Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tara Marie started an office cleaning service on May 1,2022. During the first month of operations, the following events and transactions occurred. ACCOUNTING 1-CHAPTER 2

Tara Marie started an office cleaning service on May 1,2022. During the first month of operations, the following events and transactions occurred.

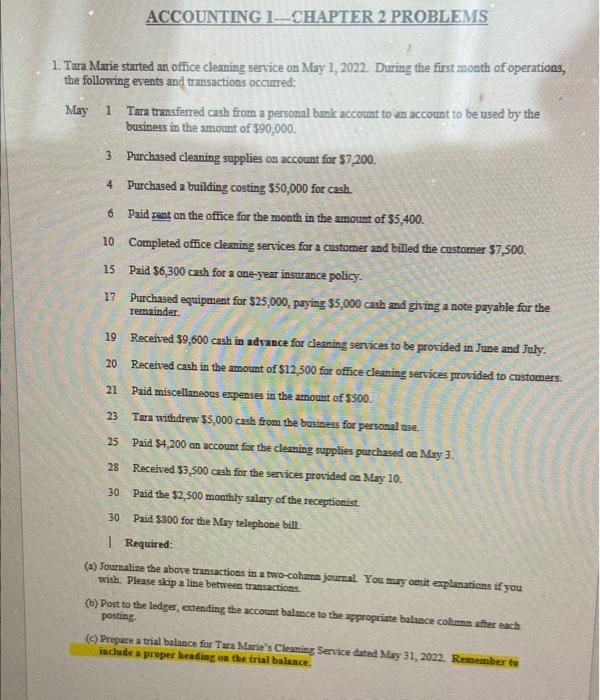

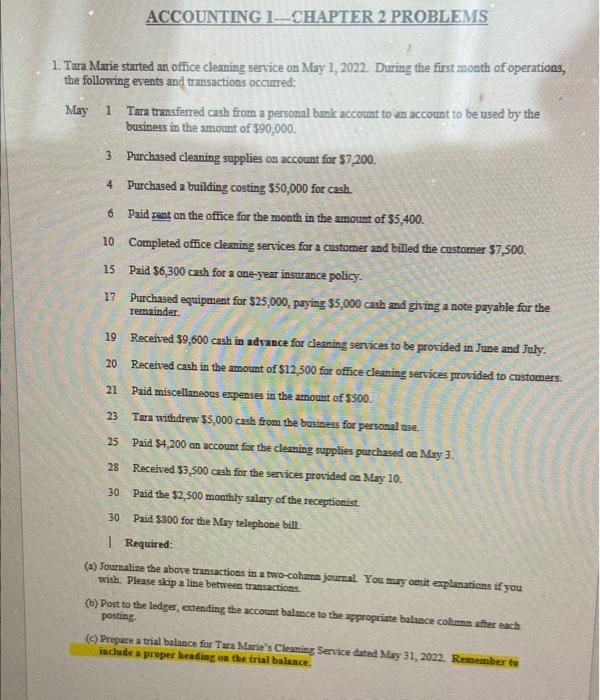

ACCOUNTING 1-CHAPTER 2 PROBLEMS 1. Tara Marie started an office cleaning service on May 1, 2022. During the first month of operationg, the following events and transactions occured: May 1 Tara transferred cach from a personal bank accotmt to an accomnt to be used by the business in the amount of 590,000 . 3 Purchassed cleaning supplies on account for $7,200. 4 Purchased a building costing $50,000 for cash. 6 Paid rent on the office for the month in the amount of $5,400. 10 Completed office cleaning services for a customer and billed the customer $7,500. 15 Paid $6,300 cach for a one-year ingurance policy. 17. Purchased equipment for $25,000, paying $5,000 cash and giving a note payable for the remainder. 19 Received $9,600 cash in advance for cleaning services to be provided in June and July. 20 Received cash in the amount of $12,500 for office cleaning services provided to customers. 21 Paid miscellaneons expenses in the amount of $500. 23 Tara withdrew $5,000 cash from the business for personal ase. 25 Paid $4,200 on account for the cleaning supplies parchased on May 3 . 28 Received $3,500 cash for the services provided on May 10. 30 Paid the $2,500 monthly salary of the receptionist. 30 Paid $800 for the May telephone bill. I Required: (a) Journahize the above transactions in a two-cohunn joumal. You may omit explamations if you. winh. Please ship a line between transactions. (b) Post to the ledger, extending the account balance to the appropriate balance column affer each posting (c) Propare a trial balance for Tara Manie's Cleaning Service dated May 31, 2022. Remember to include a proper heading on the trial baiasce. ACCOUNTING 1-CHAPTER 2 PROBLEMS 1. Tara Marie started an office cleaning service on May 1, 2022. During the first month of operationg, the following events and transactions occured: May 1 Tara transferred cach from a personal bank accotmt to an accomnt to be used by the business in the amount of 590,000 . 3 Purchassed cleaning supplies on account for $7,200. 4 Purchased a building costing $50,000 for cash. 6 Paid rent on the office for the month in the amount of $5,400. 10 Completed office cleaning services for a customer and billed the customer $7,500. 15 Paid $6,300 cach for a one-year ingurance policy. 17. Purchased equipment for $25,000, paying $5,000 cash and giving a note payable for the remainder. 19 Received $9,600 cash in advance for cleaning services to be provided in June and July. 20 Received cash in the amount of $12,500 for office cleaning services provided to customers. 21 Paid miscellaneons expenses in the amount of $500. 23 Tara withdrew $5,000 cash from the business for personal ase. 25 Paid $4,200 on account for the cleaning supplies parchased on May 3 . 28 Received $3,500 cash for the services provided on May 10. 30 Paid the $2,500 monthly salary of the receptionist. 30 Paid $800 for the May telephone bill. I Required: (a) Journahize the above transactions in a two-cohunn joumal. You may omit explamations if you. winh. Please ship a line between transactions. (b) Post to the ledger, extending the account balance to the appropriate balance column affer each posting (c) Propare a trial balance for Tara Manie's Cleaning Service dated May 31, 2022. Remember to include a proper heading on the trial baiasce

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started