Trial Balance DEC 31, 2023 Cash Accounts Receivable Inventory Supplies Prepaid Insurance Land Building Accum Dep-Building Equipment Accum Dep-Equipment Accounts Payable Unearned Revenue Interest Payable$0Salary Payable Mortgage Payable Tara's Capital Tara's Drawing Service Revenue Rent Expense Salary Expense Interest Expense Depreciation Expense-Blg Depreciation Exp Equip Insurance Expense Supplies Expense Total Debit $12,500 $25,000 $40,000 $8,000 $24,000 $50,000 $145,000 $80,000 $4,000 $3,000 $15,000 $0 $0 $0 $0 $0 $406,500 Additional Data Needed for Adjustments: Credit $0 $0 $109,500 $22,000 $0 $50,000 $150,000 $75,000 $406,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the additional data and transactions for Pips Puppy Company and Kei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started